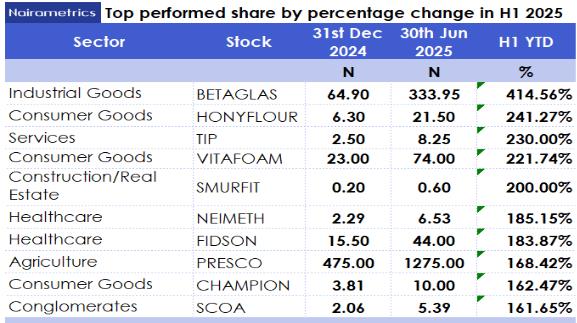

The first half of 2025 ended on a high note for some investors in the Nigerian capital market as BETAGLAS emerged the star performer, surging by a jaw-dropping 414.56%, far outpacing the broader market.

The stock climbed from N64.90 at the start of the year to close at N333.95 by the end of June.

While the All-Share Index (ASI) appreciated by a modest 16.57%, moving from 102,926.40 points to 119,978.57 points, a total of 70 stocks outperformed the market benchmark, with 20 of them delivering returns exceeding 100%.

A broader view of the market reveals that 35 stocks returned over 50%, according to Nairametrics’ analysis of 135 stocks listed on the Nigerian Exchange (NGX).

Sector Performance

The Industrial Goods sector led the charts with BETAGLAS as its standout performer, while the Consumer Goods sector accounted for the highest number of outperformers, 14 stocks in total, demonstrating renewed investor confidence in the sector’s fundamentals. Close behind were the Services and Financial Services sectors, with 13 outperforming stocks each.

Top gainers across sectors include:

Consumer Goods:

- HONYFLOUR +241.27% (N6.30 → N21.50)

- VITAFOAM +221.74% (N23.00 → N74.00)

- CHAMPION +162.47% (N3.81 → N10.00)

Services:

- TIP +230.00% (N2.50 → N8.25)

- CAVERTON +157.40% (N2.23 → N5.74)

- SKYAVN +118.09% (N33.45 → N72.95)

Financial Services

- NGX Group: +57.43% (N27.25 → N42.90)

- WEMABANK: +64.29% (N9.10 → N14.95)

- STANBIC: +47.57% (N57.60 → N85.00)

- GTCO: +42.54% (N57.00 → N81.25)

Healthcare:

- NEIMETH +185.15% (N2.29 → N6.53)

- FIDSON +183.87% (N15.50 → N44.00)

Agriculture:

- PRESCO +168.42% (N475.00 → N1,275.00)

- ELLAHLAKES +141.77% (N3.16 → N7.64)

- LIVESTOCK +116.02% (N4.12 → N8.90)

Conglomerates:

- SCOA +161.65%

- CHELLARAM +157.57%

The top best-performed stocks in H1 2025 by percentage gain

The top best-performed stocks in H1 2025 by percentage gain were led by BETAGLAS, which surged 414.56%, followed by HONYFLOUR (+241.27%), TIP (+230.00%), and VITAFOAM (+221.74%).

These stocks, spanning industrial goods, consumer goods, healthcare, agriculture, and conglomerates, reflected strong investor sentiment, sector recovery, and solid earnings momentum.

- BETAGLAS (Industrial Goods): +414.56% — the strongest performer, reflecting massive investor interest and sector leadership.

- HONYFLOUR (Consumer Goods): +241.27% — driven by strong demand and positive sentiment in the food processing segment.

- TIP (Services): +230.00% — boosted by renewed confidence in logistics and support services.

- VITAFOAM (Consumer Goods): +221.74% — supported by solid earnings and steady consumer demand.

- SMURFIT (Construction/Real Estate): +200.00% — a small-cap gainer benefiting from speculative interest or potential turnaround.

- NEIMETH (Healthcare): +185.15% — reflecting growth in pharmaceutical production and healthcare spending.

