Nigeria’s political season is almost upon us. Already, we know most of those who will be running for different political posts and those whose political ambitions have lost momentum prematurely. Now, while the focus is on the two major contenders in the race (i.e., incumbent President Muhammadu Buhari and former Vice President Atiku Abubakar), there are other aspirants who have caught our attention here at Nairametrics.

These are successful businessmen who have excelled in the boardroom and are now hoping to bring their corporate experiences to public service. We are talking about the likes of Tonye Cole, Abdullahi Sule, Chima Anyaso, etc.

For this week’s corporate personality profile on Nairametrics, we are focusing on the above-mentioned businessmen and others. Let us get to know more about their backgrounds and their chances of winning the positions which they are vying for.

Meet the candidates

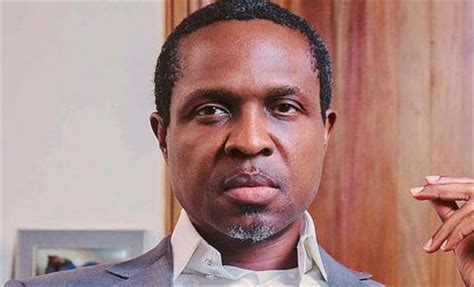

Chimaobi Desmond Anyaso: Dr Anyaso is a young Nigerian businessman, serial entrepreneur and an aspiring politician who has recently been selected by the People’s Democratic Party (PDP) to run for the House of Representatives. He wants to represent the people of Bende Federal Constituency in Abia State.

Though he is an Abia State indigene and was born there, he has lived most of his life in Lagos where he studied (at the University of Lagos) and currently works. He achieved most of his wealth and fame through his position as the Chief Executive Officer of Ceecon Energy Oil and Gas Limited, a company he founded and grew to success. He is also one of the youngest naira billionaires in Nigeria, thanks to the success of his many ventures, including his hotel business.

Since making his interest in politics known in late 2016, Dr Chima has been courting the political elite whilst romancing the grassroots all at once. He seems to understand how to navigate the dynamic Nigerian political terrain. However, his success at the polls come early 2019 will be dependent on his ability to defeat his opponents. Nairametrics believes that he stands a fair chance, all things being equal.

Tonye Cole: Mr. Cole is vying for the position of Rivers State Governor. But does he have what it takes defeat incumbent Governor Nyesom Wike? This is a question that has boggled our minds here at Nairametrics ever since news about his political ambition broke.

Without a doubt, Mr Tonye Cole is an accomplished businessman who has both the years of experience, a business concern, and an impressive net worth to show for it. He co-founded Sahara Group in 1996, an oil and gas company which has since grown to become one of the biggest companies in the country; with a diversified operation in more the thirty other countries.

Note that many people do believe that it is the same experience with which he ran Sahara Group as CEO that he will use to transform Rivers State if he gets the chance to win the 2019 gubernatorial election in the state. He is running on the platform of the ruling All Progressive Congress, APC.

Mr Cole was born in Port Harcourt, although he has lived in many places including the United Kingdom. He studied at the University of Lagos and has been involved in business since 1993.

He recently announced his resignation from the Board of Sahara Group to enable him to concentrate on electioneering campaign, as well as distance his political career from the business. We will be watching to see how he fares.

Akin Alabi: When Mr Akin Alabi founded Nigeria’s first online sports betting platform (Nairabet) in 2009, he probably had no plans to one day run for any political post in Nigeria. Even he, himself admitted that he was just focused on succeeding as a business, no thanks to having tried and failed several times prior in his entrepreneurial quest.

Now fast forward to 2018, Mr Alabi has been selected by his party, the All Progressive Congress (APC), to run for the House of Representatives. He will be representing his constituency, the Egbeda Ona-Ara Federal Constituency.

Mr Alabi was born in Ibadan, the Oyo State capital, where he lived throughout most of his childhood. He later studied at the Polytechnic Ibadan, before proceeding to the University of Liverpool where he obtained a master’s degree in Marketing. He is also an alumnus of Harvard University.

This past June, Akin Alabi stepped down as the Chief Executive Officer of Nairabet to enable him to concentrate on his political ambition. Last week, he announced via Twitter that all of his opponents during his party’s primaries stepped down for him to run as sole candidate; facing off with the main opponents come next year. However, it remains to be seen if he can defeat these opponents to emerge the winner.

Meanwhile, one thing is clear, and that is the fact that Mr Alabi is a successful businessman. He has managed to build one of the most successful Nigerian companies in less than a decade. Many are now hopeful that he will be able to bring the same experience (with which he has ran the company) to the Nigerian political scene.

Abdullahi Sule: Earlier this month, Mr Sule won the All Progressive Congress’ governorship primaries in Nasarawa State. He will be vying to become the State Governor come early 2019.

Mr Sule’s foray into politics took many people by surprise seeing as he, until recently, ran the affairs of Dangote Sugar Refineries as General Manager. Currently, it is unclear whether or not he has fully resigned from his position at Dangote Group in order for him to focus on his new-found political career.

Meanwhile, Abdullahi Sule is an accomplished business executive with years of professional experience to his credit. He is a graduate of the Indiana State University in the United States of America where he studied Mechanical Engineering (Bsc.) and Technology (Msc.) respectively.

He is expected to bear his many years of professional experience to bear towards transforming Nasarawa State come 2019. However, this is all but dependent on his ability to win the gubernatorial poll.

In the countdown to the general elections, Nairametrics will be observing these candidates and others who have not be included in this article due to editorial constraints. We wish them all the best, even as we anticipate positive representation from them in the nearest future.

How young are they? Can you help with their ages.