Nigeria recorded a foreign trade surplus of N1.89 trillion in the third quarter of 2023, surpassing the N708.9 billion trade balance in Q2 2023 and overturning the deficit of N409.4 billion recorded in the corresponding period of 2022.

This represents the fourth consecutive quarter of positive international trade balance for Nigeria, bringing the aggregate balance to a surplus of N3.52 trillion in the first nine months of 2023. This is according to the recently released foreign trade report by the National Bureau of Statistics (NBS).

The recent trend in Nigeria’s trade balance has been lauded by analysts, which has been attributed to increased income from crude oil exports and is expected to have a positive impact on the country’s foreign exchange market.

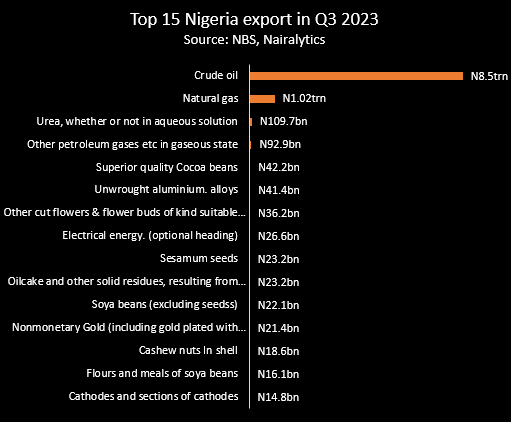

Specifically, crude oil exports jumped by 71% from N5 trillion in Q2 2023 to N8.54 trillion in the review period. Between January and September this year, Nigeria has made N19.7 trillion from the exportation of crude oil, compared to N16.2 trillion as of the same period in 2022. Interestingly, the N8.54 trillion in Q3 2023 represents the highest on record based on Nairalytics data.

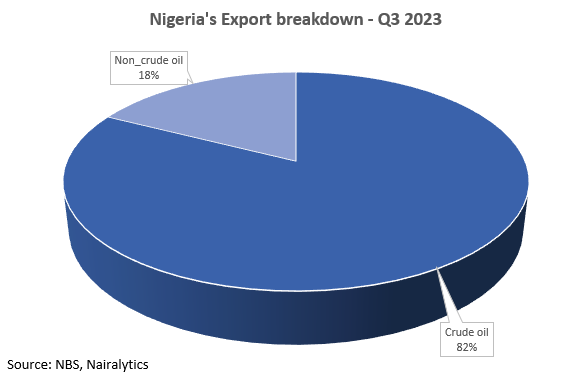

However, despite this improvement, the breakdown of Nigeria’s export components paints a rather grim picture of the nation’s trade economy and the manufacturing sector specifically. Firstly, crude oil export earnings, which is a function of global oil prices and local production account for a whopping 82% of the total export earnings.

Unfortunately, the direction of both factors is not totally in the control of Nigeria, as global oil prices are determined by some geopolitical factors, while Nigeria’s local crude production has been bedevilled by oil theft and pipeline vandalism.

- A cursory glance at Nigeria’s top exported products shows that at least 97% of Nigeria’s exports were in their raw form. For example, in addition to crude oil export, which accounted for 82.5%, natural gas export (N1.02 trillion) accounted for 9.8% of the total, and urea (N109.7 billion) represented 1.1% of the total export.

- From the top 15 items that Nigeria exported in the review quarter, electricity energy (N26.57 billion), which is 0.26% of the total is arguably the only item that has undergone further value-added processing.

Below are the top 15 export products in Q3 2023 according to the NBS.

On the other hand, Nigeria’s imports ranging from petrol, used vehicles, jet fuel, motorcycles, medications, and transformers amongst others are value-added products that could have been produced locally, especially since some of the raw items required for their production are found in Nigeria.

For example, Nigeria imported fertilizer worth $362.18 million in 2022, converting that to naira using the average exchange rate of 2022 (N460/$) amounts to a whopping N166.6 billion.

This is a product that could have been produced locally with Urea, which is a major export product of Nigeria (This is just to state a few of many cases).

An underperforming industrial sector

The inability of Nigeria to earn more from exports despite being blessed with enormous natural resources can not be excused from the dwindling industrial and manufacturing sectors.

- Nigeria’s manufacturing sector with a nominal value of N27.51 trillion and accounting for 13.8% of the economy, yet too small to meet the local demands of over 200 million people as well as generate significant income from exportation.

- The sector has also been a victim of the current economic doldrums, which have eroded the profitability of manufacturing companies as a result of high operating expenses and FX illiquidity. According to the NBS, the manufacturing sector growth slowed to 0.48% in Q3 2023, representing the lowest since a contraction in Q3 2022.

- The index of industrial production, which shows the growth rate in different industry groups of the economy, reveals a decline in the manufacturing index from 205.31 points in Q1 2023 to 173.51 in Q2 2023, the lowest since Q2 2022.

The continuous impact of high costs, changing customer buying patterns, and limited access to foreign exchange have also forced some multinationals to seize local production in the country.

US consumer goods manufacturer, Procter & Gamble (P&G) recently announced the halt of manufacturing activities in Nigeria, pivoting to an import-only operation.

In the same vein, GSK also announced its plans to cease the commercialization of its prescription medicines and vaccines in Nigeria through the GSK local operating companies and transition to a third-party direct distribution model for its pharmaceutical products.

Also, Guinness announced in October 2023 to stop the importation of some Diageo international premium spirits products like Johnnie Walker and Baileys.

These only add to a long list of businesses in the manufacturing and industrial sector that have either divested some parts of their Nigerian operations or sold their Nigerian business.

The series of divestments amidst a harsh operating environment has significantly impacted the growth of the manufacturing industry.

Bottom line

It is important to note that the Nigerian manufacturing and industrial sector has a long gap to fill to boost the trade sector, which is currently valued at N26.6 trillion (13.3% of the economy).

Meanwhile, the likes of Dangote 650,000bpd refinery and other growing plants in the automobile and fertilizer space could drive some level of growth in the industrial sector.

Consumer goods manufacturing and the agriculture value chain need an improved collaboration to bridge the food supply gap and drive down imported food inflation in the country.