The directors present the summary financial information on First City Monument Bank Limited (“the Bank”) and its subsidiary companies (together “the Group”) for the year ended 31 December 2023.

These summaries financial information is derived from the full financial statements for the year ended 31 December 2023 and are not the full financial statements of the Group and the Bank.

The full financial statements, from which this summary financial information was derived, will be delivered to the Corporate Affairs Commission within the required deadline.

The Bank’s independent Auditors issued an unmodified audit opinion on the full financial statements for the year ended 31 December 2023 from which this summary financial information was derived.

To the Shareholders of First City Monument Bank Limited

Report on the Summary Financial Information

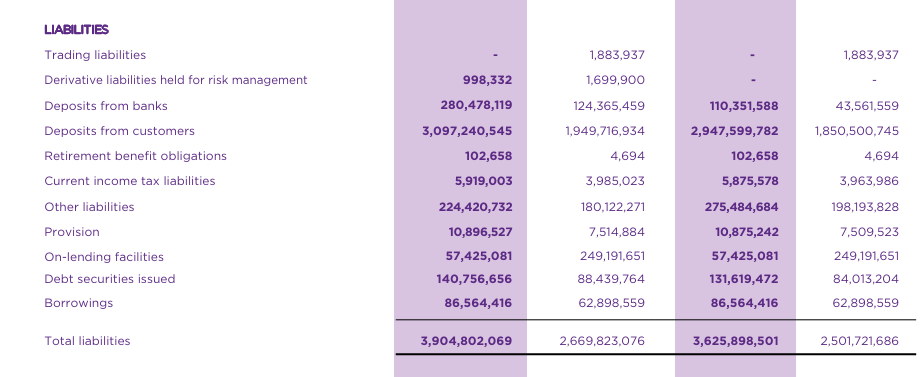

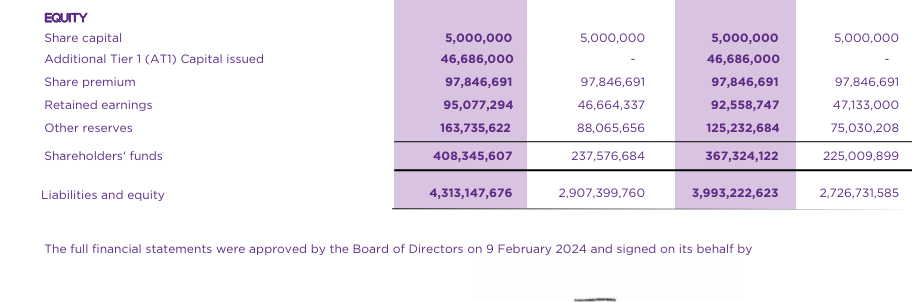

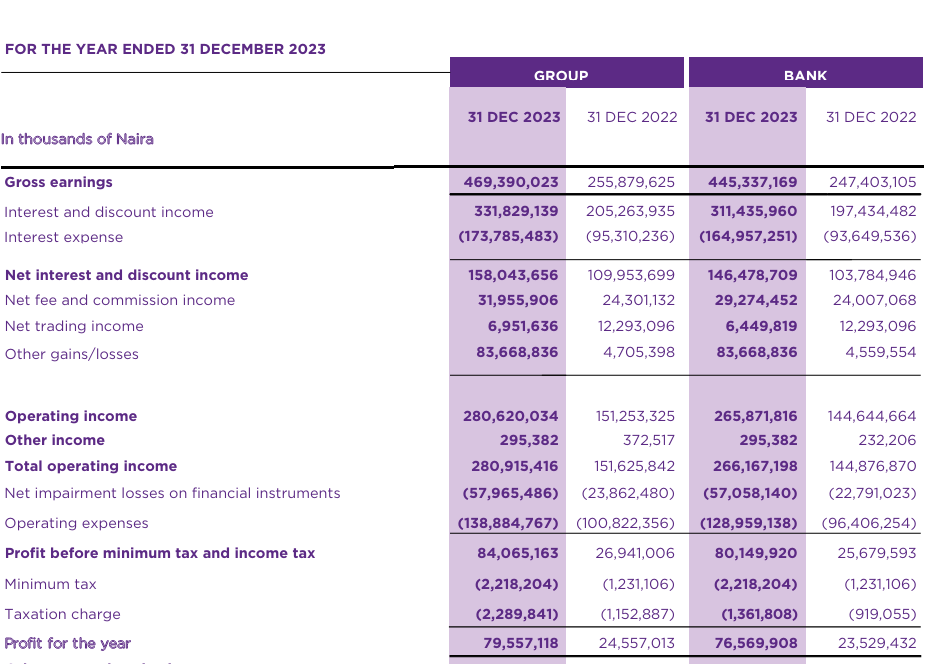

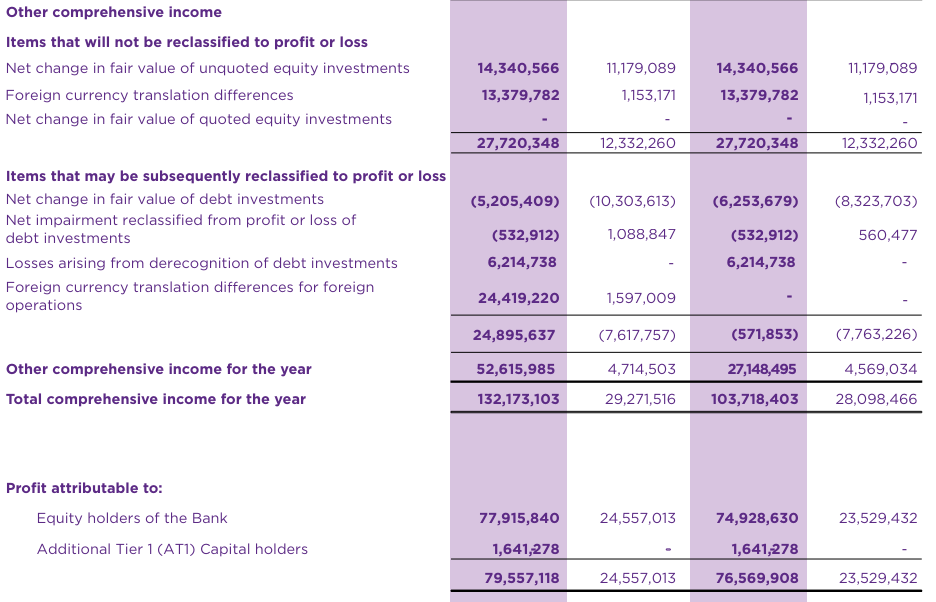

The summary consolidated and separate financial statements of First City Monument Bank Limited, which comprise the summary consolidated and separate statements of financial position as of 31 December 2023, the summary consolidated and separate statement of profit or loss and other comprehensive income for the year then ended are derived from the audited consolidated and separate financial statements of First City Monument Bank Limited for the year ended 31 December 2023.

In our opinion, the accompanied summary consolidated and separate financial statements are consistent, in all material respects, with the audited consolidated and separate financial statements of First City Monument Bank Limited in accordance with the requirements of the Companies and Allied Matters Act 2020, for abridged reports, the Banks and Other Financial Institutions Act 2020, Central Bank of Nigeria regulatory guidelines and the Financial Reporting Council of Nigeria (Amendment) Act 2023 as applicable to summary financial statements.

