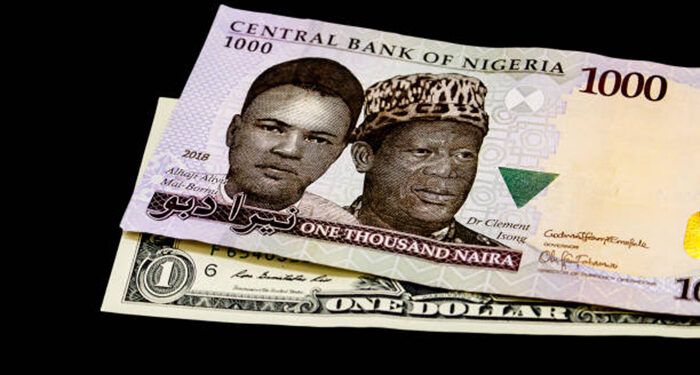

The Nigerian naira exhibited stability in the official market, aligning with Fitch Ratings’ projections, despite trading within the N1500 range against the U.S. dollar in the parallel market.

Meanwhile, the U.S. dollar index surged to its eight-week high in the broader market.

The naira briefly lost its N1,500 support level in the black market amid increased demand for the U.S. dollar.

However, enhanced oil receipts and multilateral donor financing for the third quarter of this year are expected to support the naira at the N1,500 level.

Fitch Ratings, an international credit rating agency, projects the naira to end the year at N1,450 per dollar.

Naira’s Fundamentals Brighten

- In June, the naira demonstrated relative stability against the U.S. dollar. Data from the Financial Market Dealers Quote (FMDQ) revealed that the naira traded within the N1,473 to N1,485 range against the U.S. dollar this month.

- Its 100-day price swings are at their lowest since November, and its 10-day rolling volatility is at its lowest point in a year, attributed to the hawkish stance of the Central Bank of Nigeria (CBN).

- The CBN has been aggressively influencing the foreign exchange market to improve liquidity, a crucial aspect of this effort.

- The bank has also implemented monetary tightening measures to maintain the value of the local currency. In a move to enhance transparency, the central bank abandoned exchange rate ceilings and adopted market-based limitations.

- To attract dollar inflows, reduce volatility, and curb inflation which surged to a 28-year high of 33.95% in May—the CBN raised its benchmark interest rate to a record 26.25%.

- The regulator is combining a total rise of 750 basis points this year with significant naira liquidity mop-ups through monthly bond sales and dollar inflows from external lenders.

- Recently, the African Export-Import Bank (Afreximbank) provided Nigeria with $925 million, the third tranche of a $3.3 billion crude oil-backed prepayment facility, aimed at boosting hard currency availability in the local foreign exchange market.

- Additionally, the World Bank approved $2.25 billion in aid this month to support Nigeria’s economic reforms, which should further enhance foreign exchange liquidity.

U.S. Dollar Index Outlook

The U.S. Dollar Index (DXY) is on an upward trajectory, poised for potential gains for the third consecutive week. Despite the challenges, the data indicate that the greenback has not performed well this week.

Traders should be cautious of the 105.9 index points, which triggered a rejection in early May and now serves as resistance.

The most significant hurdle lies at 106.51 index points, the peak from April 16 this year.

On the downside, the trio of Simple Moving Averages (SMA) acts as support, with the 105.52 level as the initial support.

The 55-day SMA at 105.14 comes first, protecting the 105.00 value. The 100-day and 200-day SMAs create a double layer of support around 104.61-104.48 index points.

Should this region be breached, the index will likely consolidate around 104 index points.