Nigeria’s total trade exports surged to $50.4 billion in 2024, driven by exchange rate depreciation and the elimination of fuel subsidies, which boosted the country’s trade balance.

Data from the National Bureau of Statistics (NBS) shows that Nigeria recorded a total trade volume of N138 trillion, the highest in the country’s history, representing a 106% increase compared to the previous year.

This translates to $89.9 billion in dollar terms, suggesting a total surge of 22.1% in 2024 when dollarized.

This is a rebound from a 35% decline recorded the previous year when the government introduced a more market-driven exchange rate.

Nigeria’s 5-year high total trade figures were recorded in 2022 when total trade hit $113.8 billion at a time when the exchange rate closed the year at N460 officially.

However, the parallel market exchange rate closed at around N736/$1 which would have delivered a dollarized total trade of just $71.7 billion.

Nigeria transitioned to a more market-determined exchange rate in 2023, leading to a 50% depreciation of the naira that year.

However, businesses appear to have adjusted to the new realities, as trade surged significantly in 2024.

What the data is saying

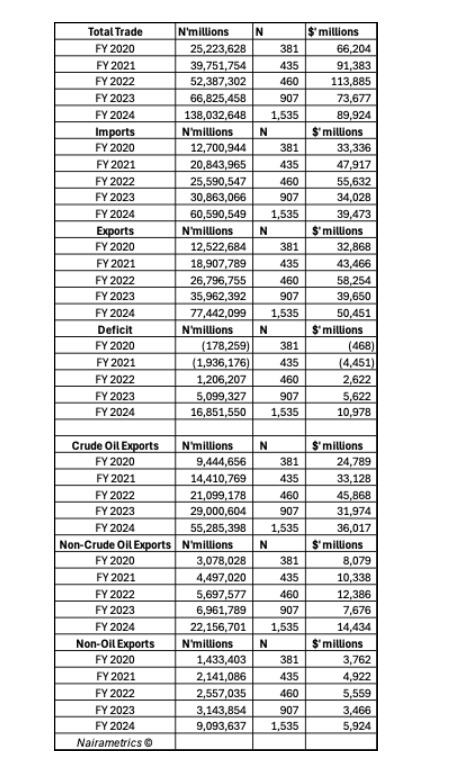

A closer look at the data shows that total trade in 2024 stood at N138 trillion, up from N66.8 trillion in 2023. However, when adjusted for the exchange rate, total trade in dollar terms rose by 22.1% to $89.9 billion.

Nairametrics used the official closing exchange rates of N1,535/$1 for 2024 and N907/$1 for 2023 in its calculations and used official rates throughout for the prior years as well.

- Total exports nearly doubled, rising by 96.3% to N60.59 trillion in 2024, as Nigeria’s crude oil output reached 1.5 million barrels per day.

- In dollar terms, total exports stood at $50.5 billion, up from $39.6 billion in 2023. However, this was still lower than the $58.2 billion recorded in 2022, which, at the time, translated to N26.7 trillion based on the prevailing exchange rate.

- But when the parallel market rate is used, 2024 delivers the largest export earnings.

Crude oil exports remain dominant: Crude oil exports accounted for $36 billion (N55.2 trillion) in 2024, making up about 71% of total exports.

This compares to $31 billion in 2023 and $45.8 billion in 2022.

- Nigeria remains heavily dependent on crude oil exports to finance fiscal spending and shore up foreign exchange reserves. However, the sector continues to face multiple challenges, including crude oil theft, inadequate investment in the upstream sector, and environmental and community-related issues affecting production.

- Although the government has introduced several initiatives to boost crude oil exports, it has yet to achieve its target production output of 2 million barrels per day.

Non-oil exports hit a four-year high: Non-oil exports reached $5.9 billion in 2024, the highest level since 2020 in both naira and dollar terms. Nigeria’s non-oil exports largely consist of agricultural and mineral products, with Africa being a key export destination.

Imports were also on the rise: In dollar terms, total imports reached $39 billion (N60.5 trillion) in 2024, based on the closing exchange rate of N1,535/$1. This compares to $34 billion in 2023 but remains significantly lower than the $55.6 billion recorded in 2022.

Nigeria’s import bill has declined over the past few years due to massive naira depreciation and limited access to foreign exchange.

What you should know

While Nigeria’s foreign trade data paints a positive picture and boosts confidence in the economy, it is important to note that the figures exclude trade in services, which constitutes a significant portion of the country’s foreign exchange demand.

- Nigeria spends heavily on imported services, particularly in sectors such as technology, consulting, technical services, and support.

- These outflows contribute to the persistent pressure on the exchange rate and significantly impact the actual current account balance.

- Despite this, the most recent data from the Central Bank of Nigeria (CBN) shows that Nigeria recorded a current account balance of $5.14 billion in Q3 2024, according to the CBN’s latest Balance of Trade report.

- This suggests some improvement in external accounts, even as the country continues to grapple with forex-related challenges.