The Nigerian University Pension Management Company, known for short as Nupemco published its 2023 summary audited accounts, providing an abridged, but insightful overview of the company’s financial health and pension funds’ performance.

This report provides a summary review and presents key financial highlights, financial ratios, managed funds’ performance, and the trend in the number of Retirement Savings Account (RSA) holders.

Please note: Nupemco only manages funds for current and retired staff members of the public university system.

Financial Highlights

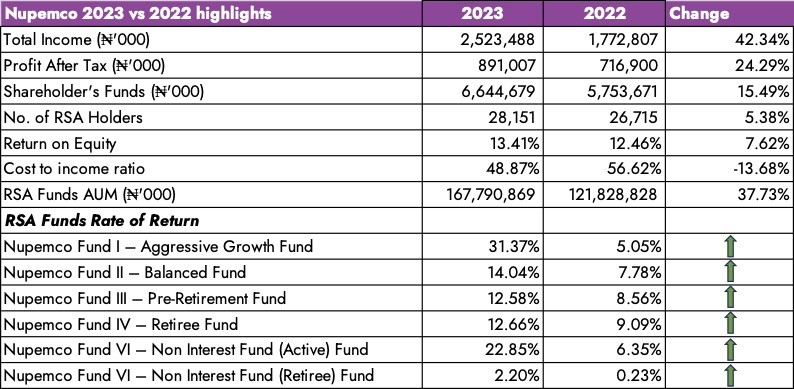

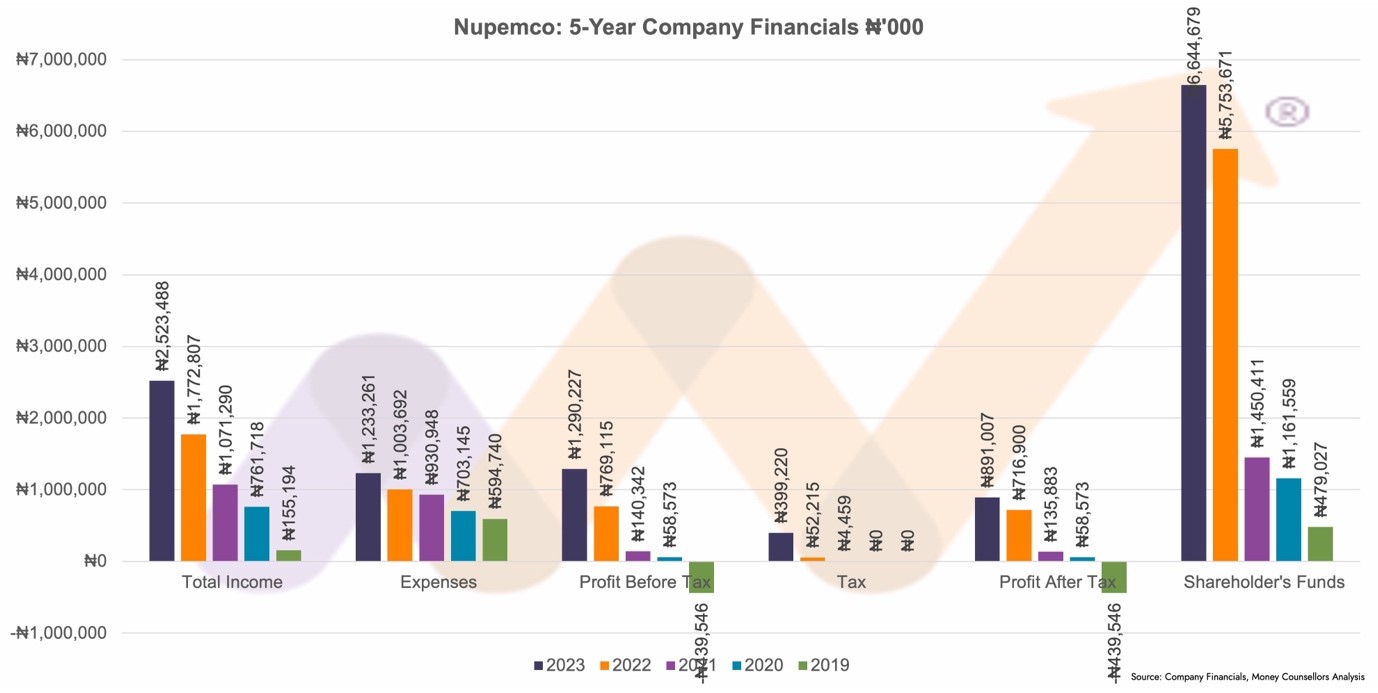

- Total Revenue: Total revenue for the company rose 42% to N2.52 billion in 2023, up from 1.77 billion in 2022. Income generated from the management of pension funds rose 38% to N1.69 billion from N1.23 billion whilst income from managing internally generated revenue rose by 53% to N838 million from N548 million.

- Profit After Tax (PAT): PAT rose 24% to N891 million, up N174 million on the previous year’s N717 million.

