Companies under the Dangote Group lost about N1.21 trillion of their market capitalization in July 2024, as they all experienced double-digit share price decline during the month.

Dangote Cement, Dangote Sugar Refinery, and NASCON Allied Industries are the three subsidiaries of Dangote Group listed on the NGX.

These companies’ share price declined by 10%, 13.6%, and 19.8% respectively in July, translating into a market capitalization loss of N1.21 trillion during the period.

The NGX declined by 2.28% in July, with its market capitalization declining by N1.09 trillion during the period, from N56.602 trillion at the start of the month to N55.514 trillion.

During the period, Dangote Cement shed N1.12 trillion of its market cap to close July with a N10.07 trillion market cap, from N11.19 trillion at the start of the month. Dangote Sugar Refinery Plc recorded a N71.06 billion decline in its market cap, which moved from N522.32 billion to N451.26 billion.

Salt maker NASCON Allied Industries posted a N19.7 billion decline in its market cap, which moved from N93.2 billion to N79.7 billion during the month.

Impact on Aliko Dangote

The market losses by these companies during the month had an impact on the networth of the group’s President, Aliko Dangote.

Dangote who is Africa’s richest man directly and indirectly through Dangote Industries Limited owns an 86% stake in Dangote Cement Plc, a 72.2% stake in Dangote Sugar Refinery, and a 62.19% stake in NASCON.

Hence the losses posted reflected a N1.02 trillion (~$680 million) hit to Dangote’s personal fortune.

According to Bloomberg Billionaires’ Index, his net worth as of July 1, 2024, was about $14.8 billion. However, at the end of the month, it declined to $13.6 billion.

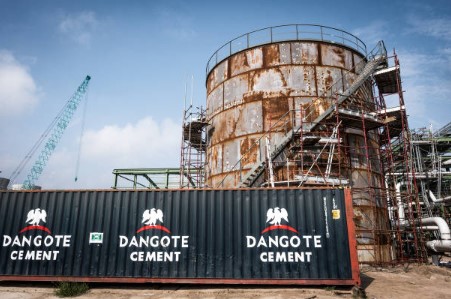

The bulk of Dangote’s assets are his publicly quoted companies. However, his private assets such as the Dangote fertilizer plant were valued at $5.1 billion. The flagship of Dangote’s assets, the Dangote Refinery, is not yet valued amidst a myriad of controversies that have plagued the plant over the past month.

Dangote’s faceoff with Nigerian authorities

In July, the sharp decline in Dangote’s assets on the stock market, though attributed to the poor financial performance of Dangote Sugar and NASCON during the first half of 2024, was more significantly influenced by the conflict between Aliko Dangote and Nigerian regulators.

In late June, the Vice President of Oil and Gas at Dangote Industries expressed frustration at the inability to source crude oil from International Oil Companies (IOCs), while accusing them of trying to undermine the refinery. An accusation which was refuted by the CEO of the Nigerian Upstream Regulatory Commission (NUPRC) in a TV interview.

On July 14, Dangote doubled down in his faceoff with Nigerian petroleum authorities, noting that NNPC’s stake had dropped to 7.2% from the initial 20%. And in response the CEO of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) noted that Dangote Refinery was supplying dirty diesel to the Nigerian public.