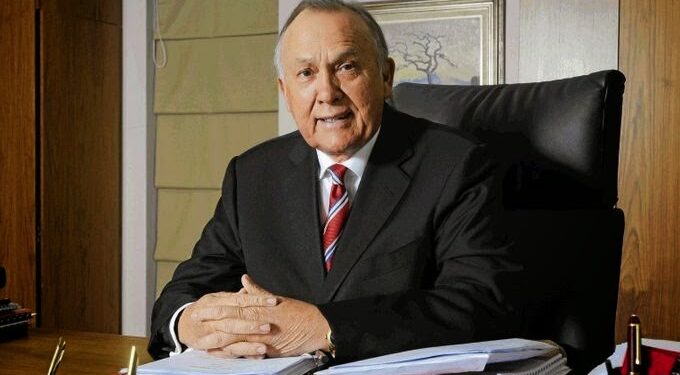

South African billionaire, Christoffel Wiese, a major shareholder with an 11.58% stake in Shoprite, previously valued at over $900 million as of September 10th, has recently decided to reduce his stake in the retail giant.

This is according to an announcement published on their website. Shoprite shares had been a significant part of his $1.1b 1.1 billion fortune, solidifying his status as one of Africa’s wealthiest individuals.

This strategic move by Wiese comes on the heels of his receipt of a final dividend amounting to R261.91 billion (equivalent to $13.84 million) from his stake in Shoprite on October 2nd. This dividend payout follows Shoprite’s commendable financial performance during the fiscal year 2023, which concluded on July 2, 2023.

Shoprite reported a 2.8% increase in profit for the fiscal year 2023, surging from R5.74 billion (equivalent to $300.17 million) in the previous year to R5.9 billion (equivalent to $308.55 million). This achievement is particularly remarkable, considering the challenging operating conditions and rising energy costs that contributed to increased operating expenses, ultimately affecting profit margins.

The company showcased robust revenue growth throughout the year, achieving an impressive 17.1% increase. Shoprite’s revenue surged from R187.53 billion (equivalent to $9.8 billion) in 2022 to R219.53 billion (equivalent to $11.48 billion) in 2023.

According to reports, it recorded a 9.6% increase in net profits within one year for the year ended in July.

In acknowledgment of its resilience, the board of directors at Shoprite announced a final dividend of R4.15 (equivalent to $0.217) per share. This signifies a noteworthy 10.5% growth in full-year dividend per share, reaffirming Shoprite’s commitment to delivering value to its shareholders and stakeholders.

More about Christoffel Wiese

Based on reports by Forbes, Christoffel Wiese initially built his Pepkor retail empire by offering affordable prices in South Africa and later expanded its presence into other African nations.

In 2015, the South Africa-based furniture retailer, Steinhoff International, made a substantial $5.7 billion cash and stock acquisition of Pepkor.

However, in December 2017, Wiese decided to step down from his role as the chairman of Steinhoff. This move came after the company revealed significant accounting irregularities, causing a sharp decline in its share price. Unfortunately, Wiese also lost his billionaire status in the wake of this turmoil.

Nevertheless, Wiese managed to regain his substantial wealth in 2022. This came about when he resolved his dispute with Steinhoff, receiving a combination of cash and stock as part of the settlement, which also included a 5% stake in Pepkor.

While Wiese’s most valuable asset remains Shoprite, he also holds stakes in various other entities, including retailer Tradehold, private equity firm Brait, and industrial products company Invicta Holdings. He is currently worth $1.1 billion.