Nigeria’s burgeoning interest in cryptocurrency assets is being fueled by its strong need for US dollars, as evidenced by the high interest for stablecoins according to Google search statistics.

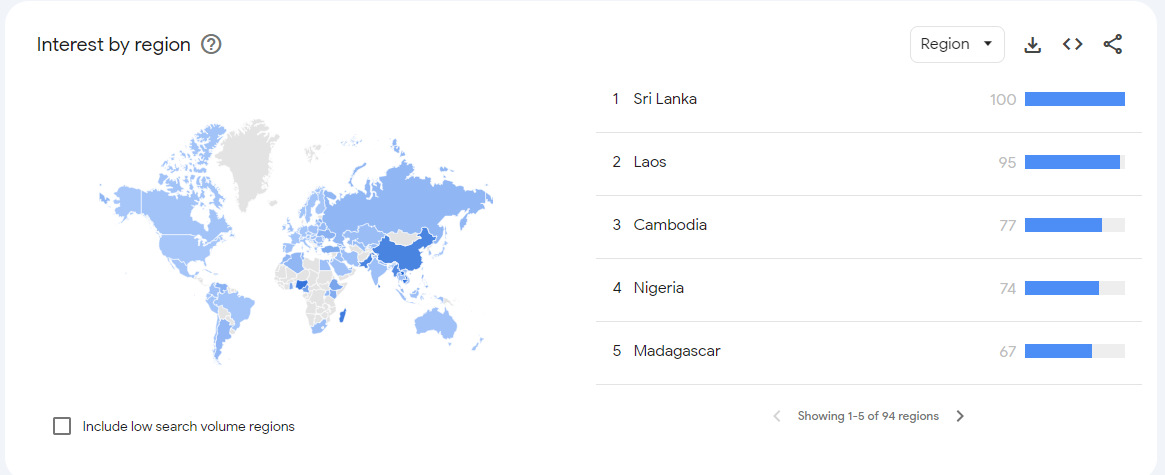

Google Trends data indicates that USDT, the most well-known and well-funded stablecoin globally, is most popular in Nigeria. However, on a 12-month spectrum, Nigeria is rated fourth after Sri Lanka, Laos, and Cambodia.

Nigerians may have turned to stablecoins due to several factors, including inflation, the sharp decline in the value of the naira, and the urge for cross border transactions.

Dollar stablecoins are becoming a very attractive choice for people and companies in regions where there is a lot of inflation and local currency instability.

Remittances and cross-border payments are made easier by USDT, and for many Africans, this is an important source of income. Using stablecoins instead of more conventional means like banks or money transfer services can lower the cost, time, and friction involved in sending and receiving money across borders.

Stablecoins are marketed as an affordable way to send money and as a sensible way to join the Bitcoin ecosystem without worrying about losing money. The typical range of transfer fees for USDT and USDC is 0% to 1%.

Africa’s largest crypto market maintains the top usage of cryptocurrencies in the 54 nations locked continent, with an annual growth rate of 9%, even with the recent decline in interest in Bitcoin. Nigeria is ranked third out of just six countries that have experienced steady growth since 2021, according to Chainalysis research

Nigeria’s interest in the crypto market has overcome obstacles to establishing itself as a major means of transacting in the sub-Saharan country, but it is quickly slipping behind more crypto-friendly countries like the United Kingdom, United Arab Emirates, and Brazil.

Nigeria is one of the youngest countries in the world and one of the fastest-growing in Africa, with over 200 million people living there 43 percent of the population is under the age of 15.

Enhancing Financial Innovation and Access, EFiNA, 2023 Access to Finance Survey Report, showed 45% of Nigerians used digital financial services in the past year, up from 34% in the lockdown period

Stablecoins are a class of cryptocurrencies that are usually backed by conventional assets like US dollars and gold. Examples of stablecoins are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). To shield stablecoins from the volatility that typifies popular cryptocurrencies like Ethereum and Bitcoin, which have a market capitalization of almost $1.1 trillion, these currencies are intended to be tied 1:1 with the dollar.

Stablecoins and initial coin offers (ICOs) would be accepted as investment classes, according to the Central Bank of Nigeria (CBN), which also said that a regulatory framework would be developed.

According to the CBN’s “Payment System Vision 2025” research, private stablecoins have become a popular payment option in the country, necessitating regulation of their operations.

Nigerian financial system is hoping to take advantage of the country’s interest in stablecoins by developing and managing the cNGN, a new stablecoin that is intended to benefit token holders as well as the Nigerian economy.

The cNGN cryptocurrency is correlated with and supported by the Nigerian naira, the nation’s fiat currency, according to anonymous individuals within the project.

Similar to well-known stablecoins, the cNGN has compatibility with multiple public blockchains, allowing for simple international transfers and expanding its use globally.