- Nigeria, Kenya, and Egypt have implemented new policies, including fuel subsidy removal and tax increases, which are impacting businesses across these countries.

- Elevated Benchmark Interest Rates: Benchmark interest rates in Kenya, Nigeria, Ghana, and Egypt have remained high, increasing the cost of capital and affecting real estate markets.

- Mixed Real Estate Performance: The office sector has seen a decline in development pipelines in Lagos, Nairobi, and Accra due to the subdued macroeconomic environment. Residential markets have deficits in the ultra-luxury and affordable segments, while the luxury and deluxe segments are oversupplied.

Across the continent, new policy adoptions are turning the tide on business as usual operations.

The removal of the decades-old fuel subsidy in Nigeria, the adoption into law of Kenya’s finance tax that is set to increase taxation on core components such as fuel and income tax, as well as Egypt’s new tax initiatives focused on components such as income tax and entertainment tax are just a few examples of such policies.

Interestingly, local financing has also faced its own share of downturns. Benchmark interest rates across Kenya, Nigeria, Ghana and Egypt have remained elevated at 10.5%,18.5%, 29.5% and 18.75% respectively resulting in an increased cost of capital.

As such, market performance across the real estate sector remains varied with the changing macroeconomic environment having a direct impact on development pipeline, market take up and real estate prices.

Therefore, we anticipate the second half of the year to continue reflecting limited transaction activity underpinned by cautious optimism by investors. In this article, we discuss the performance of the office, residential, hospitality and retail sectors across our core cities of Accra, Lagos and Nairobi and end with our expected outlook across each of the locations.

Office Performance remains mixed across the different cities.

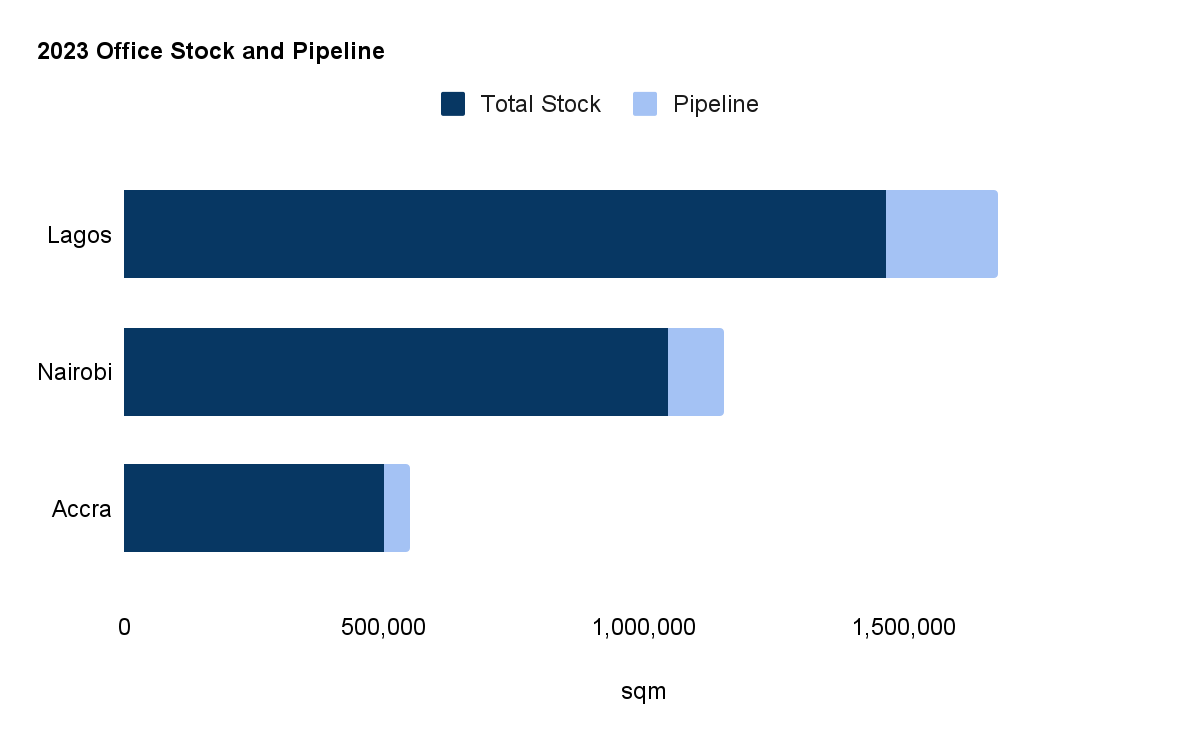

The office development pipeline across Lagos, Nairobi and Accra declined by 34%,53% and 52% respectively in 2023 compared to 2022. This can be attributed to a subdued macroeconomic environment that has impacted on the cost of financing as well as the cost of construction materials.