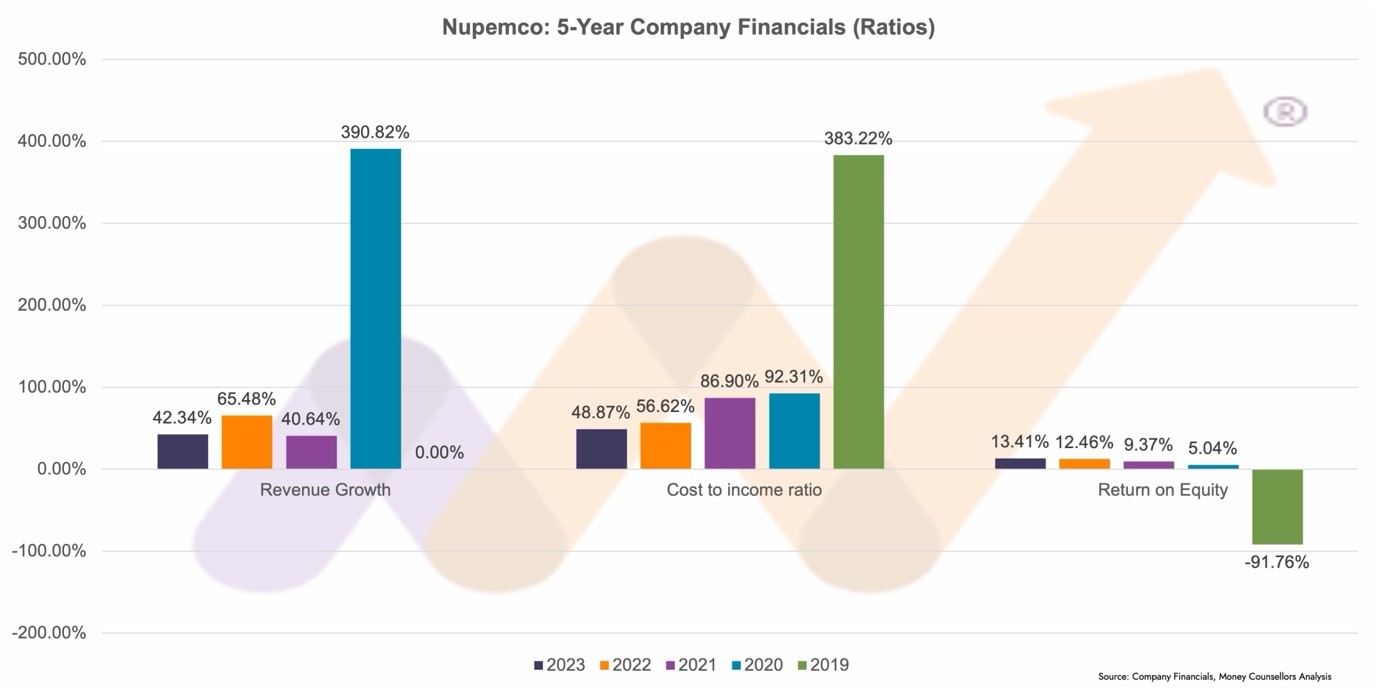

- Operating Expenses: Operating expenses rose much slower than the rise in both revenue and PAT, up by 23% to N1.23 billion from N1.00 billion. This increase of N230 million led to a sizable fall in the company’s cost-to-income ratio, which fell to 48.87% from 56.62%, which is not surprising with the level of growth in revenue.

- Shareholder’s Funds: The company’s shareholders ended the year at N6.64 billion in 2023 up 15.5% from N5.75 billion in 2022.

