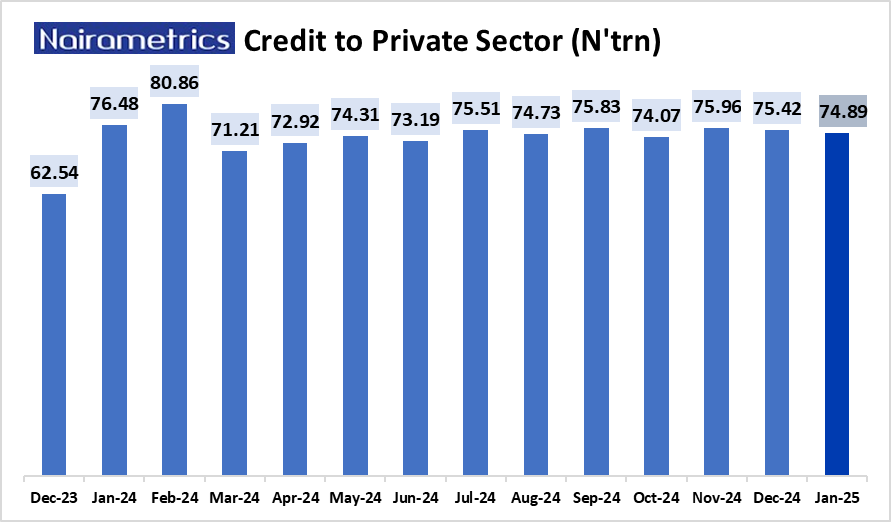

Nigeria’s private sector credit recorded a measured decline of N1.07 trillion (1.41%) in January 2025, bringing the total credit to N74.88 trillion from N75.90 trillion in November 2024.

The Central Bank of Nigeria did not release data for December 2024, prompting the Nairametrics Research Team to estimate a N536 billion decline on a month-on-month basis, bringing December’s estimated credit to N75.42 trillion.

This moderation in credit aligns with the Central Bank of Nigeria’s (CBN) ongoing stringent monetary policies under Governor Yemi Cardoso, aimed at curbing inflation and stabilizing the economy.

Trend of declining private sector credit

According to the latest Money and Credit Statistics report by the CBN, credit to the private sector has exhibited fluctuations, reflecting both increases and declines over time.

In a year-on-year comparison, credit to the private sector stood at N76.47 trillion in January 2024, declining to N75.42 trillion (based on Nairametrics research estimate) in December 2024, representing a N1.05 trillion (1.38%) drop.

Additionally, private sector credit had risen significantly from N62.54 trillion in December 2023 to N76.48 trillion in January 2024—before the CBN, under Governor Cardoso, adopted a hawkish stance with the first of six consecutive hikes in the Monetary Policy Rate (MPR) in February 2024.

Despite a relatively modest 0.71% month-on-month decline in January 2025 (based on Nairametrics estimate), the impact of high borrowing costs on businesses is evident, reflecting the CBN’s sustained monetary tightening measures.

Impact of monetary policy on credit and money supply

The persistent decline in private sector borrowing highlights the tightening credit conditions driven by high interest rates.

As noted in a previous Nairametrics report, the M3 money supply, which includes net foreign assets (NFA) and net domestic assets (NDA), has expanded significantly over the past year.

- By November 2024, M3 stood at N108.97 trillion.

- It increased further to N109.41 trillion in September 2024 and hit its latest peak in January 2025.

The CBN’s monetary tightening, including six consecutive MPR hikes in 2024, has played a key role in moderating private sector borrowing patterns, with credit oscillating between N71 trillion and N76 trillion throughout the year.

What you should know – Sectoral Distribution of Credit

- The latest CBN Economic Report (November 2024) shows that the manufacturing sector received the largest share of private sector credit, accounting for 14.1% of the total.

- This is followed by the general commerce sector, which accounted for 13.4% of the total credit, agriculture followed by 9.2% while finance and insurance by 7.3%.

- The manufacturing and commerce sectors remain the primary drivers of credit demand, while the agriculture and finance sectors receive relatively lower allocations.

Nigeria’s GDP growth outpaces private sector credit expansion

Nigeria’s economy recorded a notable growth of 3.84% year-on-year in real terms in Q4 2024, surpassing the 3.46% growth rate achieved in the previous quarter and corresponding period of 2023.

- This growth momentum was sustained across both the oil and non-oil sectors, resulting in an annual real GDP growth rate of 3.4% in 2024, up from 2.74% in the previous year.

- However, despite this impressive growth, the credit to private sector as a percentage of GDP stood at 27.81% as of 2024, significantly lower than 33.26% recorded in 2023.

- This disparity highlights the existing gap in credit access for Nigeria’s private sector, which is crucial for driving economic growth and development.

- In comparison, the credit to the private sector by commercial banks as a share of GDP in Sub-Saharan Africa increased by 8.19% in 2023, reaching 27.73%.

This growth trend underscores the region’s efforts to expand credit access and support private sector development.