Access Pensions Limited is the resulting entity formed from the business combination of Access Corporation’s acquisition of First Guarantee Pension Limited and Sigma Pensions Limited in 2022.

Important: After the merger, Sigma Pensions Limited became the surviving entity. Consequently, the published audited accounts for 2022 used Sigma Pensions accounts for the comparative numbers from 2021.

To ensure an accurate representation of annual changes and avoid any potential inflation of figures, we in places integrated the financial data from both merged entities. This approach guarantees a well-balanced analysis of the 2022 numbers.

As of 31 December 2021, new Access Pensions had shareholders’ funds of ₦12.14 billion, over the new regulatory minimum capital of ₦5.00 billion.

Analysis:

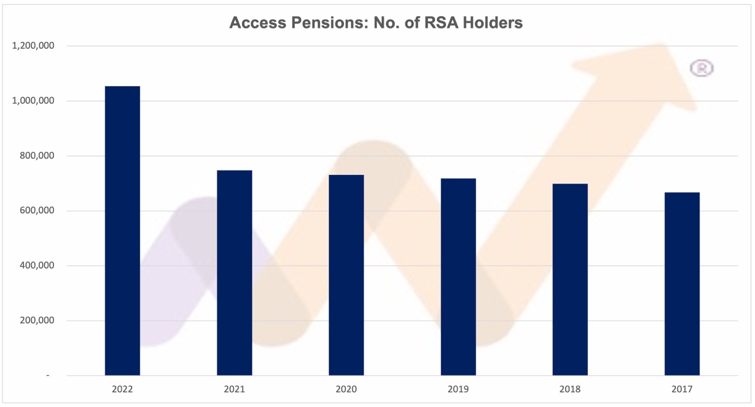

Access Pensions ended the 2022 financial year with 1,054,095 RSA holders in the 7 publicly available RSA funds, an increase of 27,910 RSA holders from the combined 1,026,185 accounts from First Guaranty Pensions and Sigma Pensions in 2021.

Additionally, assets under management for the 7 audited Retirement Savings Accounts (RSAs) funds published was ₦836.24 billion, up 10.33% from a combined ₦757,96 billion in 2021.

Performance Analysis: Company

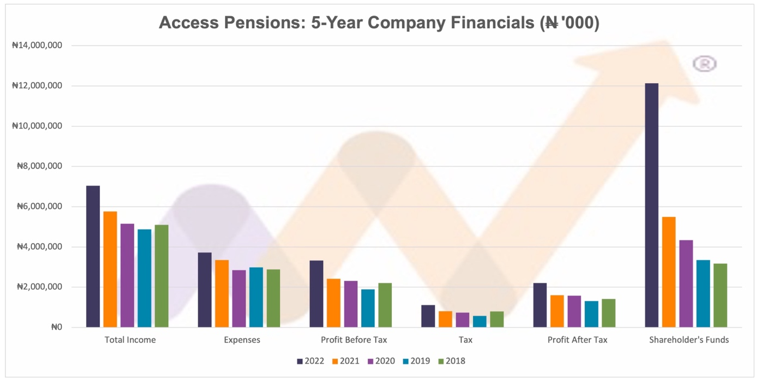

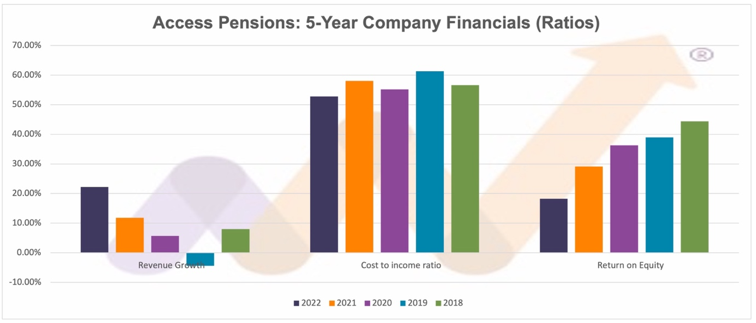

Revenue for the fiscal year ending on December 31, 2022, amounted to ₦7.04 billion, representing a decline of 21% compared to combined revenue of ₦8.86 billion recorded in 2021.

- It’s worth noting that the accounts indicate a 22% growth when singularly compared to the surviving company’s 2021 accounts.

