The Governor of the Central Bank of Nigeria, Oluyemi Cardoso, recently announced plans to recapitalize banks in anticipation of achieving the Tinubu administration’s target GDP size of $1 trillion.

Speaking on the process of recapitalization, Cardoso highlighted the crucial need for banks to be recapitalized, considering the substantial developmental role the apex bank anticipates them to fulfill over the next seven years.

“Considering the policy imperatives and the projected economic growth, it is crucial for us to evaluate the adequacy of our banking industry to serve the envisioned larger economy. It is not just about the stability of the financial system in the present moment, as we have already established that the current assessment shows stability.

“However, we need to ask ourselves: Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1.0 trillion economy shortly? In my opinion, the answer is “No!” unless we take action. Therefore, we must make difficult decisions regarding capital adequacy. As a first step, we will be directing banks to increase their capital,’’ Yemi Cardoso

This announcement has sent ripples through the banking industry, echoing the events of 2004 when the Soludo-led Central Bank increased bank minimum capital requirement from N2 billion to N25 billion in a move called banking consolidation.

- The decision at that time compelled numerous banks to merge, reducing the number of banks in the country from over 100 to just 25 by the end of the consolidation process.

- It has been nearly 20 years since then, and commercial banks have substantially increased their shareholder funds.

- But while we have experienced a significant increase in shareholder funds, adjusting for exchange rate devaluation over the years suggests banks are not as strong in terms of capital at least in dollar terms.

Most analysts believe this is perhaps why the central bank is keen on increasing bank’s share capital in 20224.

Bank Shareholder funds

Most tier-one banks, commonly known as FUGAZ, now possess over N1.5 trillion in shareholder funds.

- A selection of the top 10 Nigerian banks also reveals a combined shareholder fund exceeding N11 trillion.

- These are primarily composed of retained earnings, other reserves, and various forms of tier 1 capital acquired from external investors.

- On paper, many of these banks appear robust, and the Central Bank governor has affirmed that they maintain acceptable capital adequacy ratios, meeting most, if not all, of the apex bank’s regulatory benchmarks for solvency.

A recent central bank report also confirmed the soundness of Nigerian banks suggesting their capital adequacy ratios (CAR) was around 14.2%, higher than the 13.8% recorded in the previous quarter.

CBN determined to increase capital

Despite this, credible sources have informed Nairametrics that the apex bank is firmly proceeding with its recapitalization plans, with a formal announcement expected early in 2024.

- Although the exact capital requirements for banks remain unclear, Nairametrics Research anticipates that the focus will be on the bank’s share capital rather than their shareholder funds.

- The share capital of banks comprises issued capital (based on the nominal price) and the share premium (the difference between the nominal price and the actual capital raised).

- Typically, most banks have a significant market share premium but moderate share capital, which is calculated by multiplying their outstanding shares by the nominal share price of 50 kobo.

Current Share Capital of Banks

According to data from Nairametrics Research, 11 major Nigerian banks listed on the NGX have a combined share capital of N1.8 trillion, in contrast to shareholder funds of over N11 trillion, based on their third-quarter results for 2023.

- On average, these banks have a share capital of N163.9 billion, with Ecobank possessing the highest capital at N353 billion and Wema Bank the lowest at N14.9 billion.

- Industry insiders suggest that the Central Bank’s recapitalization plans might vary depending on the size of the banks.

- For instance, Tier 1 banks with an international presence could face significantly higher capital base requirements compared to Tier 2 and regional banks.

What is also poignant to add is that Nigerian banks also have “other forms of capital” estimated at N4.8 trillion per Nairametrics research.

This capital includes reserves, and other forms of tier 1 capital such as quasi debts, reserves held by CBN, etc. The banks also have another combined N4 trillion in retained earnings as of September 2023.

The apex bank is however likely to exclude this capital from the amount it requires the banks to raise in 2024 focussing mainly on share capital (ordinary share capital plus share premium).