Source: Estate Intel

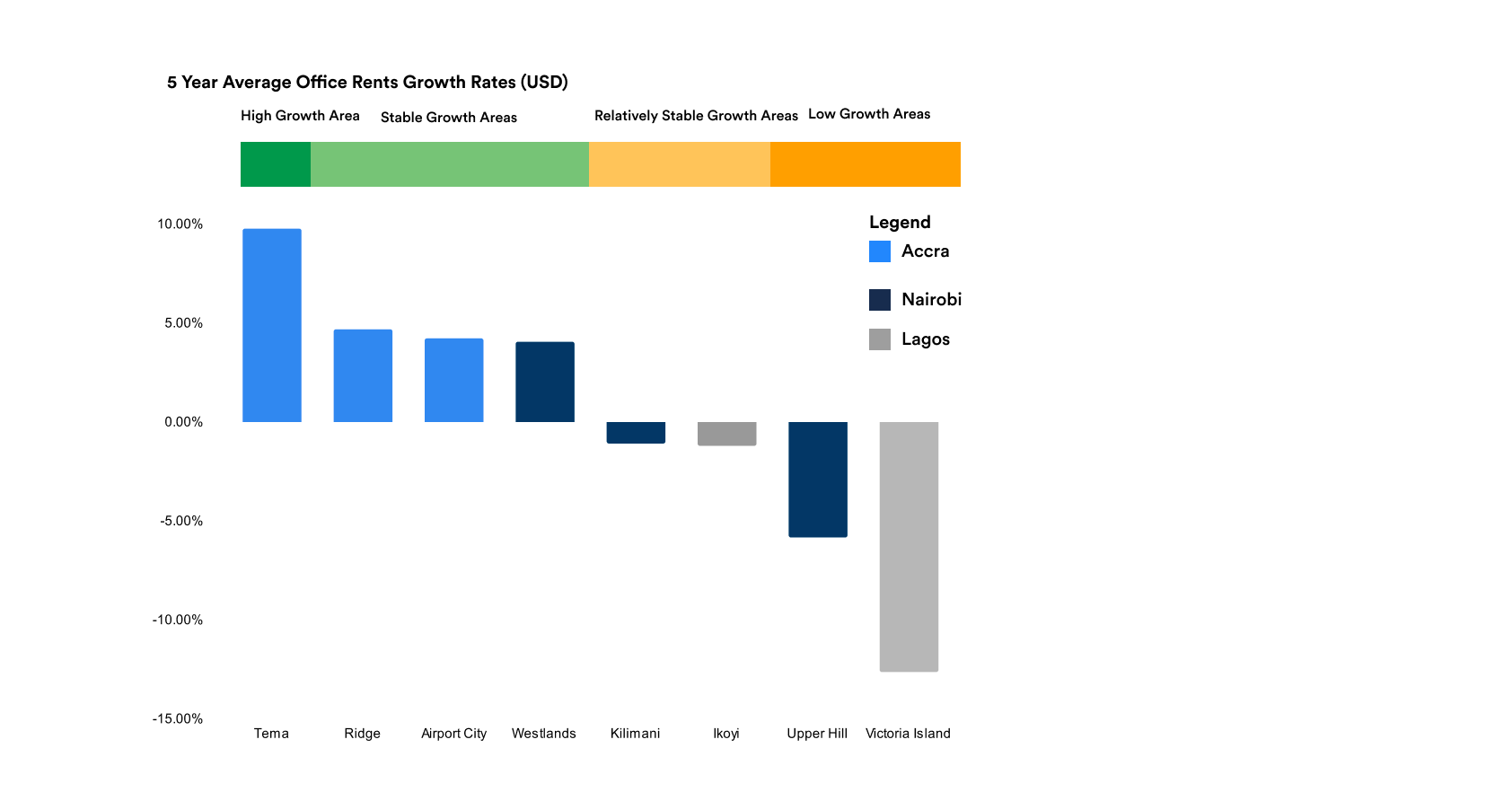

Interestingly, with the exception of Accra, both Lagos and Nairobi are still tenant markets due to an oversupply recorded pre-pandemic with occupancy levels currently averaging 75% for Grade A offices and 80% for Grade B offices.