- Total expenses, according to the published accounts, increased by 11% and reached ₦3.72 billion. However, when comparing the expenses to the combined expenses of the merged entities in 2021, there was a notable decrease of 34%, from a combined ₦5.60 billion.

- The company recorded a profit after tax (PAT) of ₦2.21 billion, showing a 38% growth over the surviving entity’s ₦1.60 billion.

- However, the growth was a modest 4.63% over the combined PAT of ₦2.11 billion in 2021. The shareholders’ funds closed the fiscal year at ₦12.14 billion.

- The return on equity (ROE) for the year 2022 stood at 18.22%. However, when considering the average equity throughout 2021 and 2022, the return was higher at 20.59%.

Performance Highlights: Access RSA Funds (audited)

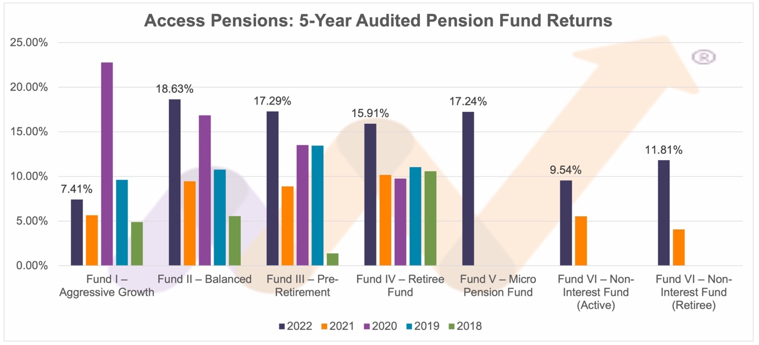

For the period ending on December 31, 2022, Access Pensions Fund I appreciated by 7.41%, while Fund II appreciated by 18.63%.

- Similarly, Fund III recorded a growth of 17.29%, Fund IV appreciated by 15.91%, and Fund V by 17.24%.

- The specialized funds, Fund VI – Non-Interest (Active) and Fund VI – Non-Interest (Retiree), experienced respective increases of 9.54% and 11.81%. The pension industry does not currently benchmark the performance of any fund to any performance index.

- In the absence of any benchmark index to measure/compare fund performances for the year 2022, and to aid readers’ indirect comparison

- The NGX All-Share Index (a measure of performance of the Nigerian stock market) appreciated by 19.98%, the NGX Pension Index appreciated by 16.96%

- Inflation was 21.47% and MPR closed the year at 16.50%, having risen steadily through the year.

Note: Access Pensions did not publish income statements for the summary audited fund accounts released. As such some figures and some ratios are incomparable to prior periods due to the ‘missing’ income statement information.

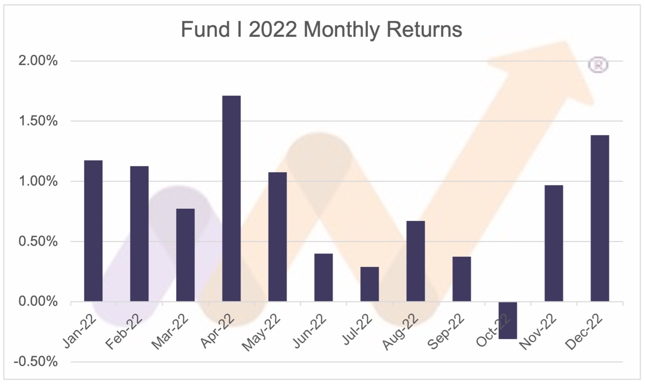

Access Pensions Fund I highlights:

- Fund I performance: up 7.41% in 2022, higher than the 5.64% in 2021 but lower than the 22.77% in 2020.

- Fund I income was up 47% to ₦1.61 billion in 2022, from ₦1.09 billion in 2021 and ₦1.77 billion in 2020.

- Fund size: the size of the fund, measured by net assets, grew 20% to ₦17.90 billion from ₦14.86 billion in 2021. ₦8.47 million was added to the fund because of the merger.

- Asset Allocation (31-12-2022): Fixed Income Instruments 64.00% (2021: 43.82%), Equities 9.00% (2021: 11.67%), Money Market instruments 24.00% (2021: 25.86%), Cash 0.00% (2021: 0.00), Others 3.00% (2021: 18.65%).

- Performance ranking: The fund performance for 2021 was ranked 13 out of 19 in our 2022 Annual Report on Pensions.

