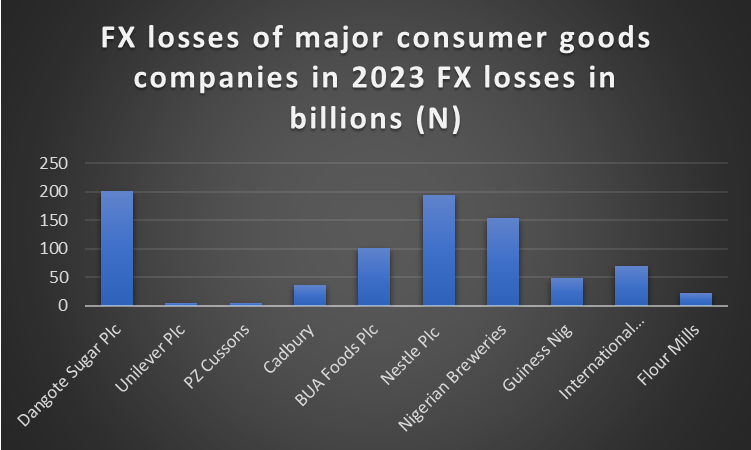

In 2023, major consumer goods companies listed on the Nigerian Stock Exchange (NGX) recorded FX losses amounting to N839.24 billion in the 2023 financial year.

This is according to a review of the 2023 full-year financial statements of 10 major consumer goods firms in Nigeria.

According to the report, Dangote Sugar Plc recorded the highest FX loss in the past year totalling N201.67 billion, which is around 45.3% of the company’s revenue over the period. On the other hand, Unilever recorded the lowest FX losses among the companies featured in the report at N4.58 billion. This was followed by soap maker, PZ Cussons, which saw FX losses of N4.95 billion.

In total, FX losses by consumer goods companies featured in this report represent around 18.06% of the N4.64 trillion revenue generated over the period.

Cadbury recorded an FX loss of N36.93 billion in the year under review.

The food and beverage section of the consumer goods industry was severely affected with BUA Foods seeing an N100.68 billion FX loss and Nestle Plc recording a N195.07 billion loss. Nigerian Breweries, Guinness Nigeria, and International Breweries posted N153.33 billion, N49.09 billion, and N70.37 billion respectively in foreign exchange losses for the year.

Also, Nestle Plc emerged as the second biggest loser in foreign exchange losses with N195.07 billion for the year.

It is important to note that some of the losses were unrealised for debt obligations that are not yet due.

Recommended reading: MTN Nigeria’s net forex losses rises to staggering N1.39 trillion

Reason for the FX losses

The significant escalation in foreign exchange losses among consumer goods companies stems from the policies of the Central Bank of Nigeria (CBN) with respect to the unification of the foreign exchange market and the devaluation of the naira during the year.

In June 2023, the CBN confirmed the unification of the multiple foreign exchange market- a move which saw the naira depreciate by over 40% from N471.67/$1 to over N600 to the USD immediately after the introduction of the policy

The naira continued its downward slide over the USD in the second half of 2023 and crossed the N1000 mark during the year- a record depreciation.

The impact of the unanticipated drop in the value of the naira on companies’ balance sheets was severe as shareholders’ funds were totally wiped out for some companies.

A market analyst, Ike Ibeabuchi, explained that the losses were inevitable given the naira’s steep depreciation in 2023. He noted that the CBN’s efforts to stabilize the local currency could have a positive impact on firms’ balance sheets in 2024.

- “The CBN is already working to stabilize the foreign exchange market. That could help to reduce FX losses borne by firms in 2024 and 2025. My advice always to Nigerian firms is to seek local alternatives to foreign contracts to reduce their FX exposure,” he said.

Recommended reading: Stocks Decline Amid Currency Fluctuations, Nestle Nigeria Reports Forex Losses