- Return on Equity (ROE): The ROE closed the year at a low of 13.41%, almost 54% below inflation which closed 2023 at 28.92%.

Financial and Fund Highlights

Corporate Audited Annual Results

Financial Ratios

Financial Ratios

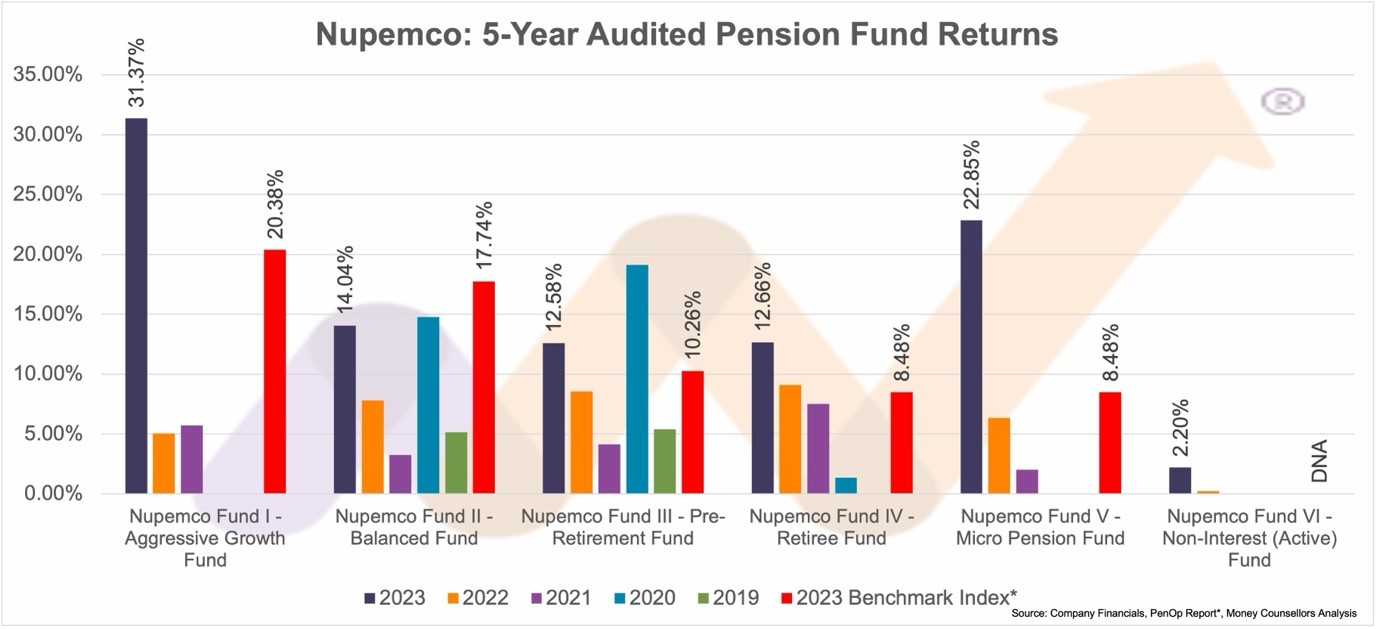

Fund Performance Highlights

- RSA Funds Performance: Nupemco offers six funds to current and retired university staff. All six funds performed better in 2023 than in 2022, and all four funds outperformed the industry benchmark returns (see our article on benchmark returns here).

