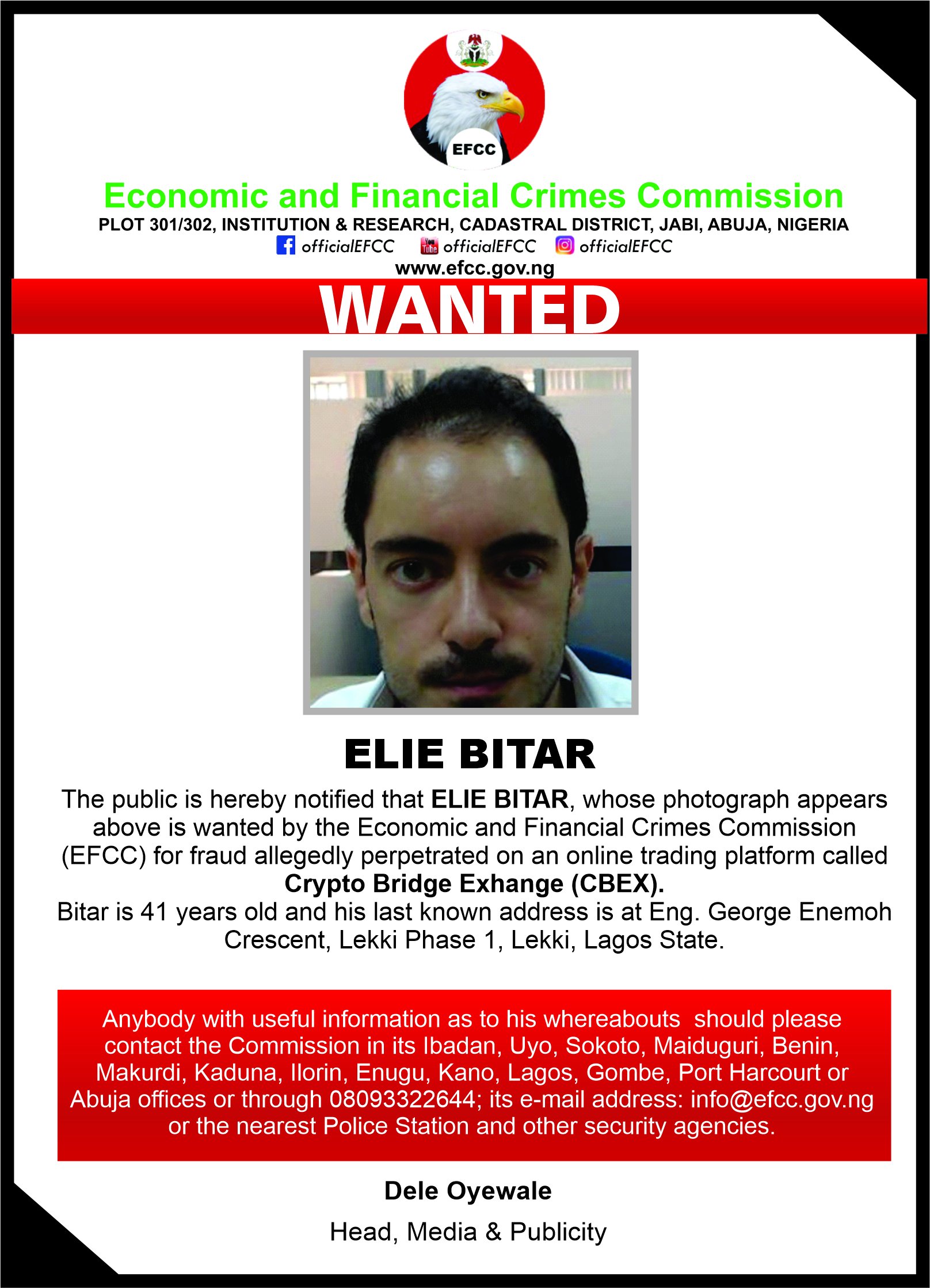

The Economic and Financial Crimes Commission (EFCC) has declared Elie Bitar, a foreign national, wanted in connection with fraud allegations linked to Crypto Bridge Exchange (CBEX), an unregistered cryptocurrency trading platform.

The anti-graft agency announced the development on Wednesday, publishing a wanted notice across its social media platforms.

However, the EFCC did not specifically reveal the country of Bitar.

Expanding the Investigation: A Growing List of Suspects

Bitar, aged 41, was last known to reside at Eng. George Enemoh Crescent, Lekki Phase 1, Lagos State, according to the EFCC.

He now joins eight Nigerian suspects previously declared wanted by the commission for allegedly promoting the CBEX scheme, which has resulted in major financial losses for investors.

The EFCC had earlier declared the following individuals wanted:

- Adefowora Abiodun Olanipekun

- Adefowora Oluwanisola

- Emmanuel Uko

- Seyi Oloyede

- Johnson Okiroh Otieno

- Israel Mbaluka

- Joseph Michiro Kabera

- Serah Michiro

On Monday, Olanipekun voluntarily surrendered to authorities, signaling the deepening probe into the fraudulent CBEX operations.

CBEX Collapse and Investor Losses

CBEX users began reporting issues with fund withdrawals in April, raising concerns about the platform’s legitimacy.

Many Nigerian investors alleged that they lost millions of naira, prompting calls for intervention.

The Securities and Exchange Commission (SEC) later confirmed that CBEX was not registered, further validating claims that the platform had violated financial regulations.

Legal Proceedings and Arrest Warrants

A Federal High Court in Abuja recently granted the EFCC permission to arrest and detain six CBEX promoters in connection with a $1 billion investment fraud allegation.

Presiding Judge Emeka Nwite issued the ruling after the EFCC’s legal representative, Fadila Yusuf, submitted an ex parte application seeking judicial approval for the detentions.

As the investigation continues, authorities are working to track down and prosecute those involved in the high-profile crypto fraud, sending a strong message against financial crimes in Nigeria’s digital economy.

What you should know

CBEX prides itself as an investment platform that gives users 100% return on investment in one month, and “investments” are only in USD. Users also get a bonus for referrals.

- Operating without any official social media presence, CBEX presented itself as a high-yield investment platform but ultimately left its users in financial disarray.

- Director General of the Securities and Exchange Commission (SEC), Emomotimi Agama, warned Nigerians against patronizing unregistered platforms.

During a virtual engagement hosted by Nairametrics on X (formerly Twitter), medical practitioner Dr. David Udoh shed light on the regulatory lapses that allowed CBEX to operate freely in Nigeria.

“CBEX was not regulated by the Nigerian Securities and Exchange Commission (SEC). The platform operated without registration, which is a clear violation,” Udoh stated.

He attributed the platform’s success in exploiting investors to systemic issues such as unemployment, economic hardship, and widespread financial illiteracy.