As a result, average office rents have remained stable across the board over the past five years as illustrated below.

However, bright spots remain with a market such as Tema, in Accra emerging as a stand out neighbourhood with a five-year average growth rate above 5%.

Source: Estate Intel

In terms of an outlook, with heightened inflation and rising construction costs, we expect limited new project announcements across the markets in the near term resulting in a core balance between demand and supply.

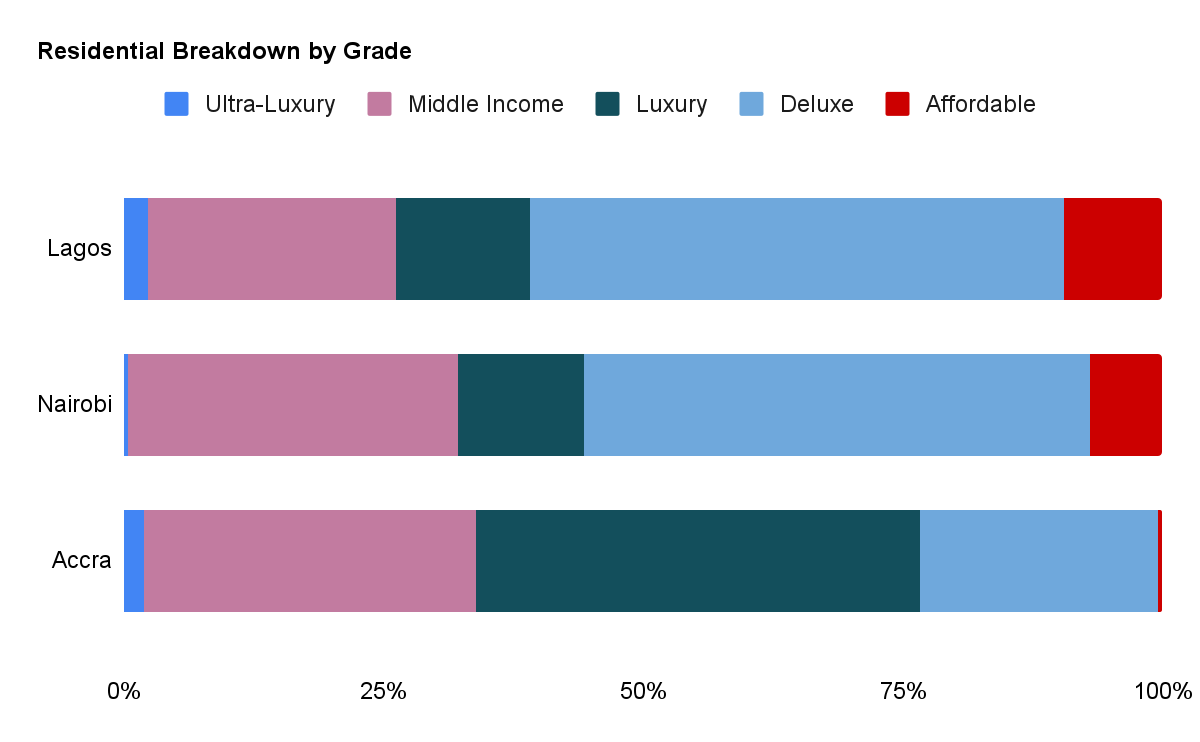

Residential markets have recorded deficits in the extreme ends of the market across both the ultra-luxury and the affordable segments

In the residential sector, the ultra luxury and affordable segments of the markets remain undersupplied effectively presenting an opportunity to developers. In Lagos and Accra for example, the ultra luxury segment accounts for only 2% of the market , while in Nairobi it accounts for approximately 0.5% of the total stock. In addition, the affordable housing segment accounts for 1%(Accra), 7% (Nairobi) and 10% (Lagos) of total stock.

Source: Estate Intel

On the other hand, the luxury and deluxe segments remain oversupplied accounting for 22% and 41% respectively of total stock on average across the three markets.