5-Year Audited Pension Funds Performance

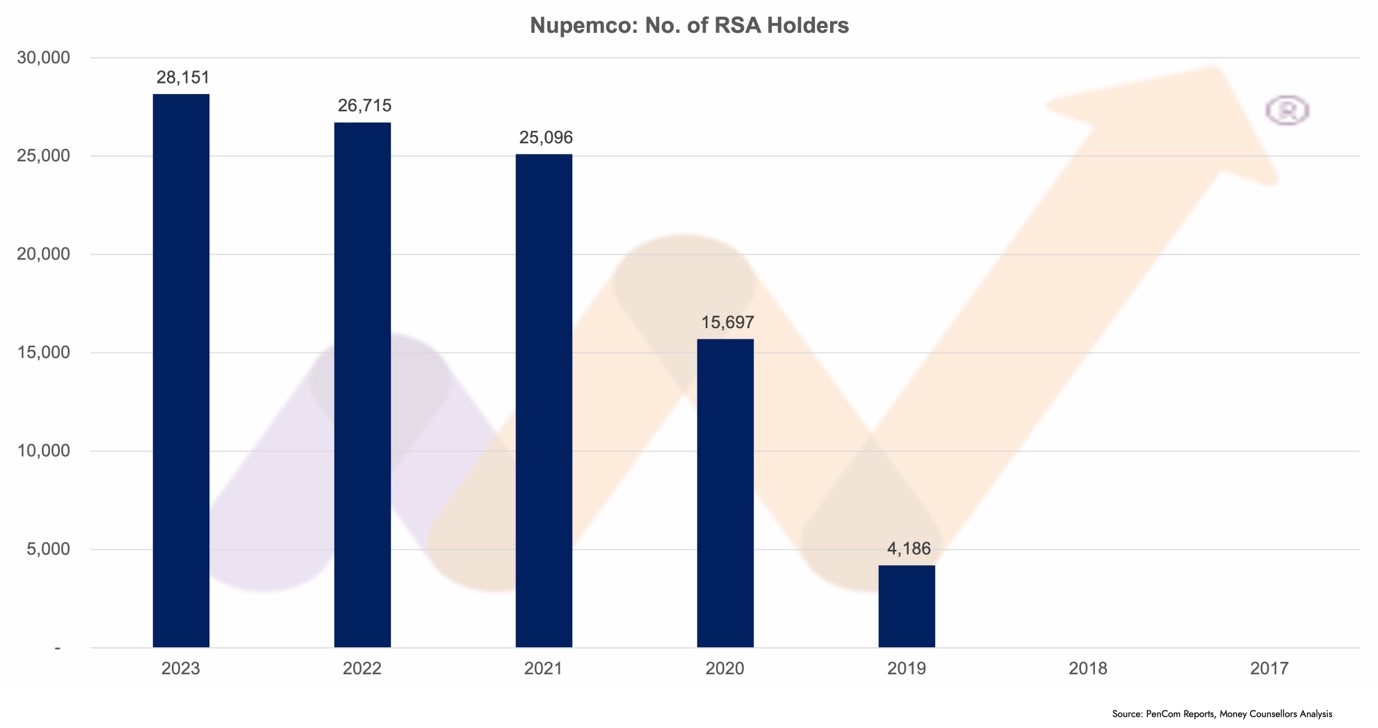

Number of RSA Holders

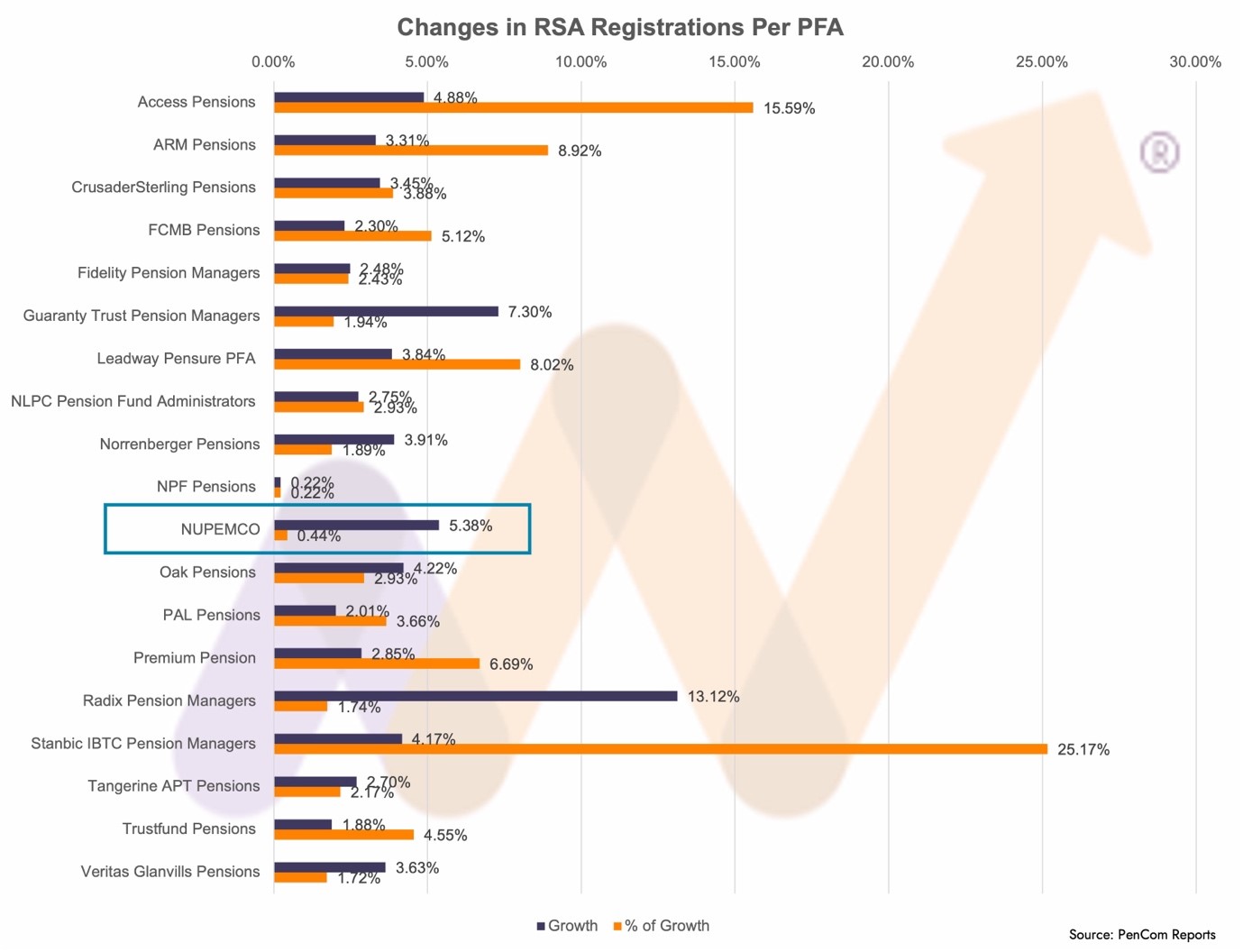

- RSA Growth: Nupemco added 1,476 new accounts, a growth of 5.38% over 2022 closing numbers, reaching a total of 28,151 from 26,715 the year before.

