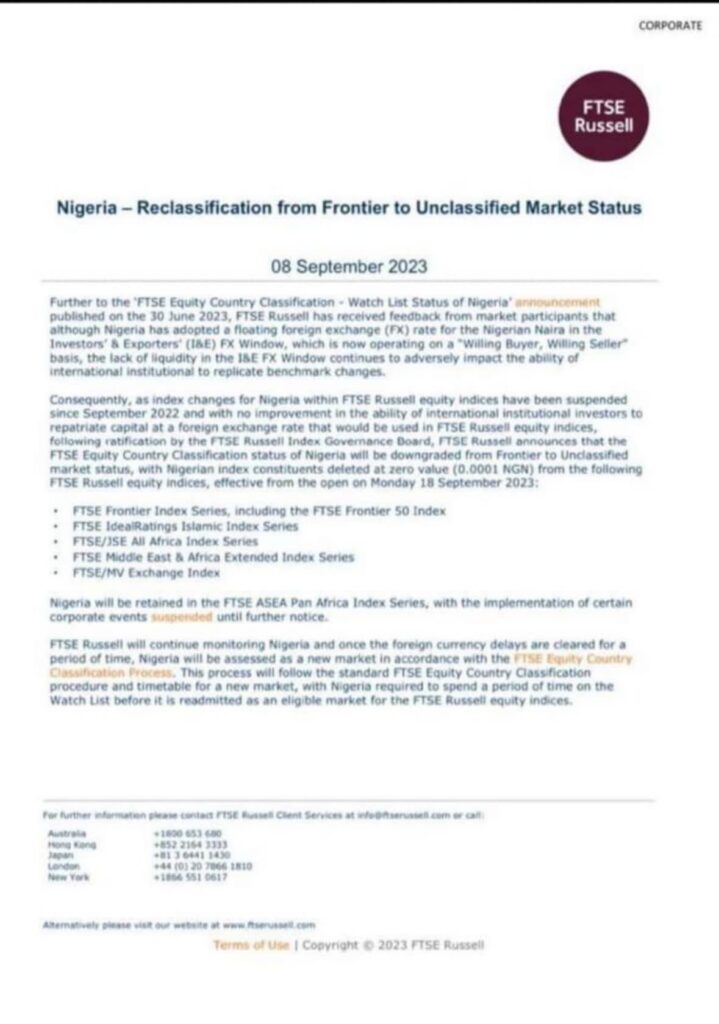

Nigeria’s stock market took a dramatic plunge to start the week, erasing the gains of the prior week, as FTSE Russell, the global index provider, downgraded the Nigerian Stock Exchange from “Frontline” to “Unclassified Market.”

The reclassification, set to take effect on September 18, 2023, prompted immediate selloffs that drove the All-Share Index down by 1.24% to close at 67,296.18 points.

The downdraft was felt acutely in Nigeria’s Tier-1 banking sector, with Zenith Bank plunging by 5.82%, Guaranty Trust Holding Co. (GTCO) dropping by 8.62%, and Access Bank falling by 8.57%.

This resulted in the market’s year-to-date (YTD) returns tumbling to 31.11% and wiping out ₦463.66 billion ($1.14 billion USD) in market capitalization, which closed at ₦36.83 trillion ($90.81 billion USD).

Foreign Exchange Woes Prompt Downgrade

In a statement released on Monday, September 11, FTSE Russell cited Nigeria’s ongoing foreign exchange problems as a key motivator behind the downgrade.

- According to the UK-based financial institution, these issues have hindered the ability of institutional investors to repatriate trapped capital.

- The statement also expressed skepticism about the effectiveness of Nigeria’s recent foreign exchange reforms, including the adoption of a ‘willing seller, willing buyer’ policy at the Investor and exporter (I&E) foreign exchange window.

Despite these changes—introduced last year—FTSE Russell noted little or no improvement in foreign exchange supply trends, a factor that continues to deter capital inflows from institutional investors.

Financial Indices Remove Nigeria’s Presence – The downgrade means Nigeria’s index status will be removed entirely from all five FTSE stock indices, effectively given a value of zero. This significant move is likely to have repercussions for Nigeria’s visibility on the international investment landscape, making it more challenging for the country to attract foreign capital.

Lackluster Market Activity Continues – Trade turnover also sagged relative to the previous session, down by a marginal 0.08%. In total, 520.13 million shares worth ₦8.33 billion were exchanged in 9,914 transactions.

United Bank for Africa (UBA) led the volume chart with a precipitous 9.18% fall, trading 73.9 million units, while Zenith Bank, despite its steep decline, led in value with deals amounting to ₦1.52 billion.

Looking Ahead – The downgrade and subsequent market reaction raise pressing questions about the sustainability of investment in Nigeria, particularly in its once-robust banking sector.

Investors and policymakers alike will likely be focused on how the country can stabilize its foreign exchange market and restore investor confidence in the wake of this critical development.

Let’s put our house in order before seeking foreign investments. If the investment environment is right, many of these highly sought-after portfolio investors would be falling over themselves to invest here even without much of these expensive foreign trips to campaign for their funds.

Any nominal reforms without building up the productive base of the nation will never result in the right outcomes. The pronouncement of, or intention to unify exchange rate is no solution to supply shortages in the fx market. I will also not subscribe to impulsive reactions from traders in the market. These same foreign institutions have the habit of praising badly packaged policies of underdeveloped countries and being the first to punish bad outcomes of such policies.

The Nigerian investors be it retail or institutional have tried to stabilise the market in the last two years. As foreign investors exited, we had local investors filling the gap. Now is the time for govt to.implemebt a minimum living wage so that citizens can keep the pace of investing up. Our listed companies are still doing well from.the recent quarterly reports with few ones maintaining and improving on their mid year interim dividend payouts. I expect this downgrade to have less impact on the market because of the quantum of trading foreign investors left but in.any case, a downward slide in the market offers opportunity for new buyers to take positions. Every market goes through burst and boom cycles. And the NGX had been predicted to slow in Q4 but to pick up again in Q12024. There is usually self adjusting mechanisms in the market only that the leadership under Oscar Onyema and Temmy Popoola have been despicable, self centred and irresponsible having lacked capacities to manage a market of this size and complexity. They have been pre occupied with cashing out under various schemes

The take away from this FTSE Russell downgrade and NGX price downtrend is ‘opportunity for the discerning’…..

It is an opportunity for long term investors to take position in fundamentally sound stocks. In life there are always seed time and harvest time which is applicable in the stock market.