The Nigerian real estate sector is set to see significant growth in the coming 3-5 years, with affordable housing and luxury real estate emerging as the primary drivers.

According to the BuyLetLive 2024 Nigeria Price Index Report, key players in the market—including agents, property managers, developers, investors, landlords, tenants, estate surveyors, valuers, and research analysts—identified these segments as having the most promising potential for growth.

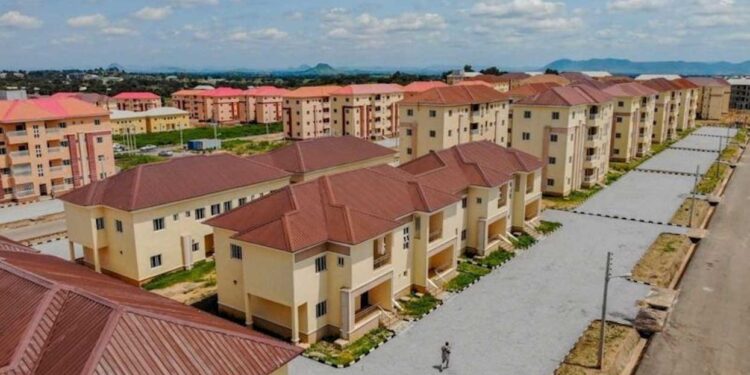

Affordable housing stands out as the biggest opportunity, with 60% of respondents pointing to it as the key growth area.

This reflects the growing demand for affordable housing solutions in Nigeria, where the need for cost-effective housing continues to rise due to urbanization and a rapidly expanding population.

“We also asked key players to identify the biggest growth opportunities they foresee in the real estate market over the next 3-5 years.

“Our analysis revealed that key players in the market anticipate that the most significant growth opportunities in the Nigerian real estate sector will be in the affordable housing segment,” the BuyLetLive report read in part.

The report further noted that as a result of affordable housing standing out as the biggest opportunity, both private investors and the government are focusing their efforts on addressing this gap, seeing it as essential for long-term economic stability and growth in the real estate market.

Luxury real estate follows closely, with 21% of the market players highlighting it as another area poised for growth. The demand for high-end properties is increasing, especially in major cities like Lagos and Abuja, driven by a growing number of affluent individuals and investors seeking premium homes and exclusive developments.

In addition to these primary sectors, the report notes other opportunities for growth, albeit on a smaller scale. Tech-enabled real estate solutions, shared properties, and commercial spaces are seen as emerging areas, with 12%, 9%, and 8% of respondents indicating potential in these categories. Meanwhile, industrial/warehouse spaces (4%) and green buildings (3%) round out the remaining opportunities.

More insights

While projections were made for the next 3 to 5 years, the BuyLetLive 2024 Nigeria Price Index Report also sheds light on the broader market outlook for 2025.

In the first quarter of 2025, the Nigerian real estate market is expected to experience a cautious “wait-and-see” approach from investors, as they await clarity on the 2025 budget announcement and its subsequent execution. This period of anticipation reflects investor interest in understanding how fiscal policies will influence the macroeconomic landscape and impact real estate demand.

- Looking beyond the first quarter, the overall outlook for 2025 presents a more optimistic picture. The introduction of investor-friendly policies and gradual improvements in key economic indicators are expected to restore confidence, driving both local and foreign investment in the sector. Despite the challenges faced in 2024, including high inflation and currency instability, which dampened investment and demand, 2025 offers a more favorable environment for growth.

- One of the most significant areas of opportunity is the continued surge in demand for affordable housing, which remains a priority for both developers and the government. With several initiatives under the Renewed Hope Project expected to be completed in 2025, efforts to address the housing deficit, particularly for middle- and low-income earners, are gaining momentum.

- These initiatives align with the increasing need for accessible housing solutions, despite the rising costs of construction materials driven by currency pressures.

- The warehousing and industrial sectors are also projected to maintain steady growth, buoyed by heightened demand for logistics and manufacturing spaces. The commercial real estate segment is likely to benefit from the ongoing recovery in business activities, although rising costs may temper the pace of growth in this area.

As the year progresses, the collaboration between the private sector and government will be essential in addressing persistent challenges such as infrastructure deficits, regulatory bottlenecks, and currency volatility. Innovative construction techniques and localized production of building materials could help reduce costs and enhance market stability, fostering sustainable growth.

With these strategic interventions, the Nigerian real estate market is poised for continued development in 2025 and beyond, balancing challenges with opportunities to deliver value across all segments.