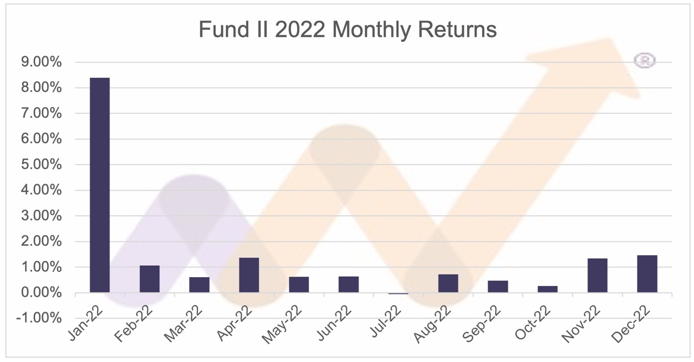

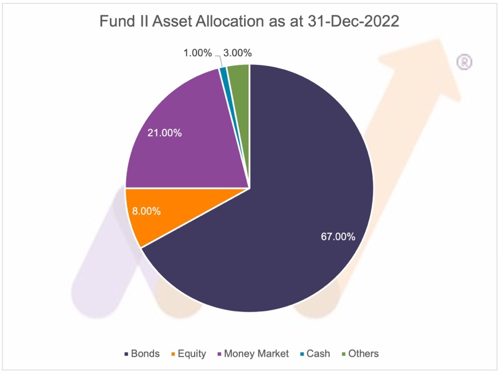

Access Pensions Fund II highlights:

- Fund II performance: up 18.63% in 2022, compared to 9.46% in 2021 and 16.85% in 2020.

- Fund II income was up 58% to ₦35.60 billion in 2022. This was up by ₦22.47 billion in 2021 and ₦32.07 billion in 2020.

- Fund size: Fund II grew almost 64% to ₦364.17 billion from ₦222.40 billion in 2021. ₦111.64 billion was added to the fund because of the merger.

- Asset Allocation (31-12-2022): Fixed Income Instruments 67.00% (2021: 54.11%), Equities 8.00% (2021: 11.81%), Money Market instruments 21.00% (2021: 21.26%), Cash 1.00% (2021: 0.00), Others 3.00% (2021: 12.82%).

- Performance ranking: The fund performance for 2021 was ranked 2 out of 19 in our 2022 Annual Report on Pensions.

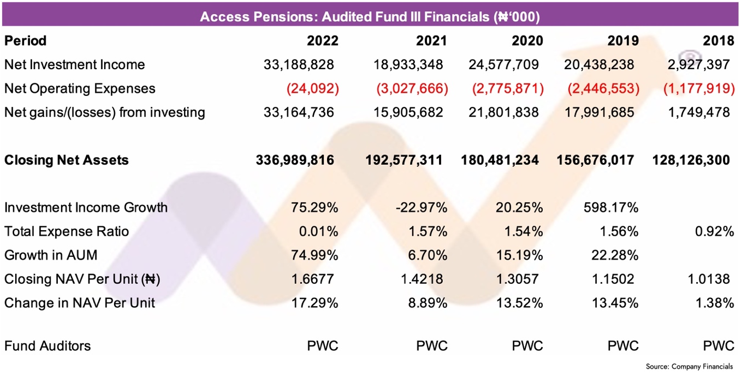

Access Pensions Fund III highlights:

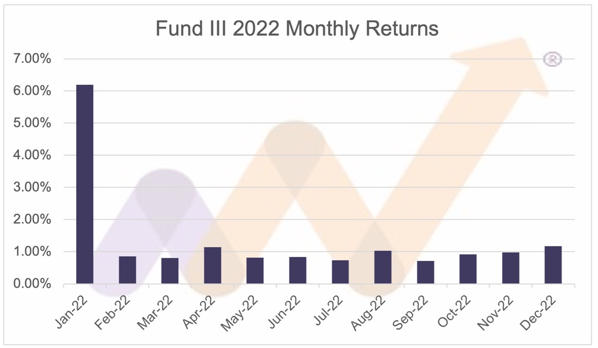

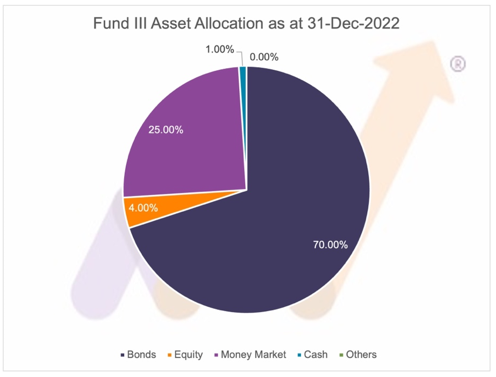

- Fund III performance: was 17.29% in 2022, compared to 8.89% in 2021 and 13.52% in 2020.