Scenario Analysis

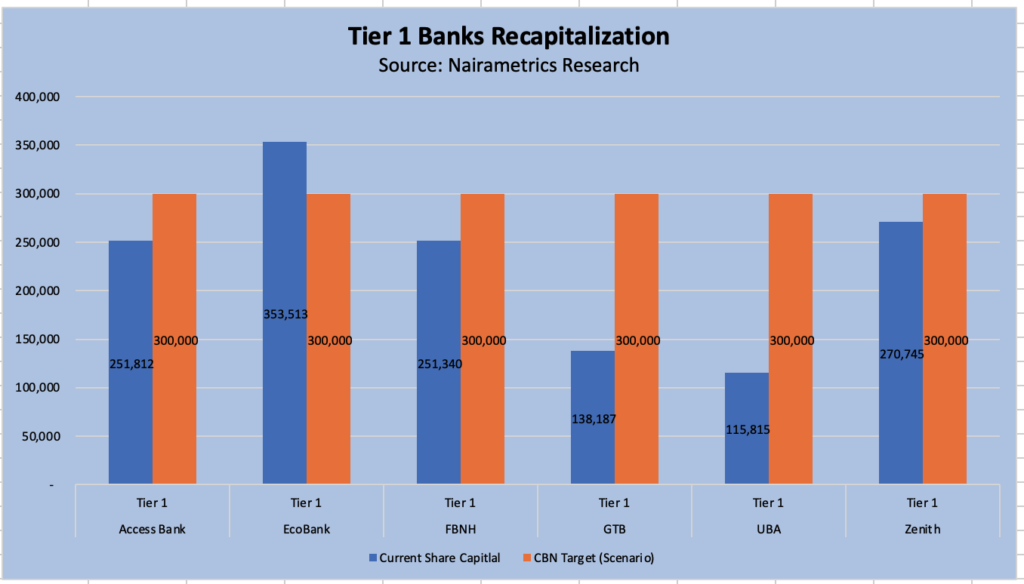

In light of this, Nairametrics conducted a scenario analysis assuming a share capital base of N300 billion for Tier 1 banks, N150 billion for Tier 2 banks, and N50 billion for regional banks. This scenario indicates a potential overall capital requirement.

- Based on a scenario of N300 billion share capital, Tier 1 banks could be required to raise around a combined N472 billion.

- If it is N200 billion then they might raise just N149 billion with only GTB and UBA only required to raise capital. In a scenario for N500 billion then the total raise can be a combined N1.6 trillion (inclusive of Ecobank).

However, for this story, we focus on the implication of a scenario for N300 billion.

Tier 1 Banks – Target: N300 Billion

In this scenario, all the Tier 1 banks listed will need to raise capital to meet the minimum share capital requirement of N300 billion.

- United Bank for Africa (UBA), a key player among the FUGAZ, currently boasts a total share capital of N115.8 billion.

- Under the new threshold of N400 billion, UBA might need to raise an additional N184.1 billion, representing the largest capital requirement among all the banks.

- Guaranty Trust Bank (GTB) follows, with a potential need to increase its capital by N161.8 billion, supplementing its current share capital of N138.1 billion.

- Zenith Bank, First Bank of Nigeria Holdings (FBNH), and Access Bank, which complete the FUGAZ group, are likely to require capital raises of N29.2 billion, N48.6 billion, and N48.1 billion, respectively.

- Ecobank, on the other hand, currently has a share capital of N353.5 billion, already exceeding the N300 billion benchmark used in this scenario.

Tier 2 Banks – Target: N150 Billion

In this scenario, all the Tier 2 banks listed will need to raise capital to meet the minimum share capital requirement of N150 billion.

- Sterling Bank faces a significant challenge, as it will likely need to secure an additional N92 billion to reach the target, given its current share capital of just N57.1 billion.

- Other banks in this category, such as Stanbic IBTC, Fidelity Bank, and First City Monument Bank (FCMB), will need to raise N40.7 billion, N34.6 billion, and N24.7 billion respectively to align with the new threshold.

Wema Bank, categorized as a regional bank in our analysis, may need to raise N35 billion.

- However, it’s noteworthy that the bank recently completed a capital raise of N40 billion, already exceeding the N50 billion threshold set for regional banks in our scenario.

- Otherwise, it will need an additional N100 billion to meet the tier 2 bank target used in our scenario.

What this means

Whilst the apex bank’s plan for bank recapitalization is welcomed, banks will be under pressure to post a higher return on equity to justify the raise.

- According to Nairametrics research, Nigerian banks posted a return on average equity of 18%close to the annual average inflation rate of 18.85% in 2022.

- Whilst their 2023 results have performed well above inflation, this is largely due to exceptional item effects of forex gains.

A recent report on Nairametrics also suggests the central bank could rely on CAR as a means towards achieving its capitalization target for banks, an option different from a straight increase in share capital.

- Currently, the CBN requires that banks with international subsidiaries maintain a capital adequacy ratio (CAR) of 15.0% while banks without international subsidiaries maintain a CAR of 10.0%.

- The minimum requirement for systemically important banks is 16.0% (although the CBN has been giving a forbearance).

- Following the implementation of BASEL III, an additional tier 1 capital is required for a Capital Conservation Buffer (CCB1) of 1.0% of TRWA.

What is the likely hood of giving out bonus to meet this recapitulation kindly update

The ownership of FMDQ need to be investigated.