The glass ceiling in Nigeria’s banking industry might not be shattered yet, but the latest data suggests it might be starting to crack.

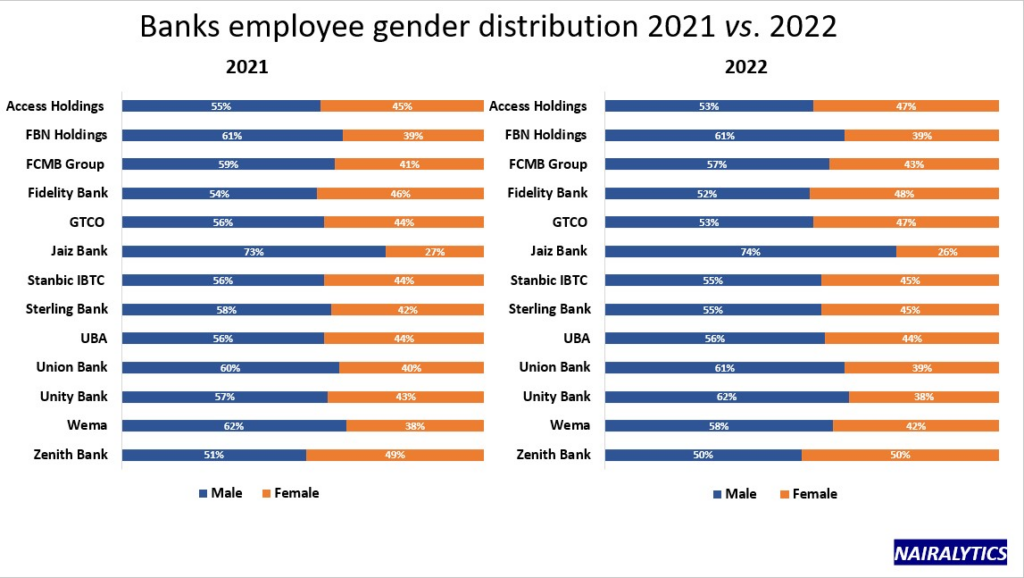

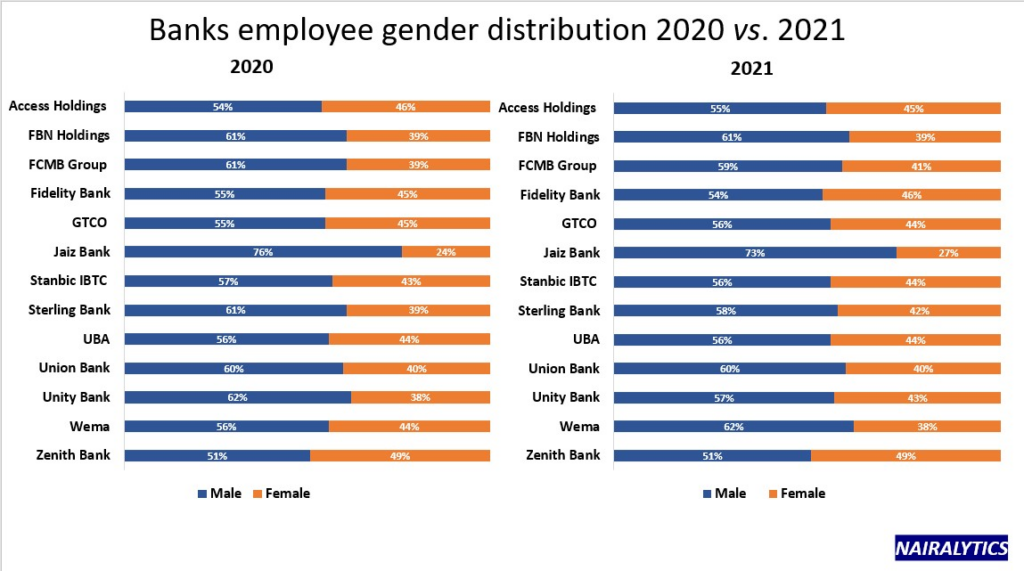

According to newly released Nairalytics research on Gender Diversity in Nigerian banks over the last three years, there has been a marginal yet noticeable shift toward greater gender diversity within Nigeria’s top 13 listed commercial banks.

The year 2022 witnessed a significant shift in gender dynamics within the banking industry, with more male employees leaving their positions compared to their female counterparts.

The attrition rate for males stood at 8%, while females experienced a 5% attrition rate during this period. This is in contrast to the preceding years of 2021 and 2020 when both genders had an average attrition rate of 3%.

