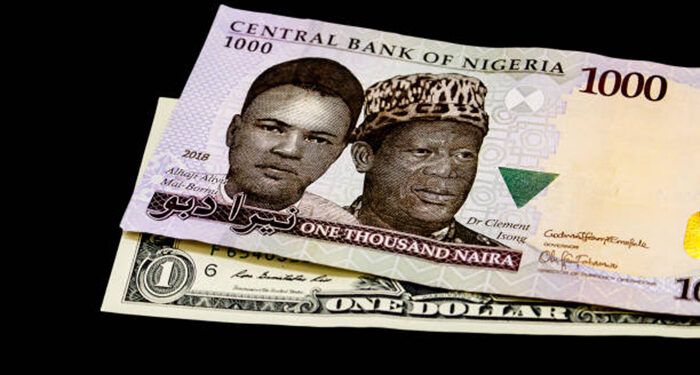

The naira has shown some form of stability against the US dollar on the NAFEM window, closing at N1,476.95/$1 on June 4, 2024.

This slight dip of 0.06% from the previous day’s rate of N1,476.12/$1 shows the naira’s steady performance amid a volatile foreign exchange landscape.

At the start of this week, the naira was traded at N1,476.12/$1, showing a minor appreciation of 0.67% compared to earlier figures.

The low range of appreciation and depreciation on Monday and Tuesday suggests some form of stability in the market.

94.46% increase in FX turnover

The FX turnover at the start of the week was recorded at $121.87 million, a notable decline of 42.92%. It appeared that traders and financial institutions took a cautious approach on the first trading day of the week and month.

This cautious approach likely resulted in lower trading volumes as participants took time to evaluate market conditions before making significant moves.

The crash also coincided with the onset of a nationwide strike led by labour unions, likely suggesting the impact of industrial actions on the cautious approach taken by market participants.

However, the strike was suspended today, and it appears that market activity is picking up on the NAFEM window.

On Tuesday, June 4, 2024, FX turnover soared to $236.99 million, reflecting a staggering 94.46% increase.

This surge in turnover indicates a significant rise in market activity, suggesting heightened demand for the US dollar and increased transactions within the foreign exchange market.

What you should know

- The Central Bank of Nigeria (CBN) has maintained a tight monetary policy stance to manage inflation and stabilize the naira.

- However, the persistent demand for foreign exchange and the resultant pressure on the naira have posed challenges to these efforts.

- Earlier, Fitch Ratings noted that the ongoing foreign exchange (FX) reforms are necessary to boost foreign direct investment (FDI) and foreign portfolio investment (FPI). In a presentation on Monday, by Gaimin Nonyane, Director of Sovereigns at Fitch, it was stated that Nigeria’s current account (CA) will be strengthened by increase oil refining capacity, but the reforms are still very crucial in attracting foreign investments.

- The recent stability in the naira’s exchange rate, coupled with the surge in FX turnover, suggests that the CBN’s interventions may be yielding some positive results in terms of maintaining market equilibrium.

- Despite these positive indicators, concerns remain about the sustainability of the naira’s stability. The volatility in the FX market, driven by fluctuating global oil prices, capital flow reversals, and domestic economic conditions, continues to pose risks.