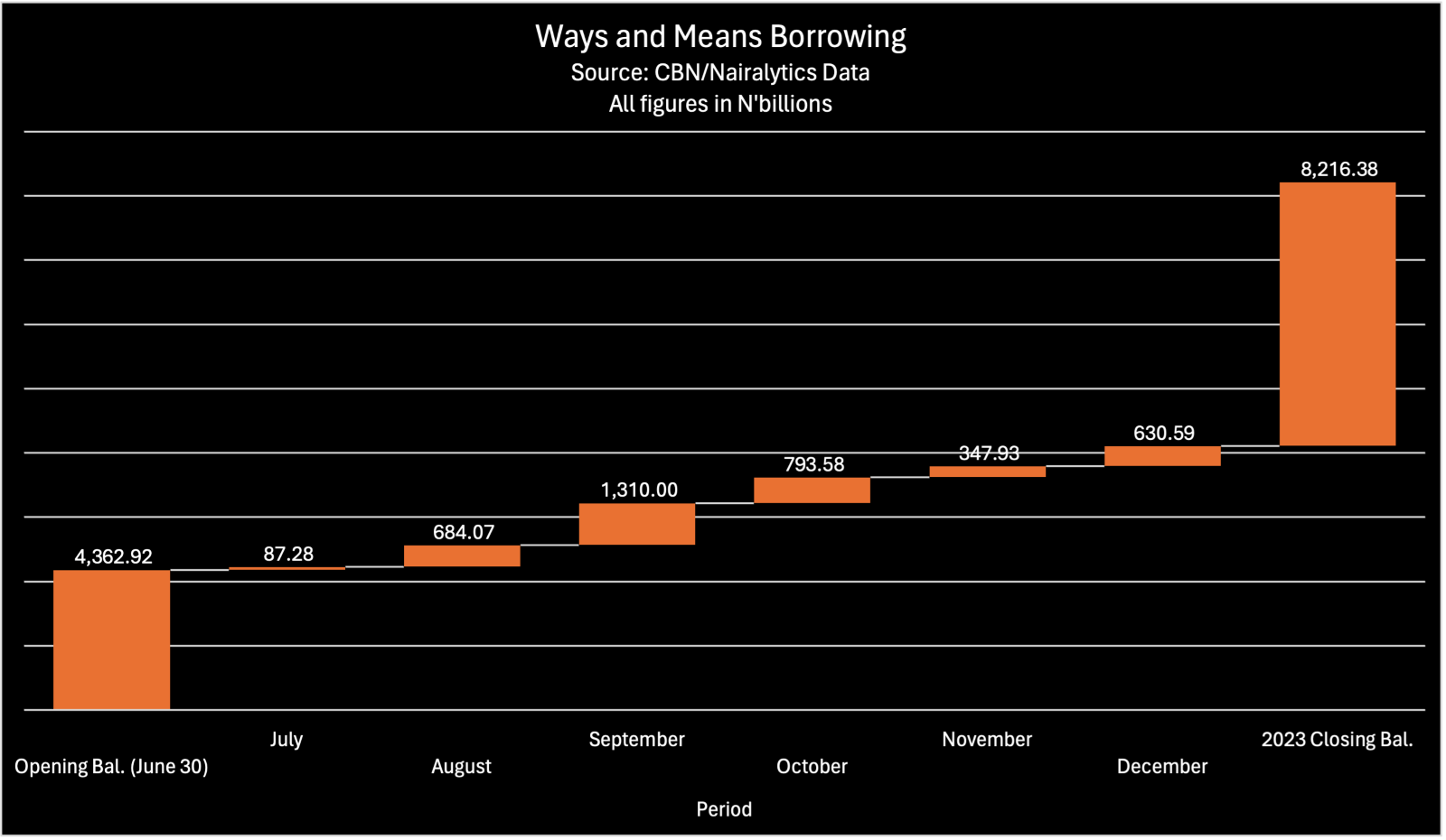

The Federal Government of Nigeria received an additional N3.8 trillion in what appears to be fresh Ways and Means Borrowing in the last six months of 2023.

This is according to provisional data published in the latest Statistics bulletin for the fourth quarter of 2023 recently released by the central bank.

The CBN’s provision data show that the total figure rose from N4.4 trillion at the end of June 2023 meaning that the cumulative Ways and Means balances due by the government now stand at N8.2 trillion as of December 2023.

This is despite news reports noting that the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, which suggest President Bola Tinubu’s government has not borrowed money from the CBN.

The Ways and Means provision serve as a mechanism enabling the government to secure short-term or emergency financing from the CBN to address cash flow gaps.

Total Ways and Means balances as of May 2023 when the Tinubu administration took over was N26.95 trillion. However, the balances were securitized as included as part of the federal government’s domestic debt profile.

Breakdown of the data

A cursory analysis of the data shows the balance at the end of June 2023 was N4.36 trillion indicating that the prior month balances may have been moved to the Debt Management Office.

However, from July 2023, the balances increase every month, first to N4.5 trillion in July, then N5.1 trillion in August, crossing the N5.1 trillion mark for the first time.

By September, the total was N6.4 trillion, representing the single largest additional borrowing for a month with about N1.3 trillion. It then climbed to N7.2 trillion in October before rising marginally to N7.6 trillion in November.

At the end of the year, in December, the total hit N8.21 trillion, suggesting that Ways and Means increased by 88% in 6 months.

Recommended reading: FG expecting $2.2 billion loan from World Bank- Wale Edun

What You Should Know

- Nairametrics earlier reported that the federal government obtained about N2.94 trillion from the CBN through Ways and Means Advances. This was earmarked for the servicing of its domestic debts, which means that the government had to resort to borrowing from the CBN to fulfil its obligations to domestic debt holders.

- It was also disclosed that the federal government allocated approximately N4.83 trillion from the proceeds of Nigerian Treasury Bills (NTBs) and Bonds issued in 2024 to settle the Ways and Means Advances from the CBN.

- Last year, the National Assembly approved the securitization of N22.7 trillion from the N23.3 trillion previously advanced by the CBN to the Federal Government through ways and means.

- This debt was subsequently transferred to the Debt Management Office (DMO) with a 40-year tenor, a 3-year moratorium, and an interest rate of 9%.

Ways and Means Act

- According to Section 38 of the CBN Act, 2007, the apex bank may grant temporary advances to the Federal Government about temporary deficiency of budget revenue at such rate of interest as the bank may determine.

- The Act placed a limit of five per cent on how much the Federal Government could borrow, although the previous administration severely violated the limit.

- The National Assembly introduced amendments to the CBN Act, elevating the ceiling of Ways and Means Advances from the apex bank from five to 15% of the Federal Government’s previous year’s revenue.

- This endeavor to raise the limit to 15% opens the door to more borrowing and an increased burden of debt service obligations for the country.

- Also, the Senate of the 10th assembly, mirroring its predecessor in the ninth assembly, approved the securitisation of the outstanding N7.3 trillion in Ways and Means. This will likely crash the figure recorded in December significantly.