In an analysis of the 13 listed banks conducted by Nairametrics, Jaiz Bank Plc consistently maintained the lowest gender diversity ratio, with a three-year average of 74% males to 26% females, hitting its lowest point in 2020.

In contrast, Zenith Bank maintained its leading position with a three-year average of 51% males to 49% females, reaching its highest diversity threshold in 2022.

Total Employee Strength

A comprehensive review of annual reports for the year 2020, serving as the base year for our analysis, revealed that these banks collectively employed 53,139 staff, including board members.

This workforce consisted of 30,154 male employees and 22,985 female employees, resulting in a gender diversity ratio of 57% male to 43% female.

In 2021, the total number of bank staff declined from 53,139 to 51,614, comprising 29,332 males and 22,282 females. This represented an average staff decline of 3%, with the gender diversity ratio remaining consistent with the previous year at 57% male and 53% female.

However, 2022 brought about a notable shift, with a 1% increase in favour of females, resulting in a ratio of 44% female to 56% male.

The total employee strength decreased by an average of 7%, with an 8% decrease for males and a 5% decrease for females.

This ultimately reduced the total workforce in NGX-listed banks to 48,123, consisting of 26,961 males and 21,162 females.

Board & Top Management

For board members, the situation seems to be improving at a better rate. From a 75.2% male and 24.8% female representation in 2020, the gender gap narrowed to 70.6% male and 29.4% female by 2022.

The data points to a higher percentage of women at the decision-making table, which is key for influencing organizational policy and direction.

Top management saw an increase in female representation from 28.9% in 2020 to 31.1% in 2022. However, 2021 witnessed a dip, as female representation in top management roles fell to 24.2%.

This rollercoaster trend indicates that while there’s a willingness to elevate women to higher ranks, it’s not yet a sustained initiative.

Gender Diversity Ratio – Performance of Banks

Access Holdings Plc:

FTE Employees: The data indicates a steady reduction in the total number of employees over the last three years, falling from 5,434 in 2020 to 4,019 in 2022. Interestingly, this decline is more pronounced among male employees, dropping from 2,910 to 2,119.

Board Composition: The board size mildly decreased from 17 in 2020 to 16 in 2022. The ratio of men to women remained relatively constant, signifying that the downsizing affected both genders evenly.

Management Team: Here, the total count shows mild fluctuation but largely stable numbers, ranging from 68 to 75 over the years. It appears that while the workforce was reduced, the management layer remained relatively stable.

Our review of the data reveals that Access Holdings Plc employed a total of 5,434 staff, with 2,910 males and 2,524 females, representing a gender diversity ratio of 54% males to 46% females, in 2020, 4,782, with 2,618 males and 2,164 females, representing 55% males to 45% females in 2021 and 4,019, comprising 2,119 males and 1,900 females, representing 53% males to 47% females in 2022.

FBN Holdings Plc:

FTE Employees: FBN Holdings experienced a slight but consistent decline in the total FTE employees. Most noticeable is the male category, which dipped from 5,079 to 4,850.

Board Composition: Alarmingly, female representation on the board reduced from 3 in 2020 to just 1 in 2022, which raises questions about gender diversity at the board level.

Management Team: The management team size remains roughly stable, with only minor fluctuations. However, female representation remains limited to 1 or 2 over the period, highlighting a significant gender gap.

FBN Holdings data shows a staff strength of 8,327 in 2020, consisting of 5,079 males and 3,248 females, 8,220, with 5,014 males and 3,206 females in 2021 and 7,951, comprising 4,850 males and 3,101 females, maintaining a gender diversity ratio of 61% males to 39% females over the three-year review period.

FCMB Group Plc:

FTE Employees: Both male and female employee numbers have declined since 2020. The decrease is more apparent in male employees, dropping from 2,188 to 1,919.

Board Composition: While the board size swelled to 60 in 2021, it reduced to 46 in 2022. This suggests a possible reorganization or consolidation strategy.

Management Team: The size remained stable at around 59-61. A slight dip in female management from 16 to 15 over the years suggests gender parity remains stagnant.

During the review period, the Group had a staff strength of 3,610 employees, with 2,188 males and 1,422 females, representing a gender diversity ratio of 61% males to 39% females in 2020, ,362, consisting of 1,991 males and 1,371 females representing a ratio of 59% males to 41% females and 3,342, with 1,919 males and 1,423 females, representing 57% males to 43% females ratio for 2021 and 2022 respectively.

Fidelity Bank Plc:

FTE Employees: Employee numbers declined, with a slight emphasis on the male category. However, it is noteworthy that the female count remained fairly stable.

Board Composition: The numbers remained constant at 13-14, but it’s concerning that only 3 females are present on the board throughout these years.

