Article Summary

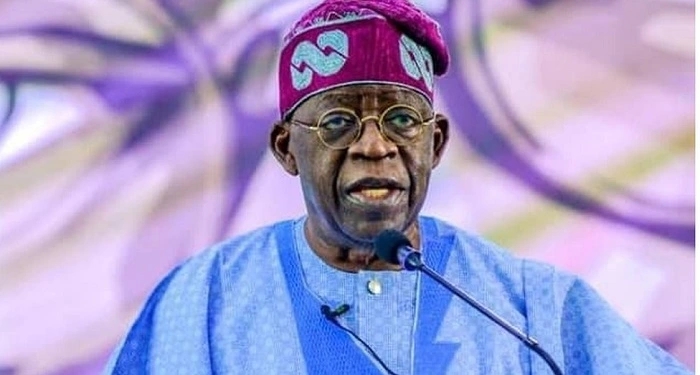

- The Centre for Social Justice has advised President Bola Tinubu to withhold his accent to the recent amendment to CBN Act by the Senate.

- It said the amendment contradicts best practices in fiscal responsibility.

- The Center added that the option of resorting to ways and means to fund budgetary deficits would further increase the already high inflation rate especially when done by printing money not backed by value.

The Center for Social Justice (CSJ) has urged President Bola Tinubu not to sign the recent amendment to the Central Bank of Nigeria (CBN) Act, which increased advances the CBN can grant to the Federal Government of Nigeria from 5% to 15%.

According to the Centre, the amendment should not be signed because the amendment contradicts best practices in fiscal responsibility and is an authorization of the Executive to create macroeconomic distortions through arbitrary and increased ways and means funding.

Citing the extant Section 38 of the CBN Act, which grants FGN access to ways and means financing in respect of temporary deficiency of budget revenue at such rate of interest as may be determined by CBN, CSJ said the total amount of such advances outstanding shall not at any time exceed 5% of the previous year’s actual revenue of FGN.

Issues of concern

The Centre in a statement signed by its Lead Director, Eze Onyekpere, highlighted some of the issues of concern over the amendment. It said:

- “If FGN has not been able to refund previous advances from the CBN at 5 percent of the previous year’s revenue, what machinery did the amendment put in place to ensure that FGN will be in a position to repay 15 percent of the previous year’s revenue by the end of its financial year?

- “There is evidence that previous advances from the CBN were in excess of the 5 percent rule and instead of reforms to ensure conformity with fit and good practices, a leeway is provided for deepening fiscal mischief.

- “Previous high levels of advances led the Executive to incur over N23trillion in ways and means which could not be repaid and had to be converted by the National Assembly to long-term indebtedness contrary to the provisions of the CBN Act.

- “S. 38 (1) of the CBN Act categorically states that such advance should be in respect to temporary deficiency of budget revenue and not as a means of funding the deficit budget as the Federal Government has resorted to in recent years. Over the years and in accordance with fit and good practices, ways and means has never been listed in the Appropriation Act as a source of funding the deficit.”

The Center added that the option of resorting to ways and means to fund budgetary deficits would further increase the already high inflation rate especially when done by printing money not backed by value. Thus, it erodes the value of the Naira, and real income; it reduces purchasing power of citizens.

- “The amendment of the CBN Act did not follow due process; it was arbitrary and lacking in popular participation. There was no opportunity for a public hearing and publicity, to give room for Nigerians to make inputs on this very crucial matter with the potential to negatively affect overall economic growth and the general welfare of the people.

- In light of the foregoing, CSJ strongly appeals to President Bola Ahmed Tinubu to withhold assent to the bill. CSJ acknowledges the revenue challenges facing the nation but the implementation of this particular bill (if it becomes law) will create monumental macroeconomic challenges now and in the future,” it added.

In case you missed it

The Nigerian Senate had in an emergency plenary session on Saturday, May 27, 2023, amended the CBN Act to increase the total CBN advances (Ways and Means provision) to the Federal Government from 5% to a maximum of 15%.

The Senate Leader, Abdullahi Gobir, who read the lead debate on the bill, said the proposed amendment was to enable the Federal Government to meet its immediate and future obligation in the approval of the ways and means by the National Assembly and advances to the Federal Government by the Central Bank of Nigeria.

Hold your horses. We’re a sovereign state with technocrats in power. Who owns the CBN? IF WE NEED FUNDS, WHO BETTER TO FUND US THAN US? Stop following and start thinking like this country is actually your personal business and everyone in it including the President is you.

@Ahmad, do you actually understand what “ways and means advances” made by the CBN to the FG is? It’s just printing money without producing anything, resulting in even more money chasing less goods and forex and ultimately leading to higher inflation and a decrease in the exchange rate value of the Naira.

Many nations allow a little bit of ways and means advances to grant the government some wiggle room during tight fiscal periods, but to keep increasing the limit is one of the surest paths to ECONOMIC DISASTER – but unfortunately the sort of economic thinking that was prevalent under Buhari.

Do we have an alternative ?if we do we should go for it please.