Achieving billionaire status is an accomplishment in itself, but being a female billionaire resonates on a different level, especially with the increasing number of women attaining this financial milestone through inheritance, family enterprises, or self-made success stories.

While a significant portion of female billionaires globally have inherited their wealth, it’s essential to recognize their valuation, duly acknowledged by reputable platforms such as Forbes and Bloomberg.

As we witness newcomers breaking barriers, some seasoned players have navigated the billionaire landscape for an extended period, amassing substantial net worth.

In this compilation, Nairametrics highlights some of the world’s oldest female billionaires according to Forbes estimations, each commanding a valuation of $35 billion or more.

These influential women span diverse industries, occupying seats on the boards of multibillion-dollar companies.

5. MacKenzie Scott

- Age: 53 years old

- Networth: $39.3B

- Source of Wealth: Amazon, United States

MacKenzie Scott, a renowned philanthropist, and acclaimed author, notably known as the former spouse of Amazon’s founder Jeff Bezos, has made headlines not just for her high-profile divorce but also for her substantial wealth and benevolent initiatives.

Following her divorce in 2019, Scott, who opted to adopt her middle name, received a 4% stake in Amazon, catapulting her wealth to a staggering $20 billion increase within a year due to the e-commerce giant’s stock surge.

Despite not being the oldest among female billionaires, Scott’s net worth rivals some of the longest-standing figures in the billionaire landscape.

In 2021, her valuation peaked at an impressive $53 billion. Demonstrating a commitment to philanthropy, Scott pledged to donate at least half of her wealth and has delivered on that promise, sharing details of her generosity through the Yield Giving website.

Since 2020, she has disbursed $14.4 billion to nearly 1,600 nonprofits, employing a unique “no strings attached” approach that empowers organizations to direct the funds according to their needs.

4. Julia Koch

- Age: 61 years old

- Networth: $57.8 B

- Source of Wealth: Koch Industries, United States

America’s wealthiest woman, Julia Koch, along with her three children, inherited a substantial 42% stake in Koch Industries following the passing of her husband, David, in August 2019 at the age of 79.

Julia’s connection with David originated from a chance blind date in 1991, leading to a fortuitous encounter six months later that eventually blossomed into a marriage in 1996.

Collaborating with her late husband, Julia demonstrated a philanthropic spirit by contributing $10 million each to Mount Sinai Medical Center and Stanford Children’s Hospital for the study of food allergies.

Notably, the Kochs, recognized as prominent dark-money mega-donors to conservative causes and candidates, also allocated tens of millions to charitable endeavours annually.

However, since David’s passing in 2019, Julia Koch’s public giving has seen a marked decline, with records indicating donations totalling less than $4 million between 2018 and 2021.

Originating from Iowa, Koch made her mark in New York City during the 1980s, initially as an assistant to renowned fashion designer Adolfo.

Her career involved working closely with high-profile clients, including the influential First Lady Nancy Reagan.

3. Francoise Bettencourt Meyers

- Age: 70 years old

- Networth: $94.1 B

- Source of Wealth: L’Oréal, France

Francoise Bettencourt Meyers, heiress to the L’Oreal fortune and currently the world’s wealthiest woman, commands a formidable position in both business and philanthropy.

Holding approximately 33% of L’Oreal’s stock, Bettencourt Meyers has been a pivotal figure on the company’s board since 1997, further assuming the role of chairwoman for the family holding company.

Her ascendancy to France’s premier L’Oreal heiress in 2017(at 64 years old) followed the passing of her mother, Liliane Bettencourt, who had held the title of the world’s richest woman until her demise at the age of 94.

Beyond her corporate responsibilities, Bettencourt Meyers extends her influence as the president of her family’s philanthropic foundation, actively promoting advancements in French sciences and arts.

Notably, in the aftermath of the devastating Notre Dame Cathedral fire in April 2019, Bettencourt Meyers, in collaboration with L’Oreal, exhibited an exemplary commitment to cultural heritage by donating a substantial $226 million for the cathedral’s restoration.