Management Team: A growth trend, particularly in female management from 8 to 12, suggests that gender inclusion at the leadership level may be improving.

Fidelity Bank Plc. showed a 3% improvement in its gender diversity ratio over the review period, shifting from 55% males to 45% ratio in 2020 with a staff strength of 2,945 employees, including 1,609 males and 1,336 females, 2,974, comprising 1,608 males and 1,561 females, representing 54% males to 46% females ratio in 2021 to a staff strength of 3,038 (a 2% increase from 2021), with 1,590 males and 1,448 females, representing 52% males to 48% females ratio in 2022.

GTCO:

FTE Employees: A marked drop from 4,617 in 2021 to 3,169 in 2022 indicates either a restructuring or significant downsizing.

Board Composition: The female representation has achieved a 50% ratio in 2022, making it one of the most gender-balanced boards among the listed banks.

Management Team: The management layer also saw a sharp decrease in size, but the proportion of women increased, which is a positive sign for gender diversity.

In 2020, GTCO had a staff strength of 3,323, including 1,814 males and 1,509 females, with a gender diversity ratio of 55% males to 45% females. In 2021, GTCO with a significant 39% growth in its staff strength to 4,617, with 2,587 males and 2,030 females, there was a 1% decline it its gender diversity ratio, bringing it to 56% males to 44% females ratio.

However, in 2022, reversed its 2021 staff strategy with a 31% employee attrition, reducing the bank’s staff strength to 3,169, consisting of 1,693 males and 1,476 females, representing 53% males to 47% females ratio and a 3% improvement in its ratio.

Jaiz Bank Plc:

FTE Employees: A gradual but consistent growth in employee numbers is observed. However, female representation remains disproportionately low.

Board Composition: Over the three years, female representation stagnated at just one, suggesting a lack of focus on gender diversity at the highest level.

Management Team: Though the team size has grown, female presence remains minimal, suggesting room for improvement in gender diversity.

Jaiz Bank Plc had a staff strength of 610 in 2020, with 463 males and 147 females, a gender diversity ratio of 76% males to 24% females. The bank experienced a 3% improvement in its gender diversity ratio following a 20% growth in the number of staff in 2021, to 735, with 539 males and 196 females, representing 73% males to 27% females ratio.

However, in 2022, despite a further 11% increase in the number of staff, to 813, consisting of 601 males and 202 females, there was a 1% decline in its gender diversity ratio, to 74% males to 26% females.

Stanbic IBTC Holdings Plc:

FTE Employees: The numbers are largely stable, but a slight increase in female employees shows a balanced workforce.

Board Composition: The board grew in size and saw an increase in female representation, which is commendable.

Management Team: The size increased from 99 to 125, with a significant rise in female managers from 33 to 42.

With a staff strength of 2,972, including 1,691 males and 1,281 females, StanbicIBTC Holdings Plc had 57% males to 43% female gender diversity ratio in 2020.

In 2021, the bank experienced a 3% reduction in its staff strength to 2,895, comprising 1,620 males and 1,275 females representing 56% males to 44% females ratio, a 1% improvement in its gender diversity ratio. Following the reduction in the bank’s staff strength in 2021, there was a 4% staff increase in 2022 to 3,008, with 1,667 males and 1,341 females, resulting in 55% males to 45% females ratio, maintaining its 1% gender diversity improvement over the period.

Sterling Bank:

FTE Employees: Female employees increased from 930 to 1,355, a noteworthy improvement in gender balance.

Board Composition: No significant change, but the board remains male-dominant.

Management Team: The numbers fluctuated, peaking in 2021, but with an observable rise in female managers, which is encouraging for gender inclusion.

Sterling Financial Holdings Company had a staff strength of 2,367 in 2020, with 1,437 males and 930 females, representing a gender diversity ratio of 61% males to 39% females.

In 2021, there was a 2% growth in the number of employees to 2,404, comprising 1,405 males and 999 females, representing a 3% improvement in the company’s gender diversity ratio from 58% males to 42% females.

A further 27% growth in the number of staff in 2022, witnessed another 3% improvement in the bank’s gender diversity bringing staff strength to 3,043, consisting of 1,688 males and 1,355 females, with a gender diversity ratio of 55% males to 45%.

This cumulative 6% improvement in the bank’s gender diversity ratio was the highest amongst the listed banks over the period.

Union Bank:

FTE Employees: A steady decline in numbers, but female staff reduction is proportionately lower than that of males.

Board Composition: Reduced to just 8 members, with only 2 females, which might raise concerns about diversity.