Recommended reading: FCMB’s Pre-tax profit surges by 193% in Q1 2024

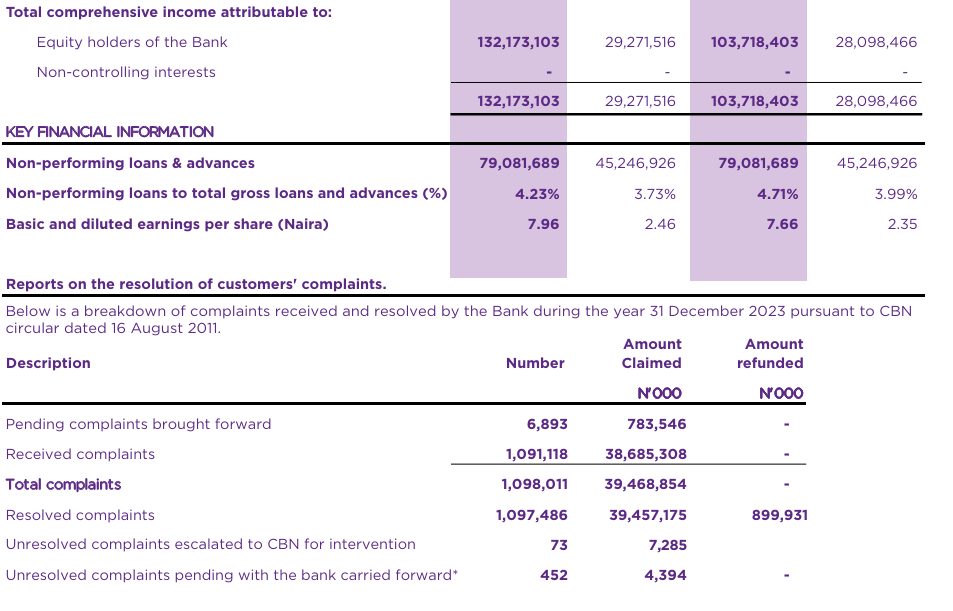

We have not audited the report on the Resolution of Customers’ Complaints by management included in the accompanying summary financial statements and accordingly, we do not express any opinion thereon.

Summary consolidated and separate financial statements

The summary consolidated and separate financial statements do not contain all disclosures required by the IFRS Accounting Standards as issued by the International Accounting Standards Board, the Companies and Allied Act 2020, the Banks and Other Financial Institutions Act 2020, the Financial Reporting Council of Nigeria (Amendment) Act 2023 and relevant Central Bank of Nigeria circulars as applicable to annual financial statements.

Therefore, reading the summary financial statements and the auditor’s report thereon is not a substitute for reading the audited consolidated and separate financial statements of First City Monument Bank Limited and the auditor’s report thereon.

The summary financial statements and the audited financial statements do not reflect the effect of events that occurred subsequent to the date of our report on the audited financial statements.

The audited consolidated and separate financial statements and our report thereon

We expressed an unmodified audit opinion on those consolidated and separate financial statements in our report dated 30 April 2024.

That report also includes the communication of key audit matters. Key audit matters are those matters that in our professional judgment, were of most significance in our audit of the consolidated and separate financial statements of the current year.

Recommended reading: FCMB reports gross earnings of N516.8 billion in 2023

Directors’ responsibility for the summary consolidated and separate financial statements

The Directors are responsible for preparing and presenting an appropriate summary of the audited consolidated and separate financial statements in accordance with the Companies and Allied Matters Act 2020, Banks and Other Financial Institutions Act 2020, the Financial Reporting Council of Nigeria Act, the Central Bank of Nigeria circulars and the International Financial Reporting Standards.

The Companies and Allied Matters Act requires abridged reports to be prepared in accordance with the framework concepts and the measurement recognition requirements of IFRS Accounting Standards as issued by the International Accounting Standards Board .

Report on other legal and regulatory requirements

In accordance with our audit report, we confirm that:

- We did not report any exceptions under the fifth schedule of the Companies and Allied matters Act;

- Details of the related party transactions and balances as defined in Central Bank of Nigeria circular BSD/1/2004 are as reported in the notes to the financial statements.

The Bank contravened certain sections of the Banks and Other Financial Institutions Act 2020 and circulars issued by the Central Bank of Nigeria during the year ended 31 December 2023. Details of these contraventions and penalties paid thereon are as disclosed in related notes to the audited consolidated and separate financial statements.

Directors’ responsibility for the summary consolidated and separate financial statements

Our responsibility is to express an opinion on whether the summary financial statements are consistent in all material respects with the audited consolidated and separate financial statements based on our procedures which were conducted in accordance with the International Standards on Auditing (ISA) 810 revised, “Engagements to Report on Summary Financial Statements”.