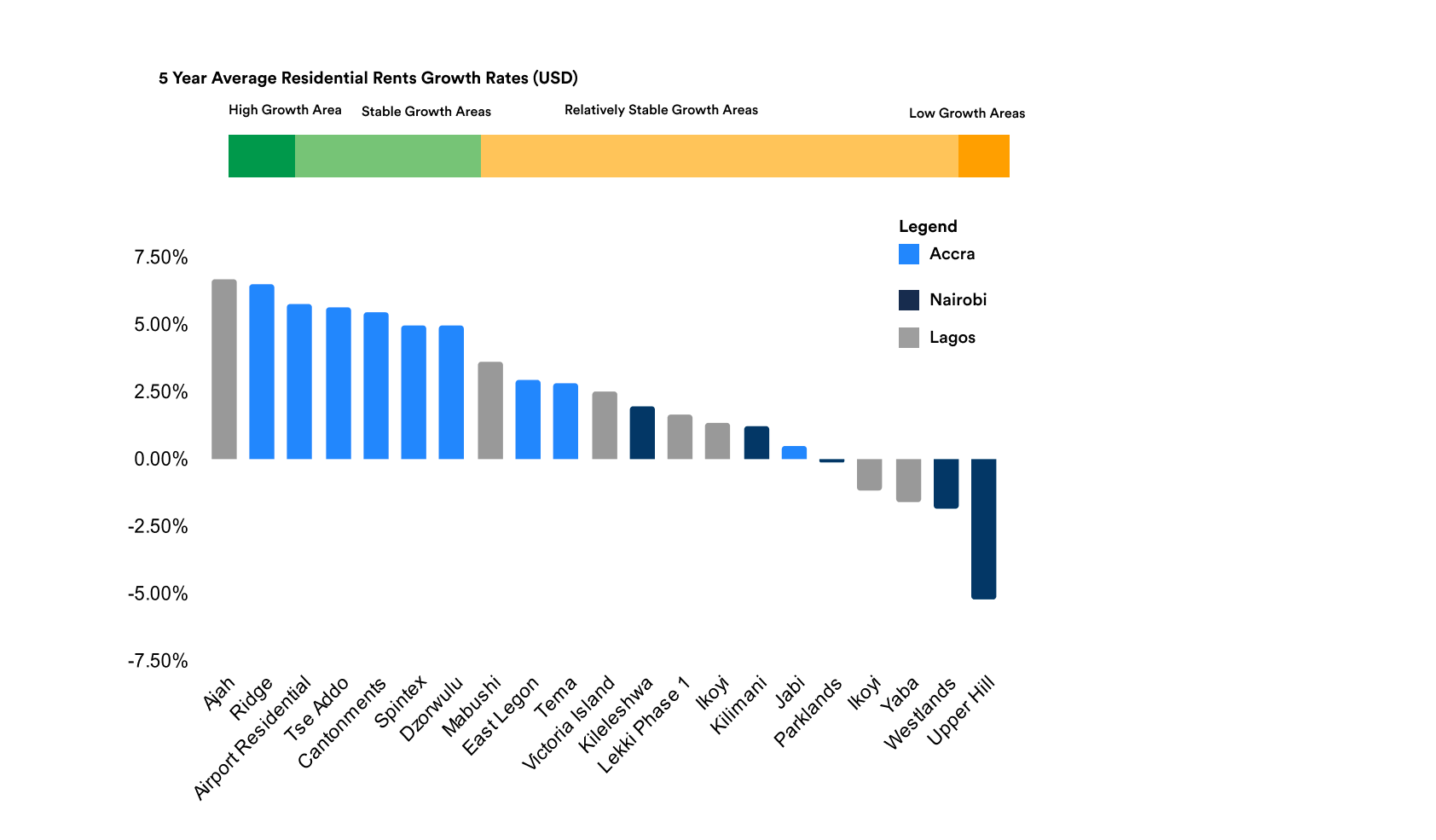

As such, this has resulted in rents remaining relatively stable in dollar terms without notable growth over the past five years across the majority of the neighbourhoods as illustrated below.

Notably, the case has been different for local currency rents, with prices remaining volatile and reactive to heightened inflation across the cities.