- Fund III income was up 75% to ₦33.19 billion in 2022 from ₦18.93 billion in 2021 and ₦24.58 billion in 2020.

- Fund size: Fund III grew 75% to ₦336.99 billion from ₦192.58 billion in 2021. ₦32.31 billion was added to the fund because of the merger.

- Asset Allocation (31-12-2022): Fixed Income Instruments 70.00% (2021: 67.75%), Equities 4.00% (2021: 5.13%), Money Market instruments 25.00% (2021: 17.91%), Cash 1.00% (2021: 0.00), Others 0.00% (2021: 9.21%).

- Performance ranking: The fund performance for 2021 was ranked 2 out of 19 in our 2022 Annual Report on Pensions.

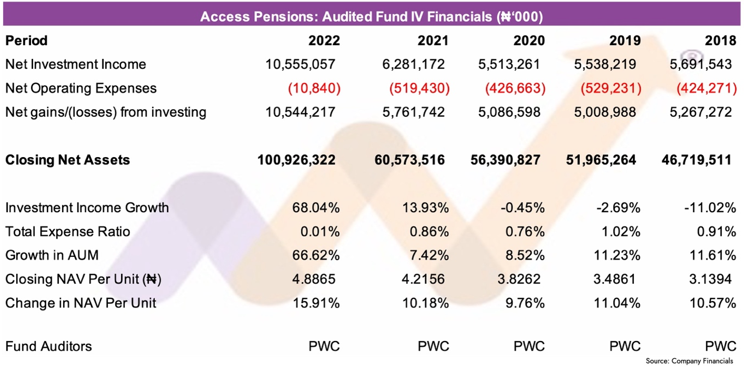

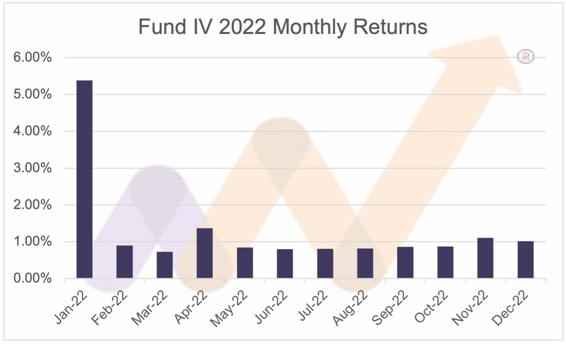

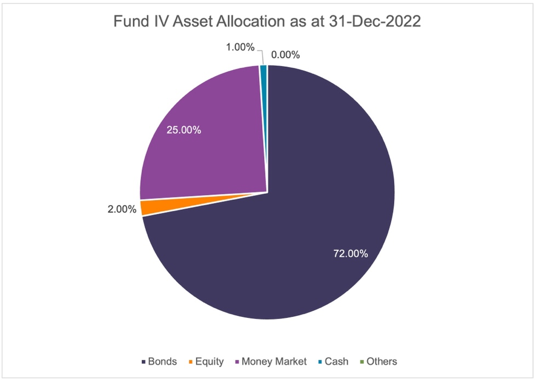

Access Pensions Fund IV highlights:

- Fund IV performance: up 15.91% in 2022, compared to 10.18% in 2021 and 9.76% in 2020.

- Fund IV income: ₦10.56 billion in 2022, up 68% from ₦6.28 billion in 2021. Both are up ₦5.51 billion in 2020.

- Fund size: Fund IV grew almost 67% to ₦100.93 billion, from ₦60.57 billion in 2021. ₦26.63 billion was added to the fund because of the merger.

- Asset Allocation (31-12-2022): Fixed Income Instruments 72.00% (2021: 63.30%), Equities 2.00% (2021: 2.27%), Money Market instruments 25.00% (2021: 22.13%), Cash 1.00% (2021: 0.00), Others 0.00% (2021: 12.30%).

