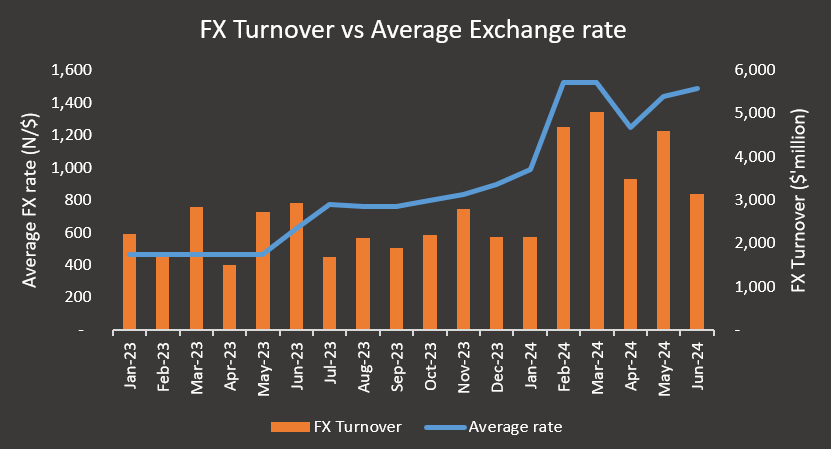

The Nigerian Autonomous Foreign Exchange Market, NAFEM, is set to record its lowest foreign exchange (FX) turnover in five months in June 2024, as dollar illiquidity continues to exert pressure on the naira.

As of June 27th, 2024, FX turnover for the month stood at $3.14 billion, with just one trading day remaining.

This marks a significant decline compared to the $4.61 billion exchanged in the previous month.

Similarly, a daily average of $196.46 million in FX turnover was recorded at the official market, month-to-date, representing a 6.2% decline when compared to the average of $209.39 million recorded in May.

This is according to data tracked by Nairalytics, the research arm of Nairametrics, from FMDQ.

Concurrently, the naira has been on a steady decline against the US dollar over the past two weeks, reaching a monthly low of N1,510.1/$ on Thursday.

On average, the naira has trended downwards, trading at N1,486.63/$1 in June, compared to averages of N1,435.87/$1 in May and N1,244.66/$1 in April 2024.

The downturn in the Nigerian FX market persists despite a slew of policies and reforms implemented by the Central Bank of Nigeria (CBN) aimed at stabilizing the market and achieving price discovery for the naira.

The continuous depreciation of the naira and the reduced FX turnover underscores the significant liquidity challenges facing the Nigerian economy.

Notably, the CBN has raised the Monetary Policy Rate (MPR) by a cumulative 750 basis points between January and June 2024, with the twin aim of tackling the rising inflation rate and attracting foreign portfolio investors.

This was following an initial call between the CBN Governor, Yemi Cardoso and foreign portfolio investors in February.

Hence, the fixed income and money market space has since witnessed high yields across TBills, OMO, and Bond auctions. Nonetheless, FX liquidity continues to remain a major bane in the Nigerian foreign exchange market, driven by massive demand and low supply, thereby leading to a steady decline in the value of the local currency.

Meanwhile, using the Nigerian equities market as a barometer for inflows of foreign portfolio investments in Nigeria, shows that a total of N190.82 billion was invested in Nigerian stocks by foreign portfolio investors between January and May 2024.

On the flip side, a total of N267.47 billion have been repatriated from the market, leaving a net deficit of N76.65 billion. This indicates that as much as hot monies in the form of FPIs are entering into the Nigerian market, a lot more are also exiting the shores.

Rising FX outflows

Despite the limited supply of foreign exchange (FX) in the country, Nigeria has seen a significant increase in FX spending in recent months. Between January and May of this year, the country expended over $3.31 billion on international payments, marking a 31% increase compared to the same period in 2023.

- A closer look at the components of this spending reveals that letters of credit for the importation of visible goods accounted for $279.99 million. Additionally, $841.37 million was used for direct remittances, reflecting the ongoing demand for foreign currency for personal and business transfers.

- However, the most substantial portion of the expenditure was on debt servicing and payments, which amounted to $2.19 billion during this period.

- This surge in FX spending, despite constrained supply, underscores the economic pressures facing Nigeria. The increase in debt servicing costs and the need to import essential goods continue to strain the country’s FX liquidity position.

On the positive side, Nigeria’s foreign reserves surged to its highest level in over three months, reaching $34.07 billion as of June 26, 2024, compared to $32.69 billion at the beginning of the month.

This increase may be partly attributed to the reduced intervention by the Central Bank of Nigeria (CBN) in the FX market, as well as improved export earnings due to increased crude oil output.

The CBN’s strategy of limiting its interventions in the FX market has allowed the reserves to accumulate, reflecting a more conservative approach to managing the country’s foreign exchange. Additionally, higher crude oil production has bolstered export revenues, contributing significantly to the rise in reserves.

This uptick in foreign reserves provides a buffer against economic shocks and can enhance investor confidence in Nigeria’s financial stability.

It also offers the CBN greater leeway in managing the exchange rate and supporting the naira, which has faced considerable pressure in recent times.

However, sustaining this positive trend will require ongoing efforts to boost export earnings, diversify the economy, and maintain prudent FX management policies.