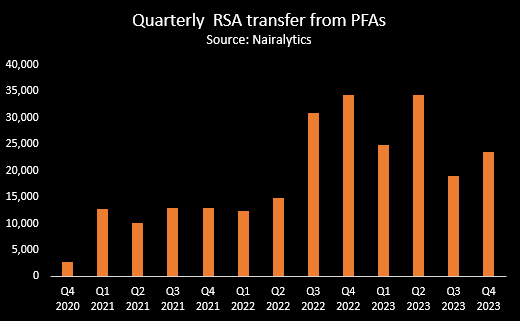

A total of 101,820 Retirement Savings Account (RSA) holders switched their Pension Fund Administrators (PFA) in 2023, representing an increase of 10.2% compared to the 92,413 transfers recorded in the previous year, and the highest on record.

A total of N462 billion was moved by the RSA holders in the review year, 28% higher than the N361.5 billion that was transferred in the previous year, bringing the total since the inception of the transfer window to N1.14 trillion.

It is worth noting that since the National Pension Commission (PenCom) reopened the transfer window in Q4 2020, a total of 245,625 RSA holders have changed their pension administrators.

This transfer is in line with section 13 of the Pension Reform Act (PRA) 2024, which specifies that an RSA holder may transfer his/her account from one PFA to another.

This is done in a bid to improve efficiency in the industry by intensifying the level of competition among the administrators. This was also complimented by the recapitalization of the PFAs from N1 billion to N5 billion, which resulted in a series of mergers and acquisitions in the industry.

Hence, the industry has recorded significant growth in recent years as the number of RSA registrations has increased by over 950,000 in the last three years, taking the total registrations to a record high of 10.16 million people.

In the same vein, total pension assets rose to a record high of N17.93 trillion as of November 2023, an increase of 1.5% from N17.66 trillion recorded as of the previous month. According to PenCom, the Nigerian pension asset increased by over N2.93 trillion between January and November 2023.

Meanwhile, most of the assets have been deployed in fixed-income securities, with about 66% of the funds invested in FGN securities, specifically federal government bonds, which gulped about N11.25 trillion of the total assets, which is in line with the regulation of the PenCom for PFAs to be conservative with public funds.

Investments in the local bourse have however witnessed growth in recent times, on the back of the bullish performance of the Nigerian stock market in 2023, printing an annual return of 45.9%.

Specifically, a total of N1.49 trillion was deployed in the local equities market, representing a 64% increase compared to N908 billion recorded as of December 2022.

Further breakdown, of the pension assets showed that N1.91 trillion was invested in corporate debt securities as of November 2023, while N1.55 trillion is currently deployed in money market instruments.

About the RSA Transfer System

The RSA Transfer System (RTS) is an application that is used for coordinating all the processes relating to the transfer of RSAs from one PFA to another. The RTS is designed to provide an electronic platform through which RSA transfers are initiated, processed, and monitored and Global Net Transfer Positions (GNTPs) for all affected PFAs determined, on an online real-time basis.

- According to the RSA Transfer Guideline, transfer requests are processed based on their Effective Transfer Dates (ETDs), which is the last day of the last month of each Transfer Quarter namely, 31st March, 30th June, 30th September, and 31st December.

- Notably, an RSA Holder shall only be eligible for a subsequent RSA transfer after 365 days from the date of his/her last approved RSA transfer, irrespective of whether it is a leap year or not

- An RSA transfer request shall be irrevocable once submitted on RTS and Provisional Approval given by the Commission.

Allow contributors to use their voluntary contributions to mitigate the present hardship