The Lagos Chamber of Commerce and Industry (LCCI) has expressed apprehension over the Federal Government’s plan to secure a $2.2 billion loan, cautioning that the move could exacerbate debt sustainability challenges and hinder critical infrastructure development.

The LCCI, in a statement released on Friday, highlighted the urgent need for Nigeria to diversify its funding sources beyond debt financing.

The Director-General of the LCCI, Dr. Chinyere Almona, urged the government to intensify efforts to expand the non-oil revenue base through tax reforms and promote export-driven sectors such as agriculture and manufacturing.

She emphasized alternative funding options, including boosting exports, tourism, agriculture, and solid mineral resources, as viable means to reduce reliance on borrowing.

Additionally, Dr. Almona recommended the privatization of certain state-owned enterprises (SOEs) and improving the efficiency of those that remain under government control to enhance revenue generation.

Debt sustainability concerns

Dr. Almona noted that Nigeria’s debt-to-Gross Domestic Product (GDP) ratio, estimated to be over 50%, coupled with debt servicing costs that overshadow capital expenditure, raises serious concerns.

According to her, the country’s external debt already stands at approximately $17 billion, with implications for future economic stability.

“The LCCI warns of imminent debt sustainability issues that may further weaken critical infrastructure in the country,” Almona said.

She also highlighted the risk of external currency shocks due to the naira’s depreciation against the dollar, which could further strain the economy as debt servicing costs rise.

Call for fiscal prudence and transparency

Dr. Almona urged the Federal Government to prioritize transparency and accountability in deploying borrowed funds.

“Funding critical infrastructure should take precedence, as it underpins economic growth and job creation,” she stated.

- She stressed the need to channel loans into critical infrastructure that supports business growth, such as electricity supply, food security, and manufacturing enablers.

- To reduce borrowing pressures, Almona proposed greater reliance on Public-Private Partnerships (PPPs) for infrastructure development, emphasizing the efficiency and innovation the private sector could bring to the table.

- Almona called for urgent measures to stabilize the naira and address structural issues in the foreign exchange market, noting that the Central Bank of Nigeria’s ongoing struggles to boost foreign exchange supply have yet to yield significant results.

“Reducing external borrowing is crucial, as the continuous depreciation of the naira amplifies the burden of debt servicing,” she added.

The LCCI urged the Federal Government and the National Assembly to carefully assess the long-term impact of Nigeria’s current borrowing trajectory.

“The government must tread cautiously on the path of fiscal prudence. Project accountability, effective monitoring, and evaluation of capital projects are essential to ensure the efficient use of borrowed funds and the delivery of tangible results,” Almona advised.

The chamber reiterated its commitment to advocating for sustainable economic policies that ensure fiscal responsibility and strengthen Nigeria’s economic foundations.

Backstory

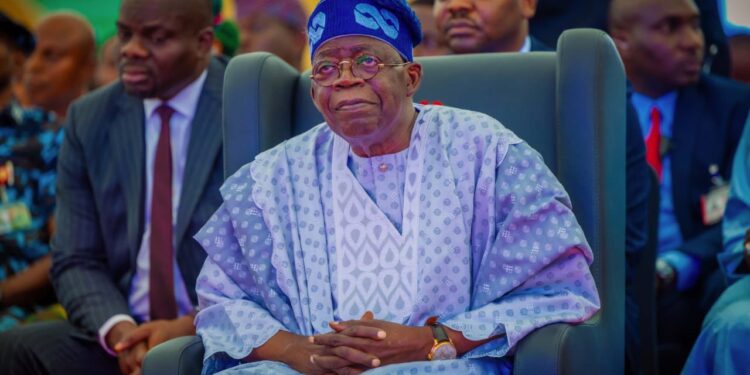

The Nigerian Senate on Thursday at plenary approved the new external borrowing plan request of $2.2 billion dollars presented for consideration by President Bola Tinubu.

- The approval followed the adoption of the report of the Senate Committee on Local and Foreign Debts. The report was presented by the Chairman of the Committee Sen. Aliyu Wammako (APC -Sokoto).

- Presenting the committee‘s report, Wammako said the presidential request was very necessary for approval.

- He said the loan request would be utilised for the execution of ongoing projects and programs in the 2024 appropriation act, saying that the projects were critical for national growth and development.