Management Team: Numbers remained stable, but fluctuations in gender composition imply that gender parity is not yet fully achieved.

In 2020, Union Bank Plc., had a staff strength of 2,342, comprising 1,415 males and 927 females, representing a gender diversity ratio of 60% males to 40% females.

With a 6% reduction in the bank’s staff in 2021, the staff strength stood at 2,193, consisting of 1,322 males and 871 females, maintaining the same gender diversity ratio as the previous year.

There was a further 8% decline in the number of staff in 2022, bringing the total number of staff down to 2,028, with 61% males to 39% females. This is reflected in a 1% decline in the gender diversity ratio, at the end of 2022.

UBA:

FTE Employees: A gradual decline, particularly for male employees, but the female count remains fairly stable.

Board Composition: While the total number decreased, female representation has improved, an encouraging trend for gender diversity.

Management Team: Generally fluctuating but increased in size with more balanced gender representation.

UBA Plc. was the highest employer of talent during the review period. In 2020, the bank had a staff strength of 10,838 which included 6,025 males and 4,813 females.

This represents a gender diversity ratio of 56% males to 44% females.

In 2021 and 2022, the bank experienced a 6% reduction in the number of staff, whilst still maintaining its gender diversity ratio mix of 56% males to 44% females for both years.

UBA Plc.’s staff strength reduced to 10,199, with 5,666 males and 4,533 females in 2021, with a further reduction in 2022 to 9,597 in 2022, with 5,399 males and 4,198 females.

Unity Bank:

FTE Employees: The data shows fluctuation but generally remains stable, with a 51:49 male to female ratio.

Board Composition: Board size is low at just 9, with only 3 females, which poses questions about gender diversity at the top level.

Management Team: Numbers remain stable but low, with minimal changes over the years.

Unity Bank Plc. had a staff strength of 1,595, which included 986 males and 609 females, with a gender diversity ratio of 62% males to 38% females gender diversity ratio.

In 2021, with a 2% increase in the total number of staff, the bank ended the year with 1,632 from 62% males to 38% females maintaining its gender diversity ratio from 2020.

In 2022, there was a 20% reduction in the total number of staff to bring its staff strength to 1,301 which included 813 males and 418 females, whilst still their gender diversity ratio at 62% males to 38% females for the year.

WEMA:

FTE Employees: Numbers have been gradually increasing, most notably for females, rising from 220 to 300.

Board Composition: A slight increase in female representation shows some focus on diversity.

Management Team: The team is growing but remains small, with a mere 26 members, which raises questions about the scope of leadership.

With a staff strength of 1,232, with 690 males and 542 females, WEMA recorded a gender diversity ratio of 56% males to 44% females.

With a 6% growth in the number of staff in 2021, WEMA missed the opportunity to improve its gender diversity, rather they experienced a 1% decline, with a staff of 1,303, comprising 743 males and 560 females and a ratio of 57% males to 43% females.

There was a further 9% growth in the number of staff in 2022, and again WEMA lost the opportunity to improve their gender diversity ratio, falling a further 1%, with a staff strength of 1,415, comprising 819 males and 596 females, and a ratio 58% males to 42% females.

Zenith Bank:

FTE Employees: A minor decline, more noticeable among male employees.

Board Composition: Female representation increased over the years, suggesting a positive trend.

Management Team: The team grew significantly, with female managers rising from 35 to 45, another encouraging sign.

Zenith Bank Plc. maintained consistency in its gender diversity ratio for employees over the period. In 2020 and 2021, the bank had a ratio of 51% males to 49% females.

However, in 2022, Zenith Bank Plc. achieved a position of equal recognition among employees by gender, improving its gender diversity ratio by 1% to equal numbers among its male and female employees.

In 2020, Zenith Bank Plc. had a staff strength of 7,544, with 3,847 males and 3,697 females. In 2021, with a 17% reduction in number of staff, the bank had 6,298, comprising 3,212 males and 3,086 females.

In 2022, there was a 6% growth in the number of staff to 6,700, comprising 3,378 males and 3,322 females.

The Need for Improvement

A report by the World Economic Forum published in July 2022 revealed significant progress in gender diversity for Nigeria, with the country moving from 146th to 123rd in global rankings.

Moreover, Nigeria recorded a 1.1% improvement in closing its gender diversity gap, especially in senior positions and income parity, aligning with broader trends in Sub-Saharan Africa.

Although there was a marginal 1% improvement in the gender diversity ratio for NGX-listed banks in 2022, reaching 56% males to 44% females, there is still ample room for banks with gender diversity ratios above the 60% threshold to reevaluate their recruitment strategies and actively promote a more balanced gender representation among their employees.