Nigeria’s manufacturing sector led the list of sectors with the highest tax remittance to the federal government between January and June 2023, with a total payment of N606.7 billion, followed by the ICT and the financial services sector.

The federal government of Nigeria through the Federal Inland Revenue Service (FIRS) generated a sum of N3.49 trillion through taxes from the Nigerian economy in the first half of 2023.

This is according to data released by the National Bureau of Statistics (NBS).

Compared to the corresponding period of 2022, the tax revenue, which is a combination of Value Added Tax (VAT) and Company Income Tax (CIT) increased by a whopping 42.2% from N2.45 trillion collected in H1 2022 and 20.9% higher in contrast from the N2.89 trillion recorded in H2 2022.

The breakdown of the report by the NBS showed that CIT in the review period stood at N1.99 trillion, while VAT was N1.49 trillion.

The tax revenue generated in the first half of the year represents 31.6% of the budgeted federal government revenue for the 2023 fiscal year (N11.05 trillion).

The new administration of President Bola Ahmed Tinubu has embarked on a crucial endeavour to rectify Nigeria’s longstanding fiscal instability, which has persisted for over a decade and is projected to reach a budgetary figure of N10.78 trillion in 2023.

The measures by the government include setting up a committee on Fiscal Policy and Tax Reform, removing petrol subsidy payments, and devaluation of the official exchange rate amongst others.

Following the ripple effects of some of these policies, several sectors of the Nigerian economy have been plagued with severe operational challenges, which have threatened their ability to record significant profit growth.

However, the manufacturing sector continues to lead the pack in terms of tax payments to the government.

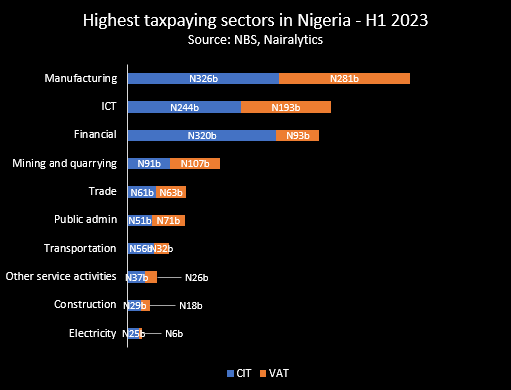

Here are the top 10 sectors with the highest tax payments between January and June 2023:

#3: Financial and insurance activities – N412.5 billion

The financial and insurance activities, which represent companies in the banking and insurance sector of the economy paid a sum of N412.5 billion as tax in the first half of the year. The sector remitted N319.8 billion as company income tax and N92.7 billion as value-added tax.

- The financial sector accounted for 11.8% of the total tax collections by the FIRS, making the sector the third highest taxpaying sector in the review period.

- Compared to the corresponding period of 2022, tax payments increased by a whopping 139.6% from N172.1 billion, while it increased by 182% from N146.1 billion paid in the second half of last year.

- The financial service sector accounted for 3.4% of the Nigerian economy with an estimated value of N6.7 trillion, playing host to the likes of Zenith Bank, GTCo, Stanbic, Access Bank, and FMDQ, amongst others.

Other sectors that made up the list of top 10 tax-paying sectors in Nigeria include mining and quarrying (N198.3 billion), trade (N124.4 billion), public administration (N122.4 billion), transportation and storage (N88.2 billion), other service activities (N63.5 billion), construction (N46.7 billion), and electricity (N30.5 billion).

#2: Information and communication – N436.5 billion

The information and communication sector, otherwise known as ICT, remitted a sum of N436.5 billion as tax between January and June 2023, retaining its second position, having contributed 12.5% to the total tax collection during the period.

- Tax payments by the ICT sector in H1 2023 increased by 39.8% when compared to the N312.1 billion recorded in the corresponding period of 2022 and 36.8% compared to the N318.9 billion paid in the second half of last year.

- The sector plays host to some of the largest quoted companies in the country, with the likes of MTN Nigeria and Airtel Africa generating billions of naira in profit annually.

- The ICT sector contributes 10.6% to the Nigerian economy with a nominal value of N21.2 trillion. A breakdown of tax payments shows more (N243.8 billion) was paid as company income tax compared to value-added tax, which stood at N192.6 billion.

#1: Manufacturing – N606.7 billion

The manufacturing sector remitted a sum of N606.7 billion as total taxes in the first half of 2023, surpassing the N451 billion paid in H1 2022 by 34.5% and the N495 billion paid in H2 2022 by 22.6%.

- The tax payment in the review period accounted for 17.4% of the total tax collection by the government, maintaining the position as the highest tax-paying sector in the Nigerian economy. A breakdown of the data showed that N325.6 billion was recorded under company income tax while N281.1 billion was value-added tax.

- The continuous dominance of the manufacturing sector in tax payment may be attributed to the size of the sector, with obvious big players like Dangote, Nestle, and Unilever operating there.

- According to the NBS, the manufacturing sector accounts for 13.8% of the Nigerian economy, with a nominal value of N27.5 trillion. The sector plays host to big players in cement, food, beverage, text, and chemical production amongst others.

More reason why Govt needs to declare a state of emergency in the manufacturing sector. If things are put right in the manufacturing sector, collectible tax may even triple quoted amount. More importantly, the multiplier effect in the economy will be significant viz. jobs, jobs jobs – unemployment will go down, wages and hence disposable income will go up leading to more economic expansion. No country develops without a healthy manufacturing sector.