Still, markets such as Ajah in Nigeria and Ridge in Accra have emerged as stand-out markets recording five-year growth rates in US$ terms above 5% due to their higher composition of luxury and affordable housing residential units resulting in heightened demand

Source: Estate Intel

Notably, renewed government initiatives on affordable housing especially in Nairobi, Lagos and Accra will likely result in increased institutional participation, focused on this asset class.

Nairobi for example is already seeing heightened institutional investor participation. This has been evidenced by the recent announcement by the International Finance Corporation of plans to co-fund the development of 5,000 affordable housing units in collaboration with the International Housing Solutions (IHS) in Nairobi.

Overall, our outlook for the sector is positive, with an increased focus on ultra-luxury and affordable residential housing.

Pent-up International and domestic demand is overpowering economic headwinds in the majority of the cities across the hospitality sector.

The hospitality sector across the continent has continued to bounce back. The development pipeline remains high, recorded at 3,525 keys, 3,161 keys and 1,961 across Lagos, Accra and Nairobi respectively according to the 2023 W Hospitality Development Pipeline Report.

Occupancy rates have also bounced back with Nairobi and Lagos recording 57% and 68% on average effectively tracking pre-pandemic levels.

With international travel bouncing back, the sector’s outlook remains positive. For example, countries such as Kenya and Ghana recorded a 49.9% and 45% increase in Q1:2023 in international tourist arrivals, driven by business and leisure travel.

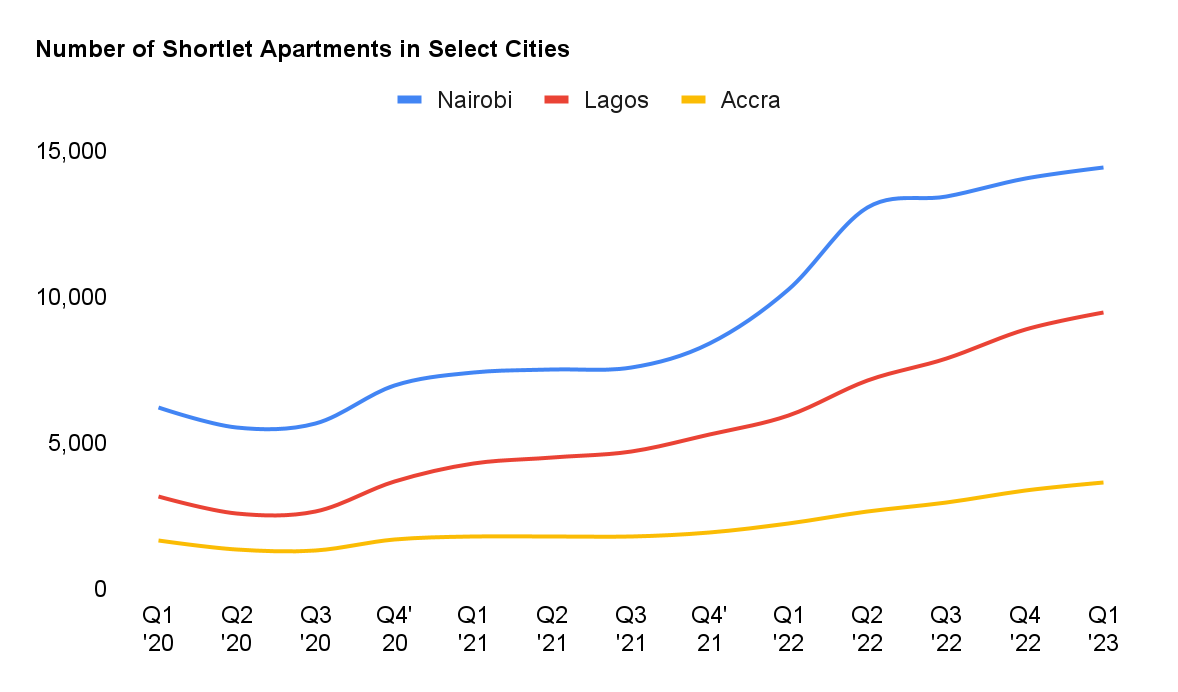

In addition, domestic tourism is also emerging as a strong driver for hospitality demand. Interestingly, this has been reflected in the steady increase in the number of shortlet homes across the major cities. So far Lagos, Accra and Nairobi have recorded a 199%,132%, and 119% increase respectively in shortlet homes over the past three years according to data from AirDNA.