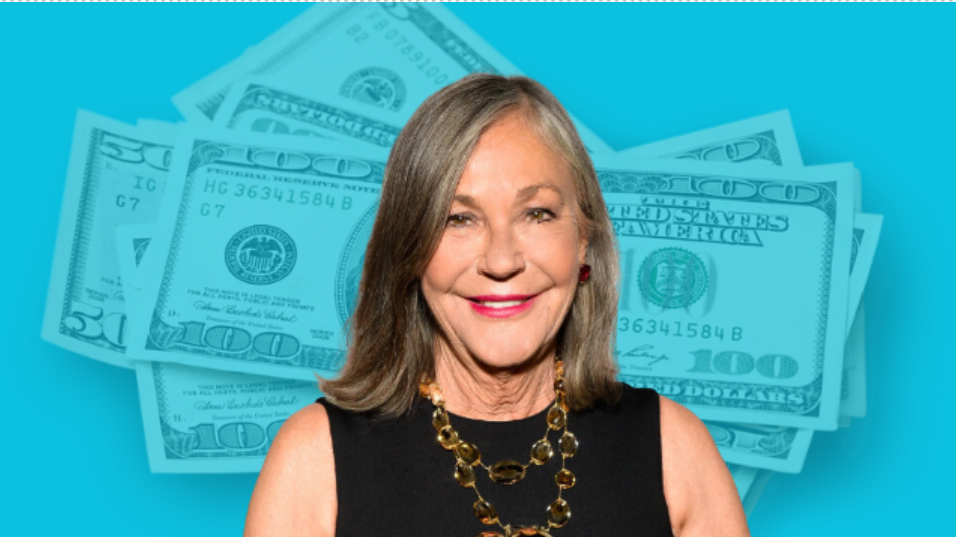

2. Alice Walton

- Age: 74 years old

- Networth: $60.8 B

- Source of Wealth: Walmart, United States

Alice Walton, the Walmart heiress, the only daughter of Walmart founder Sam Walton is the second-richest woman in America.

She has focused on curating art, rather than working for Walmart like her siblings, Rob and Jim.

She founded the Alice L. Walton Foundation, a nonprofit dedicated to improving education, health, and access to the arts, according to its website.

She donated more than $29 million to charity through the foundation in 2019, $17.6 million in 2020, and $16.9 million in 2021, according to the latest tax filings obtained by The Daily Beast.

Before launching her foundation in 2018, Walton contributed to her family foundation and also founded the Crystal Bridges Museum of American Art in Bentonville, Arkansas.

According to Bloomberg, Alice owns almost 12% of the business, based on an assumption that co-founder Sam Walton split the shares he owned equally among his four children — Rob, Alice, Jim, and John.

Since 1992, Walton has collected more than $15 billion in stock sales and dividends.

1. Jacqueline Mars

- Age: 84 years old

- Net worth: $37.4B

- Source of Wealth: Candy, pet food, United States

Mars, a key player in the confectionery industry, shares ownership of Mars Inc., the world’s largest confectioner headquartered in McLean, Virginia.

The privately held company boasts an extensive portfolio, crafting beloved treats such as M&Ms, Snickers, and Milky Way, alongside popular chewing gums like Juicy Fruit and Orbit, as well as a range of pet chow including Pedigree and Whiskas, and packaged foods such as Ben’s Original and Suzi Wan.

Having dedicated nearly two decades to the company, Mars was not only a stalwart on the board until 2016 but also witnessed her son, Stephen Badger, assume a position on Mars Inc.’s board of directors.

Beyond her corporate engagements, Mars extends her influence to the public sphere, serving on the board of the National Archives and previously contributing her expertise to the Washington National Opera.

Within the Mars family, her brother John holds an estimated one-third ownership, while the remaining share is held by the four daughters of her late brother Forrest Jr.

The company, recognized as the world’s largest candy maker, has solidified its presence through iconic confections like Snickers, Milky Way, and Twix, and boasts a diversified portfolio following its acquisition of Wrigley in 2008 for $23 billion.

Notably, Mars Inc. dominates over half of the US chewing-gum market, featuring well-known brands such as Big Red, Doublemint, Eclipse, Juicy Fruit, and Orbit.

With an array of popular candies including Skittles, Starburst, Life Savers, and Altoids, alongside food brands like Ben’s Original and Suzi Wan, and pet care lines including Pedigree, Whiskas, and Eukanuba, Mars sustains its status as an industry leader with annual sales surpassing $47 billion, according to a press release in October 2023.

Most family owned business in Nigeria does not last for more than two generations before

the business die.

It is because business owners don’t other inve to come into the business for the sake of total

Control of the business.

Another reason is that children of the founders of the business are not integrated into the business from their youth.