- Performance ranking: The fund performance for 2021 was ranked 1 out of 19 in our 2022 Annual Report on Pensions.

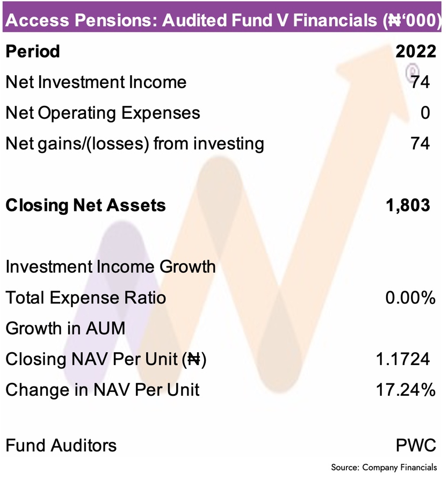

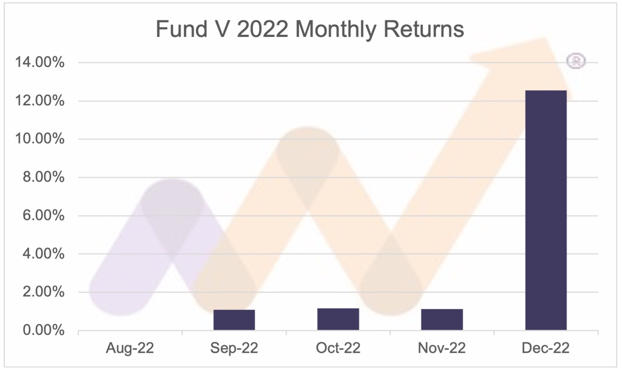

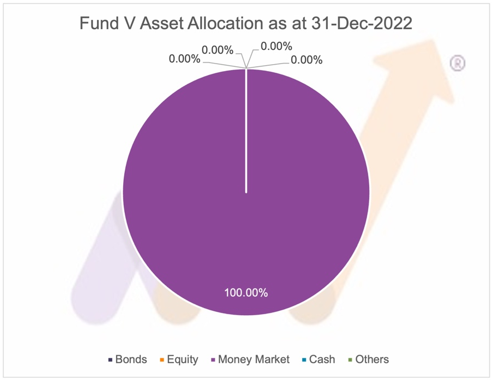

Access Pensions Fund V highlights:

- Registered Fund V RSA holders: Access Pensions had 912 Fund V RSA holders as of 31 December 2022, up from 749 in 2021. Total industry Micro Pension RSA holders in 2022 were 89,327, giving Access Pensions a 1.02% market share.

- Total assets in the fund: ₦1.80 million in 2022, the first set of accounts to be published.

- Fund V income: Net fund income for the fund was ₦74,000.

- Fund V was launched in August 2022 and the performance to the end of the year was 17.24%.

- Asset Allocation (31-12-2022): The fund was 100% invested in money market instruments as of 31 December 2022.

- Performance ranking: As the fund was not in operation it was not ranked in our 2022 Annual Report on Pensions.