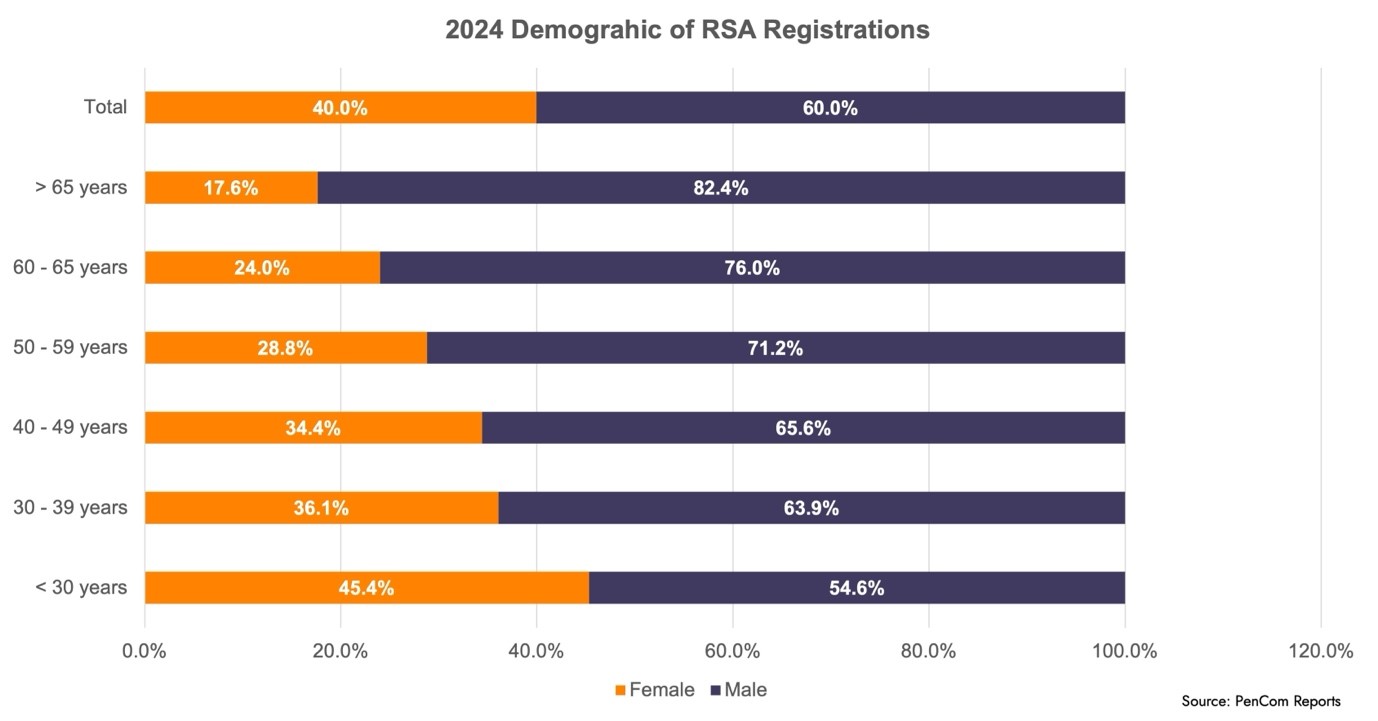

Demographic Analysis

- Age Distribution: The majority of 330,000 RSA holders registered in 2023 fell within the age bracket of <30 years to 39 years (83.9%), indicating a young and growing industry subscriber base. Of the 2023 registrations, Nupemco recorded 0.44% of this growth.

Conclusion

Conclusion

In 2023, Nupemco demonstrated resilient growth, with significant increases in revenue and profit, coupled with efficient cost management. However, the low Return on Equity compared to inflation poses a challenge, highlighting the need for strategic improvements, though we do wonder if the company is over-capitalised due to its captive eco-system. Fund performance continues to improve, which should give RSA holders a cause to smile. As Nupemco looks ahead, the focus will be on optimising returns and capitalising on its captive market.

Watch out for the 2024 Money Counsellors Annual Report on Pensions. MCARP 2023 is available here.

© MoneyCounsellors.com