- FIDSON (Healthcare): +183.87% — fueled by strong market presence and local drug manufacturing expansion.

- PRESCO (Agriculture): +168.42% — supported by strong commodity prices and consistent performance.

- CHAMPION (Consumer Goods): +162.47% — gained from improved margins and operational growth.

- SCOA (Conglomerates): +161.65% — likely benefiting from renewed investor confidence and value unlocking.

Shares with the highest price appreciation in H1 2025

In H1 2025, the top 10 best-performing stocks by price appreciation were led by PRESCO, which gained N800 per share, followed by BETAGLAS with a N269.05 increase. Others like NNFM, NESTLE, VITAFOAM, NAHCO, and NASCON also posted strong absolute gains, reflecting solid fundamentals and investor confidence across agriculture, industrials, consumer goods, and services.

- PRESCO (Agriculture): Gained N800.00, rising from N475.00 to N1,275.00 — driven by strong fundamentals and commodity demand.

- NESTLE (Consumer Goods): Gained N575.00, from N875.00 to N1,450.00 — supported by consistent earnings and brand strength.

- OKOMUOIL (Agriculture): Gained N346.00, moving from N444.00 to N790.00 — benefiting from robust palm oil prices.

- BETAGLAS (Industrial Goods): Gained N269.05, from N64.90 to N333.95 — with the highest percentage growth of 414.56%.

- MTNN (ICT): Gained N157.50, rising from N200.00 to N357.50 — reflecting continued investor confidence in telecoms.

- AIRTELAFRI (ICT): Gained N153.60, from N2,156.90 to N2,310.50 — modest percentage growth due to already high base.

- SFSREIT (Construction/Real Estate): Gained N69.80, moving from N179.45 to N249.25 — reflecting renewed interest in real estate investments.

- NNFM (Consumer Goods): Gained N64.10, from N43.90 to N108.00 — benefiting from food security focus and sector strength.

- VITAFOAM (Consumer Goods): Gained N51.00, rising from N23.00 to N74.00 — supported by strong earnings and operational efficiency.

- NAHCO (Services): Gained N44.10, from N46.05 to N90.15 — boosted by increased logistics and aviation activity.

Top underperformed stocks in H1 2025

The bottom 10 performing stocks in H1 2025 were led by VFD Group, which plunged -68.69%, followed by SUNU Assurance (-52.19%) and CONOIL (-39.44%), reflecting sharp value erosion.

The financial services sector was hit hardest, contributing four of the ten worst performers, signaling waning investor confidence or weak earnings guidance within the segment.

The oil and gas sector also saw notable underperformance, with CONOIL and MRS both recording losses above -28%, likely tied to sector-specific regulatory or operational pressures.

Other laggards like EUNISELL, Julius Berger, and MORISON suggest broader challenges in services, construction, and healthcare. Overall, these declines highlight pockets of investor caution amid profit-taking, weak fundamentals, or lack of market-moving catalysts.

Stocks that did not change in value

In the first half of 2025, six stocks recorded no price movement, remaining unchanged throughout the period. These include JULI, OMATEK, RTBRISCOE, ALEX, NOTORE, and UNITYBNK, all closing at the same prices they opened on January 1st.

Their static performance may be attributed to low trading activity, limited investor interest, or lack of market-moving disclosures such as earnings releases, corporate actions, or sector news.

Some of these stocks may also suffer from illiquidity, where a small volume of shares is traded, making them prone to being overlooked in bullish or bearish trends. In such cases, the absence of price movement doesn’t imply stability—it often signals neglect or suspended expectations from investors.

Market Sentiment and Outlook

The breadth of gainers indicates a bullish sentiment in pockets of the market, with investors rotating into mid- and small-cap names that showed strong upside potential. The performance of BETAGLAS—largely driven by fundamentals and market repositioning in the industrial space—also underscores the market’s openness to value discovery in under-followed stocks.