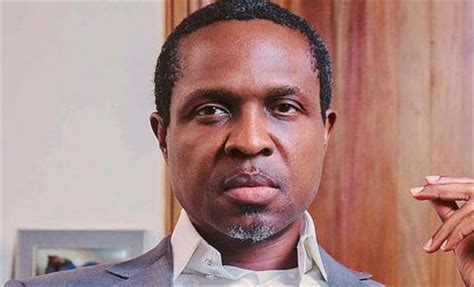

The governorship candidate in Rivers state under the All-Progressives Congress (APC) in the last general election, and former Group Executive Director of Sahara Group, Tonye Cole has said that operating the Kaduna, Warri, Port Harcourt, and Dangote refineries at full scale, will not reduce fuel pump prices in the country.

He said this during a Channels Television interview on Wednesday night.

According to him, each time, the refineries need to be maintained, some parts will be imported as Nigeria is a highly import-dependent country.

He said that foreign countries manufacture all the moving parts that are needed for refinery maintenance.

So, when Nigerian refineries need those parts to keep up with refining activities, the import of the parts will put more pressure on the dollar rate,

He said:

- “If we do not deal with productivity, nothing changes. We do not talk about productivity and that is what we need to talk about.

- “What is happening in our manufacturing sector, and how are we providing services that will keep our refineries going?

- “If Dangote has to rely on importation at the dollar price that we have today to make sure that his refinery continues to run, the price of fuel will not come down.”

Cole also highlighted the fact that although it is possible for fuel prices to reduce certain factors need to be in place first. One of which is to ensure that there is a productivity culture within Nigeria. He said:

- “It is important to ask the question: what is putting pressure on foreign exchange in Nigeria? The forex pressure is because we import almost everything in the country, including the things we can manufacture here.”

Cole advised the current government to go to existing manufacturing bases (in places like Kaduna, Kano, and Aba) and support those manufacturers so they can produce more materials for the country on a large-scale while being dependent on the Naira across the value chain.

He also said that the government should look at the areas where the country can earn foreign exchange without leaving Nigeria and boost that sector.

He pointed out the tech community, where young Nigerians are in Nigeria, and are earning foreign exchange from other countries.

State of Kaduna, Warri and Port Harcourt refineries

Nigeria’s state-owned refineries have been moribund for years, while Nigeria keeps importing petroleum products.

Some stakeholders have called for the sale of the refineries to the private sector if the country will increase its productivity.

During an interview with Arise TV last week, Momoh Oyarekhua, the Chairman of the Crude Oil Refineries Association of Nigeria (CORAN) said that government should not be in business but should play the role of regulation.

According to him, refineries around the world are mostly owned by the private sector while their government could own about 10% equity.

He said that privatizing the state-owned refineries if that should become an eventuality, is the way to go.

Recall that in June 2023, a report from the Federal House of Representatives revealed that the Nigerian National Petroleum Company Limited spent N4.8 trillion running state-owned refineries between 2010 and 2020.

Meanwhile, the output from the Port Harcourt, Warri, and Kaduna refineries had not exceeded 30% since 2010.

I do not agree with Mr. Cole completely, because if all monies that have been put to revamp the refineries all these year was sincerely and judiciously utilise, the refineries ought to be working optimally by now and for crying out loud these parts don’t break down everyday. Before they’ll need any replacement it will take at least three years that is enough time to bring prices down domestically irrespective of what is happening at the international market.

Secondly there is no way the three refineries working optimally can breakdown at the same time if government is sincere about the economy and the down stream oil sector, who said we can only export crude oil refined products can also be exported, infact we stand to gain more when we export refined petroleum products than the crude oil.

Until we stop playing politics with what we should not play politics with in Nigeria and get into the business of good governance and infrastructural development, Nigeria will continue to be a joke and a laughing stock among other Nations.

Thanks Mr Yemi Adeyi. The cost of freight on the raw crude oil to those foreign refineries and freight cost on petroleum back to Nigeria will definitely be removed from the cost structure per unit of product and it’s total cost. This represents savings which will lower the cost burden upon consuming Nigerians. Replacement costs of production parts affect all refineries whether local or foreign. The difference in replacement costs will only be in freight on replaced parts imported to local refineries and this is one-off which is a recoverable incremental cost. To produce locally will in doubt be cheaper by far compared to importations. There are other externalty economic factors in unemployment reduction and its attending advantages to engaging employeable Nigerians, lower possible unrests, stimulate production, drive upward consumption of locally produced goods and services, improve standard of living, enhanced a better GDP and ensure a stabilize economic environment.