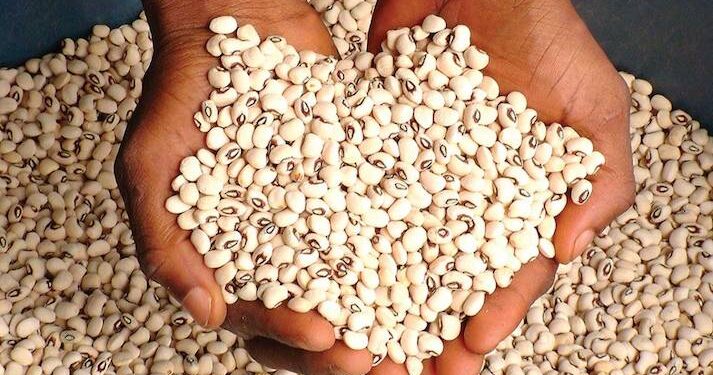

Prices of cowpea and beans in Nigeria have dropped significantly in 2025, with a 100kg bag now selling for between N80,000 and N120,000, down from a peak of N240,000 in 2024.

The President of Cowpea and Beans Farmers, Processors and Marketers Association of Nigeria (C&BFPMAN), Mr. Kabir Shuaibu, disclosed this in an interview with the News Agency of Nigeria (NAN).

He attributed the price crash to improved harvests and favourable cultivation conditions.

“Currently, a bag of beans up North costs between N80,000 and N120,000, depending on the species you are buying. As of this time last year, due to the poor harvests, the same bag sold between N210,000 and N240,000.

“We do hope for continued increased harvest in the sector as it benefits both the farmers and the consumers,” Shuaibu stated.

The development is offering relief to both traders and consumers, who struggled with steep prices in the previous year.

Increased harvests driving down prices

Shuaibu explained that the primary reason for the price drop is a record surge in harvest yield. According to him, farmers experienced harvests up to ten times higher than what was previously recorded, largely due to improved weather conditions and expanded cultivation efforts.

“We are glad the price of beans and cowpeas in general has dropped since the harvest from last year. We harvested over 10 times what we usually harvested in the past years.

“The main reason for the drop in price is the increase we got from our cultivation. This implies that with an increased supply of the produce, the prices will drop.

“The reason for the hike in the price of beans last year was due to the poor harvest in the previous year.

“You can imagine a farmer who planted in a hectare of land and expecting 10,000 bags of beans but was only able to harvest and could only get a few bags due to flooding.

“The situation of bean hike we witnessed last year was one we had not experienced in the sector for the past 10 years. We hope it does not recur,” Shuaibu said.

He noted that in the most recent harvest of beans and cowpeas, a hectare of land produced triple of its usual harvest of 10,000 bags, hence the crash in the price of the produce.

“Another reason for the surplus in the harvest of beans this year is that farmers did not take chances. While cultivating corn, they also planted beans and cowpeas along the rows, hence the increased harvest and subsequent drop in price of the produce,” he said.

Traders confirm decline and improved conditions

Confirming the development, Mrs Esther Umeileka, a wholesaler and Managing Director of Fresh2Home Ltd., said better yields and reduced pest infestations led to a sharp increase in supply.

“Last year, there was a case of insect/weevils attack which affected the produce. So, this year, we have a lot of produce that crashed high prices. Also, we have adjusted to government policies. Another reason for the drop in the price of beans is that this year the yield from the harvests is quite high,” she said.

At Oyingbo Market in Lagos, another beans trader, Mrs Zainab Ahmed, said consumer demand is now recovering due to the price adjustment.

“With the hike in the price of the produce last year, it was not easy for our customers. They just price and walk away. But now, everybody seems to be able to afford beans for their families again, as the price has dropped to about N6,000 to N7,000 for a paint bucket as against N13,000 to N14,000 that was sold last year,” Ahmed said.

Consumers welcome affordability

Consumers across Lagos have expressed relief over the return of affordable beans, a staple food in most Nigerian homes.

Mrs Tonia Sanwo, a Lagos resident, said the cost of purchasing beans had been unbearable for many families in 2024.

“Last year, the price of beans was really on the high side; we were buying a small derica cup for as high as N2,000 to N2,500. We are really glad the price has dropped; the same quantity now sells between N800 and N1,000, depending on the species. We never thought the price of beans would drop from what we experienced last year,” she said.

Another consumer, Mrs Favour Braye, a civil servant, noted that improved security has helped farmers return to their farms, resulting in higher output.

“The price of beans has really dropped in comparison to the prices last year. The farmers complained that insecurity on their farms resulted in poor yields the previous year,” Braye said.

Braye noted that with farmers now having easier access to their farms, the price of beans has dropped significantly, bringing relief to many. She added that more people can now afford beans, which remains a staple food in most Nigerian households.

“He noted that in the most recent harvest of beans and cowpeas, a hectare of land produced triple of its usual harvest of 10,000 bags, hence the crash in the price of the produce”.. Please kindly reconfirm this statement… Thank you. I don’t think he said 10,000 bags.