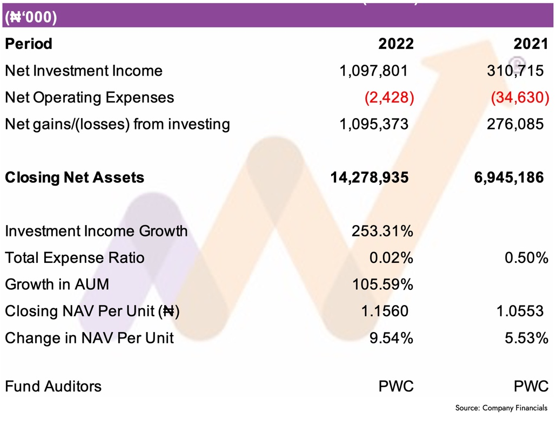

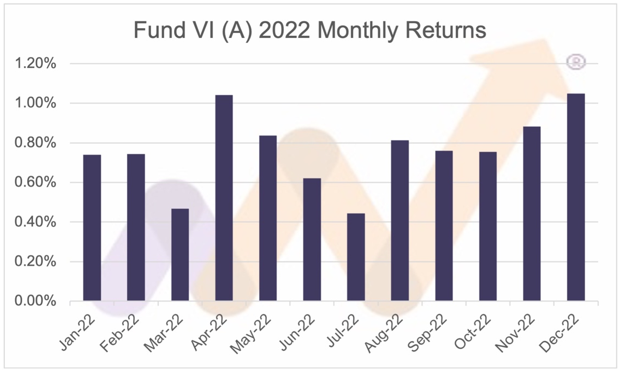

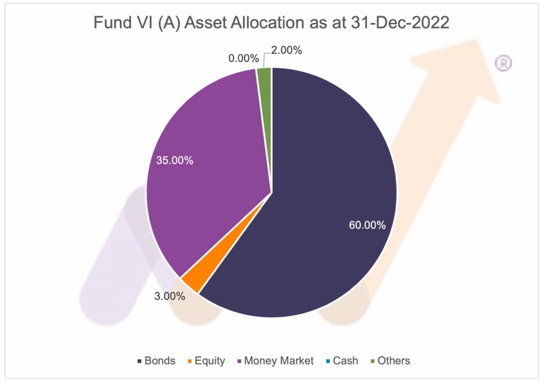

Access Pensions Fund VI – Non-Interest (Active) highlights:

- Income for the year was ₦1.10 billion in 2022, up from ₦277.70 million in 2021.

- Fund performance: up 9.54% in 2022, compared to 5.53% in 2021.

- Fund size: Fund VI non-interest (Active) was ₦14.28 billion, up 106% from ₦6.95 billion in 2021.

- Asset Allocation (31-12-2022): Fixed Income Instruments 60.00%, Equities 3.00%, Money Market instruments 35.00%, Cash 0.00%, Others 2.00%. 2021 comparison data unavailable.

- Performance ranking: The fund performance for 2021 was ranked 1 out of 11 in our 2022 Annual Report on Pensions.

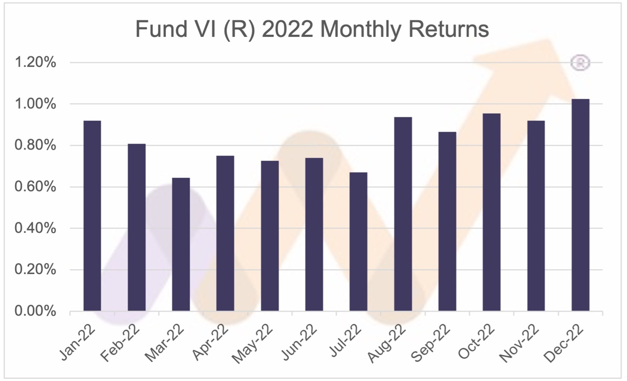

Access Pensions Fund VI – Non-Interest (Retiree) highlights:

- Income for the year was ₦176.24 million in 2022, upon the ₦34.25 in 2021.

- Fund size: Fund VI non-interest (Retiree) was ₦1.99 billion, up 72% from ₦1.16 billion in 2021.

- Fund performance: up 11.81% in 2022, compared to 4.06% in 2021.

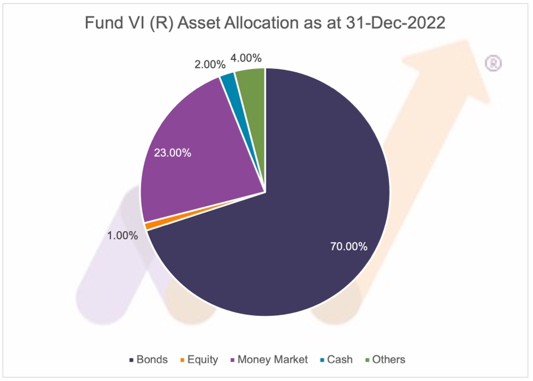

- Asset Allocation (31-12-2022): Fixed Income Instruments 70.00%, Equities 1.00%, Money Market instruments 23.00%, Cash 2.00%, Others 4.00%. 2021 comparison data unavailable.

- Performance ranking: The fund performance for 2021 was ranked 1 out of 5 in our 2022 Annual Report on Pensions.

Watch out for our 2023 report detailing all fund rankings for 2022 in the 2023 Money Counsellors Annual Report on Pensions (MCARP 2023). Download the 2022 report here.

This article was written by Michael Oyebola. For more information and analysis, visit moneycounsellors.com

Do you pay your retiree 50 percent of his total contribution after 60 years of age on retirement???

I’m glad that I’m seeing this on time