- For actually the earth had no roads to begin with, but when many men pass one way, a road is made. – Lu Xun

On September 27th 2024, a remarkable event occurred quietly and largely unobserved.

The Federal Government of Nigeria achieved a noteworthy milestone with the successful conclusion of its maiden Sovereign Sukuk.

Indeed, it seemed like just yesterday when in September 2017, and with much trepidation, the oversubscribed 7-year instrument made its historic ₦100 billion debut in the capital market.

The fact that the maturity and redemption of this first FGN sukuk passed almost unnoticed indicates several positive things.

First, and most importantly, the projects were successfully completed and the sukuk holders were seamlessly paid their rentals (equivalent to coupons) and their principal at the end of the lease period. Secondly, with 6 FGN Sukuk issuances and over N1.1 trillion raised, Sukuk is no longer strange or news in this market.

This pioneering Sukuk issuance diligently steered by the Debt Management Office (DMO), became a catalyst that transformed the Nigerian Non-Interest Finance Industry and showcased how government financing could be directly linked to specific projects. This element has become a vital component of the country’s funding strategy for infrastructure.

Paving the way towards this feat was the Securities and Exchange Commission, through the establishment of the Sukuk Rules in 2013 and the Non-Interest Capital Market Master Plan in 2015.

Throughout the centuries there were men who took first steps, down new roads, armed with nothing but their own vision – Ayn Rand

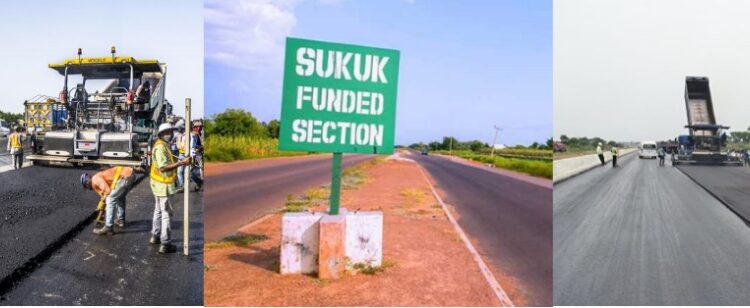

The Sukuk al-Ijarah as structured by Lotus Financial Services and other advisers, funded the construction and rehabilitation of 25 critical road infrastructure across all 6 geopolitical zones in the nation. These investments vastly improved transportation networks, enhanced mobility, promoted economic activities, improved access to resources, empowered local businesses and connected previously underserved regions, further stimulating economic activity.

Due to increased safety, significant reduction in travel time and transportation costs, trade and commerce were enhanced, particularly in sectors like agriculture and manufacturing that largely depend on the road network to facilitate the movement of goods.

The positive impact of this game changing Sukuk issuance, extended to the Non-Interest Financial Institutions including Banks, Fund Managers, Takaful (Non-Interest Insurance) companies and Pension Fund Managers, who had long endured a stifling operating environment due to the paucity of ethical liquidity management instruments. These institutions can now manage their balance sheets more efficiently, achieve some treasury requirements and innovate a new range of financial products.

Over the last 7 years, the Nigerian Non-Interest Finance Industry has blossomed with the number of institutions increasing to 4 Non-Interest Banks, 4 Asset Managers, 5 Takaful companies and 15 registered mutual funds.

Similarly delighted to be included with the landmark Sovereign Sukuk were the investors who had been previously excluded from participating in the debt capital markets due to the lack of non-interest instruments. Indeed, many Sukuk subscribers were pleased to invest in a national instrument for the first time, even though they had been eligible for decades.

The overwhelming success of the initial Sukuk demonstrated the strong market appetite for non-interest finance instruments in Nigeria. This laid a solid foundation for future issuances and became a key instrument for infrastructure financing. Since the first ₦100 billion issuance in 2017, the Federal Government has subsequently offered 5 highly over-subscribed Sovereign Sukuk, raising an additional sum of ₦992billion from the capital market. These funds were channeled towards essential road infrastructure across the country, demonstrating the increasing role of ethical finance in addressing Nigeria’s infrastructure deficit.

The expectation is that the Federal Government (through the Debt Management Office) would continue to utilize inclusive financing mechanisms with a calendar of consistent annual Sukuk issuances; and innovate further by expanding its offering to include short-term Sukuk, as well as the much-touted dollar denominated Sukuk.

State and Local Governments as well as corporates are also encouraged to follow suit. Sukuk for infrastructure development has proven successful, and financial inclusion can only expand and develop the addressable market.

As the year 2024 draws to a close and we reflect on what has passed, we who were there seven years ago and played a part in the maiden FGN Sukuk issued in September 2017, would be remiss if we did not note the successful conclusion of this Sukuk, commend the bravery of those that trod the unbeaten path, those that have followed, and declare our gratitude that a Sukuk road was made!

- When we invest in roads and bridges, we are investing in our people and our future- Kay Ivey.