Nigeria’s headline inflation rate surged to 27.33% in October 2023, marking a 0.61% increase from September’s 26.72%.

Year-on-year, this represents a substantial 6.24% rise compared to October 2022, when the inflation rate was at 21.09%.

The impact of such inflation on investments is crucial to understand, as it erodes the purchasing power of money over time.

While investors often concentrate on nominal return’ which is the actual percentage gain or loss on an investment, it is equally crucial to consider real returns, which account for inflation.

Real returns offer a more accurate reflection of the actual increase in purchasing power and are vital in an inflationary situation.

In this context, traditional asset classes, such as bonds and cash equivalents, often face challenges in providing positive real returns, while stocks generally have the potential to outperform inflation and provide positive real returns though individual stock performance can vary widely.

Some stocks may indeed experience negative real returns, especially if their growth doesn’t outpace inflation.

The interplay becomes especially evident in stock investment when considering the total return of stocks, which includes capital gains and dividend yields, about the inflation rate.

In 2022, for example, this played out, showcasing divergent outcomes among stocks. Some recorded positive real returns, indicating growth that outpaced the closing inflation rate of 21.34%, while others grappled with negative real returns

Take, for instance, Guinness Nigeria Plc, which achieved an impressive total return of 87.99% for 2022.

Considering the inflation rate closing at 21.34%, Guinness Plc secured a real return of 54.93%. This indicates that the investment in Guinness Plc not only outpaced the inflation rate but also provided a substantial real return, reflecting strong performance during the period in question.

In contrast, within the penny stock category, AXA Mansard recorded a total return of +4.21% in 2022. However, when factoring in the inflation rate of 21.34%, the real return for AXA Mansard turned negative, settling at -14.12%.

This reminds us that even in a positive total return scenario, the impact of inflation can result in a diminished real return.

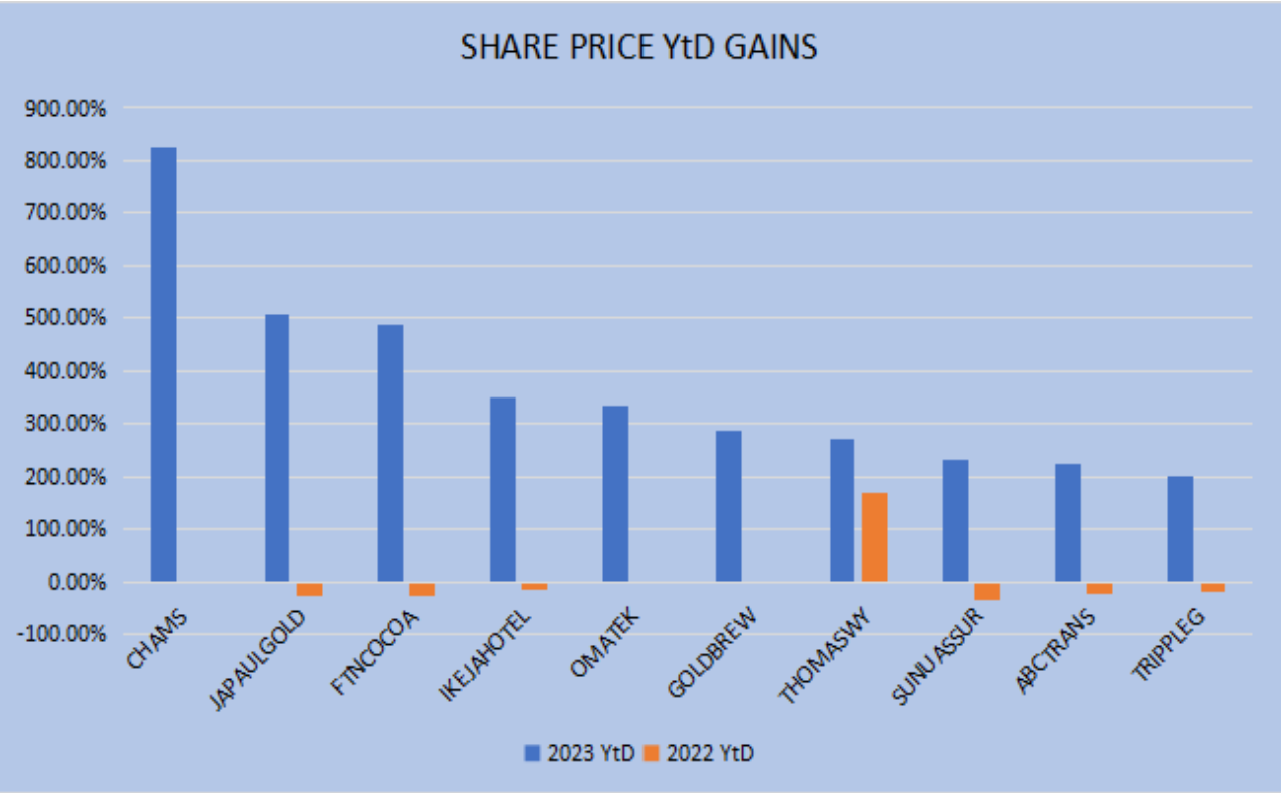

In 2023, penny stocks have shown resilience and growth. Over 40 of these stocks have year-to-date gains above the current inflation rate.

