In a dramatic turn of events, Nigeria’s Eurobond market has come under heavy pressure, echoing the shockwaves rippling through global financial markets.

A bold and controversial move by U.S. President Donald Trump, who recently announced a sweeping 10% import tariff on all foreign goods, alongside retaliatory levies targeting nations with ‘unfair trade practices’, has triggered negative market reactions.

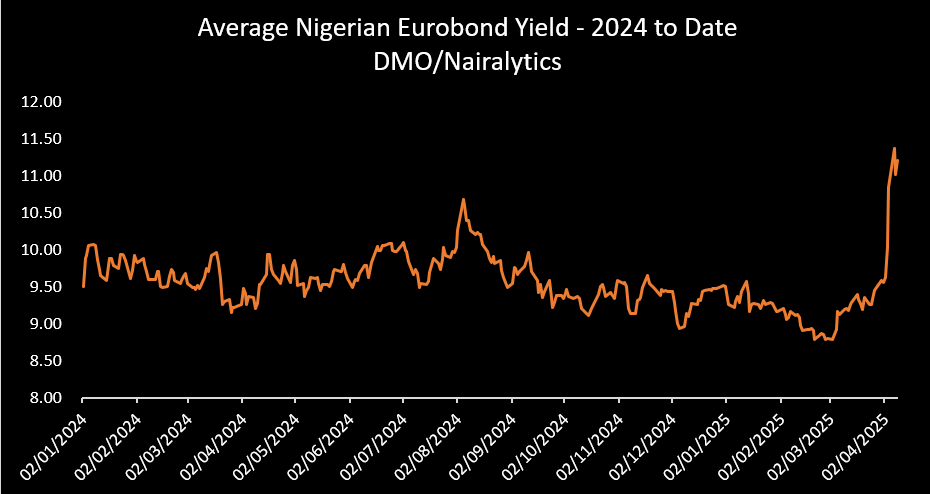

As investors scrambled to reassess risk, Nigerian Eurobonds saw sharp selloffs, sending average yields surging to 11.21% by Wednesday, April 9, 2025—up by a staggering 163 basis points from 9.584% at the end of March.

This is according to data tracked by Nairalytics from the Debt Management Office (DMO).

The current levels represent the highest since the beginning of the Covid-19 pandemic, in February 2020. Notably, the short end of the curve recorded the highest sell pressure, with the Nov 2025 rising by 282bps over the same period.

Similarly, the yield on the long end of the curve (Sep 2051) rose by 97bps to hit 11.65%, having moderated slightly from the record high of 12.12% recorded earlier in the week.

Similarly, the ongoing global trade tensions have contributed to a significant drop in international crude oil prices, with Brent crude now trading at $63.7 per barrel. This, combined with reduced domestic oil production, is likely to further strain Nigeria’s foreign exchange earnings and exert additional pressure on the already weakening naira.

The local currency has depreciated by approximately 4.8% month-to-date, closing at N1,625/$ on Tuesday, despite persistent interventions by the Central Bank. These developments have fueled investor concerns, leading to increased selloffs in Nigerian Eurobonds as risk sentiment deteriorates.

Expert view

In an exclusive interview, Mr. Victor Onyema, Head of Investment Management at Norrenberger Asset Management Limited, attributed the recent spike in Nigeria’s Eurobond yields primarily to President Donald Trump’s tariff announcement, but expressed optimism about a potential stabilization in the near term.

“Over the past week, we’ve witnessed a significant surge in global Eurobond yields, with Nigeria’s instruments particularly affected. Notably, the NIG 2051 bond traded as high as 12.5%—levels we haven’t seen since the COVID-19 pandemic,” Onyema explained.

- He further noted that the newly introduced tariffs and the intensifying trade tensions between the U.S. and China have triggered a wave of risk aversion, prompting investors to seek refuge in safer assets.

“The current uncertainty is driving a flight to quality. However, we anticipate some level of stabilization within the next week or two, as the market begins to digest and fully price in the implications of these developments,” he added.

What to expect

In the coming weeks, global attention will remain firmly fixed on the unfolding dynamics between the United States and China, as the world watches how other nations respond to Washington’s sweeping tariff hike.

- While negotiations may emerge in a bid to de-escalate tensions, the immediate impact on global markets has been profound—spilling into both variable and fixed income assets.

- The fear of a potential global recession is becoming more pronounced, especially as market participants brace for a more aggressive monetary policy stance from the U.S. Federal Reserve.

With expectations of up to four or five interest rate hikes now on the table, investors are likely to remain cautious, positioning their portfolios defensively until greater clarity emerges.