Source: Air DNA

Our outlook for African hospitality in key cities is a continuing momentum despite speculations of an oversupply due to the vibrant development pipeline.

The retail sector remains subdued with increased cost of living set to impact it further

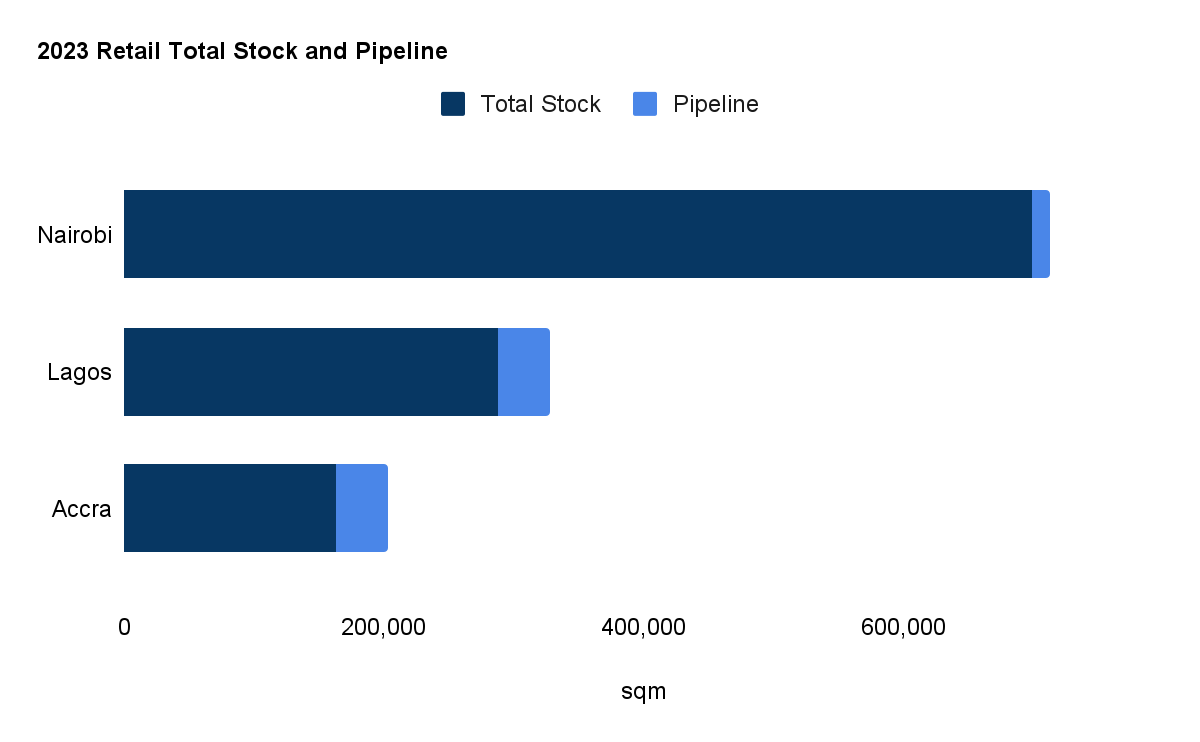

The formal retail sector remains relatively subdued with a limited active development pipeline of less than 50,000 m2 accounting for 2%,13% and 24% of total stock across Nairobi, Lagos and Accra respectively as illustrated below.

Source: Estate Intel

This decline in new supply has been a reaction to the weak performance of existing shopping centres delivered within the last decade. Demand for prime retail space, especially those with the typical US dollar-linked rentals will remain subdued and impede any new project announcements moving forward.

Notably, while occupancy levels remain relatively healthy in existing shopping malls, rising inflation coupled with currency depreciation is likely to impede the need for new space.

As such, major retailers are now either focusing on consolidation efforts by giving up space in lower-quality locations such as Smartmark in Nigeria or exiting the markets altogether such as Builders in Kenya.

This trend is expected to continue into H2:2023 with declining disposable income impacting consumer purchasing power.

Overall our outlook for the sector remains neutral at best with weak market fundamentals impacting on the possibility of an active development pipeline, especially in cities such as Nairobi.

We love your feedback! Let Estate Intel’s insights team know what your real estate outlook for H2:2023 is by sending an email to insights@estateintel.com.

Author: Tilda Mwai