Notably, ten standout performers, including CHAM, JAPAULGOLD, FTNCocoa, Ikeja Hotel, OMATEK, Golden Breweries, ABC Transport, THOMASWY, SUNUAssurance, and TRIPPLEG, have not only outpaced inflation but have soared with triple-digit year-to-date gains.

Penny stocks, identified by their modest per-share value often below N5, present an accessible entry into the market, making them an attractive option for investors.

Their affordability, coupled with the potential for significant returns, positions penny stocks as an enticing opportunity for individuals seeking to venture into investing without a substantial upfront commitment.

However, it’s essential to acknowledge the dual nature of penny stocks. Characterized by high volatility, these stocks are prone to substantial drawdowns, making them a blend of high-risk and high-profit instruments.

Consequently, some stock analysts caution against adopting long-term buy-and-hold strategies in the penny stock sector.

The tendency for short-term trades in this domain highlights the need for investors to navigate with care and consider the associated risks in their investment decisions.

This cautionary approach becomes particularly relevant, even when examining the performance of the top ten penny stock performers in 2023 in comparison to their 2022 performance.

In 2022, except for Thomas Watt Nigeria, which recorded a year-to-date gain of +169.44%, the remaining nine top performers for 2023 either remained stagnant or experienced negative year-to-date returns.

Therefore, it becomes crucial for investors to discern opportune moments to capitalize on profits, given the cyclic returns often associated with these stocks.

However, it’s crucial to acknowledge the absence of guarantees in equity investments. At best, such investments may be considered inflation-protected.

Against the backdrop of the current inflation rate of 27.33%, these penny stocks have not only weathered the economic storm but have also surpassed the rising inflation.

Omatek Ventures: +335% YTD

Omatek Ventures, with a 335% share price YtD gain, emerged as the 5th most-performing penny stock on the NGX.

It commands trading liquidity with a trading volume of 393 million shares over the past four months, ranking it as the 17th most traded stock on the NGX.

OMATEK, which operates in the ICT/Computers and Peripherals sector/subsector, is presently the 112th most valuable stock with a market capitalization of NGN 2.56 billion.

However, it has not paid dividends for the past five years, and there are concerns about the share price growth being unsupported by earnings, given the company’s loss after tax recorded over the past five years.

Ikeja Hotels Plc: +349.52% YTD

In 2022, Ikeja Hotels faced a setback, witnessing a decline and losing about 14% of its share price value. However, a turnaround occurred in the current year, as the stock rebounded significantly, gaining around 350%.

In contrast to OMATEK, Ikeja Hotels has a relatively positive dividend history. It has distributed dividends for three out of the last five years.

Additionally, the company displayed financial resilience in the first nine months of 2023, reporting a pre-tax profit of N1.070 billion compared to a pre-tax loss of N72 million in the corresponding period of the previous year.

Despite this recent positive performance, the company’s earnings have not been stable over the last five years, including a reported pre-tax loss of N3.357 billion in 2022.

This inconsistency in earnings might raise questions about the sustainability of the share price rally and whether it is fully supported by underlying fundamentals.

FTN Cocoa Processors: +489.66% YTD

FTN Cocoa Processors is the 22nd most traded stock on the Nigerian Stock Exchange over the past three months with a total volume of 226 million shares.

This suggests significant market activity and investor interest in the stock and could have an impact on the share price.

Higher trading volumes often indicate increased market liquidity and may attract more investors, contributing to price movements.

However, it is better to approach FTN Cocoa’s share price rally with caution, as it appears not to be supported by the company’s financial performance.

The company has consistently reported pre-tax losses over the past five years, and this trend continued into 2023 with a pre-tax loss of N332 million in Q3.

Additionally, FTN Cocoa lacks a stable dividend history, having not paid dividends over the last five years.

Given these factors, investors are advised to carefully consider the risks and potential implications of the share price movement considering the company’s financial record.

Japaul Gold and Ventures Plc: +507.14% YTD

Japaul Gold, formerly known as Japaul Oil and Maritime Services Plc, operates as a Nigerian upstream service company involved in diverse sectors including mining, oil and gas, maritime, dredging, transportation, engineering, and construction services.

Over the past three months, Japaul Gold has experienced significant trading activity, with an impressive volume exceeding 1.3 billion shares.

This places the company as the 6th most traded stock on the Nigerian Stock Exchange (NGX).

Japaul Gold’s financial performance has been a mix of ups and downs. Investors might perceive the company’s 9M 2023 results as a return to its golden era in 2019 when it reported a substantial pre-tax profit of N41 billion.

CHAMS Plc: +827.27% YTD

Chams Plc is Nigeria’s leading provider of integrated identity management and payment transactional systems. CHAMS Plc with a share price YtD gain of 827.27% is ranked first on the NGX in terms of share price YtD performance.

The stock has also seen trading liquidity, with a substantial volume of 707 million shares traded over the past three months.

This suggests a significant level of market activity and investor interest in Chams Plc.

The positive momentum in Chams Plc’s share price may be attributed to investors perceiving its financial performance in 9M 2023 as a welcomed improvement.

The company has recorded pre-tax losses over the last five years; however, in 9M 2023, it reported a pre-tax profit of N255 million.