Anthonio Separovic, the Co-founder and CEO of Oradian, a cloud-core banking solution, has said that fintechs leveraging cloud-based core banking systems can launch their products and services much quicker, drastically reducing the time needed to go to market.

He pointed out that elements such as seamless integrations, scalability, and continuous innovation provided by cloud core banking systems enable fintechs to move faster and more efficiently.

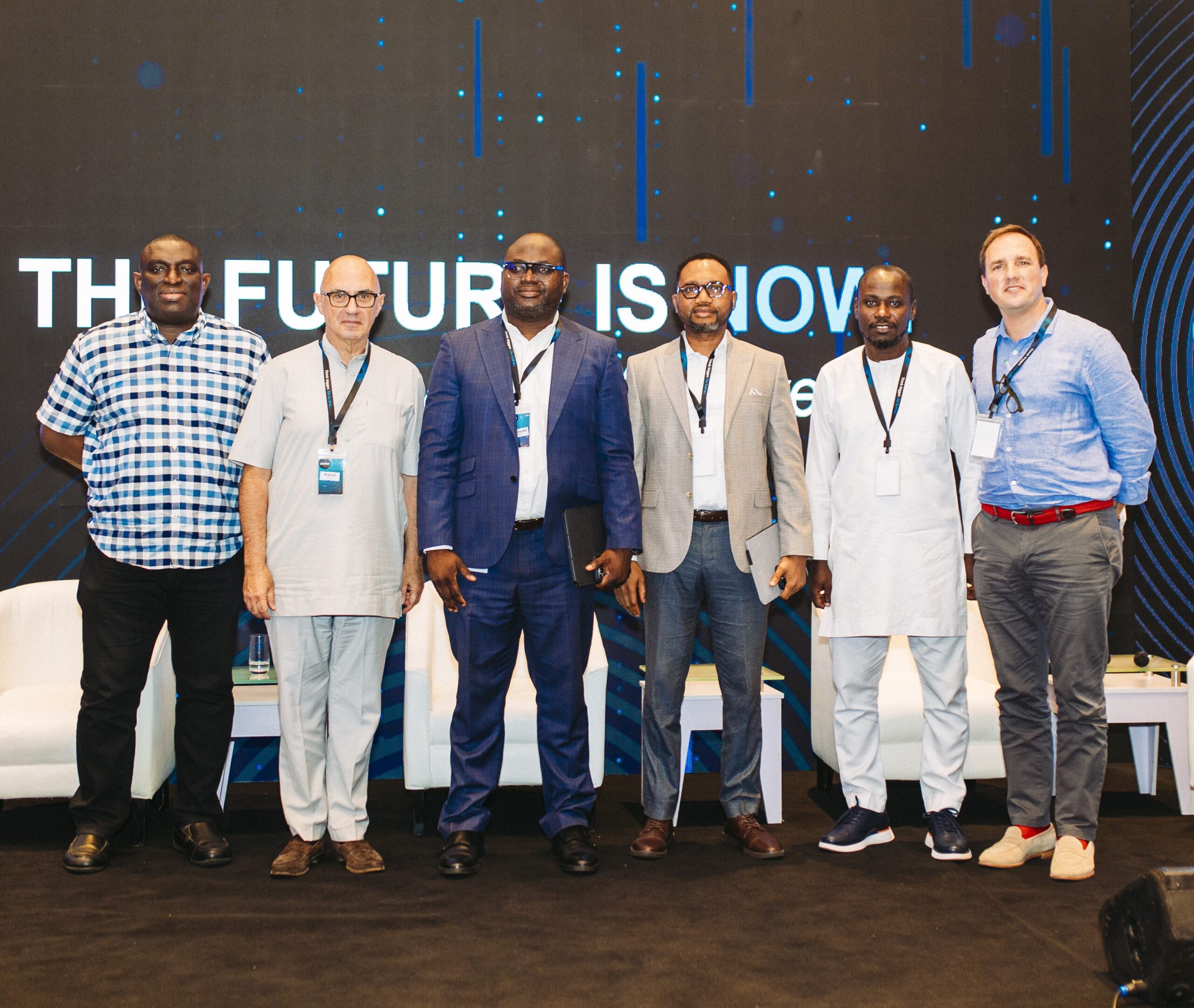

Separovic made this submission during a media parley session at the Oradian Core Banking Summit: The Future Is Now, held in Lagos on November 28, 2024.

He emphasized that cloud technology allows fintechs to focus on their core value propositions without being bogged down by the complexities of traditional banking infrastructure.

According to Separovic, with cloud-based solutions, fintechs can access essential banking functionalities—such as account management, payments, and compliance—through a unified platform, all while maintaining flexibility and speed.

“Traditionally, when fintechs want to develop a product, they have to go to the design of the product. They go then to the tech team, and they go code it, and they have to make it available. Now, when fintechs have cloud technology, everything is parameterized. They can release a new product within a few hours.

“So now fintechs can go to market much quicker. And that’s what’s enabling fintechs to become incredibly competitive. They can innovate much quicker. They can try things out and go to market much faster,” Separovic explained.

This increased speed to market gives fintechs a competitive edge, allowing them to respond to customer needs and industry changes with agility.

Separovic further highlighted that by leveraging cloud technology, fintechs can scale quickly and efficiently, offering new services without the constraints of legacy systems.

More insight

The panel session at the Oradian Core Banking Summit, which featured panelists such as Victor Asemota (Tech Entrepreneur), Kamal Boushi (CEO, Renmoney), Adewale Salami (Group CIO, First Bank), Pius Emeya (Head of IT, Access Bank), Kazeem Noibi (VP of Technology, FairMoney), and Antonio Separovic (Co-founder & CEO, Oradian), delved into the adoption of cloud core banking solutions by traditional banks.

- Pius Emeya emphasized the key advantages of cloud technology, stating that “When you are on the cloud, it is more secure, cheaper, and faster,” though he also highlighted that the decision between cloud and on-premise solutions depends on the bank’s current infrastructure and strategic objectives.

- He noted that while newer digital banks benefit from the scalability and speed of cloud systems, legacy institutions with substantial legacy data might find hybrid solutions more suitable for integrating cloud capabilities with their existing systems.

- Victor Asemota argued that the distinction is no longer between big and small banks, but between fast and slow. He stressed that banks must focus on agility and responsiveness rather than just the physical costs of infrastructure.

Adewale Salami from First Bank underscored the importance of aligning technology with customer journeys. He explained that technology should not be viewed in isolation but as a tool to enhance the overall customer experience, with banks needing to innovate in ways that serve clients more effectively.

Kamal Boushi offered a pragmatic view, advising banks to concentrate on their core strengths.

“Focus on the business and don’t spend time doing things that are not your business like payroll, legal, etc.”

He also firmly stated, “On-prem or cloud? I’ll say cloud.”

The discussions concluded that the adoption of cloud banking must be aligned with each bank’s stage of development and strategic goals.

While newer institutions can rapidly leverage cloud capabilities, traditional banks should carefully assess the integration of cloud systems with their legacy infrastructure. Ultimately, the focus should be on a clear, customer-centric strategy that drives speed, innovation, and scalability.