In its latest (July 2023) Critical Minerals Market Review, the International Energy Agency (IEA) made a case for the emergence of critical minerals taking centre stage in discussions around the global energy transition.

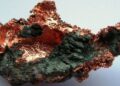

According to the IEA, the market size of key energy transition minerals such as copper, lithium, nickel, cobalt and graphite doubled, reaching $320 billion in 2022.

This contrasts with the relatively modest growth of bulk materials such as zinc and lead.

Due to these circumstances, energy transition minerals, which used to be a small segment of the market, are moving to centre stage in the mining and metals industry.

The IEA notes that the continuous increase in clean energy deployment in recent years has led to a significant rise in demand for critical minerals.

The IEA review also highlighted the fact that from 2017 to 2022, the demand for lithium tripled while nickel and cobalt demand increased by 40% and 70% respectively.

Mineral prices will determine the cost of clean energy tech

According to the IEA review cited, the prices of the critical minerals earlier mentioned will determine the cost of clean energy technologies like solar systems, wind turbines and electric vehicle (EV) batteries.

This will in turn determine if users can afford to switch to the use of clean energy.

This is especially true for consumers in developing countries. A part of the review stated:

- “The prices of wind turbines have risen consistently between 2020 and 2022, although they show some signs of easing in 2023. Prices of solar photovoltaic (PV) modules increased between 2020 and 2021 for the first time after a decade of declining prices.

- “They continued to rise in 2022, albeit at a slower pace, although 2023 could be the year of relief as silicon prices gradually start declining. Unlike solar and wind, price pressures did not arrive for batteries in 2021, but 2022 became the first year that prices for both storage and EV batteries saw an uptick, reversing a decade of falling costs that had resulted from technology innovation and economies of scale.”

Diversifying supply to increase energy security

According to the IEA review, there is a need to secure more critical minerals supply, this is because the bulk of production is in China and as demand for clean energy tech grows, the world needs more diversified supplies.

The IEA notes that in response to the projected increase in demand for critical minerals, policymakers, particularly those in resource-rich countries, are reassessing their legal frameworks for mining.

The IEA pointed out that many countries are striving to capture more value from the extraction of their natural resources.

Meanwhile, export restrictions on critical raw materials have seen a fivefold increase since 2009.

Also, countries that rely on imports are also reviewing the competitiveness of their mining policies to enhance their self-sufficiency in critical minerals while upholding environmental safeguards.

The Nigerian context

During the Muhammadu Buhari regime, Nigeria unveiled the National Geodata Center (NGC), located at the Nigerian Geological Survey Agency (NGSA) with an arm at the National Steel Raw Material Exploration Agency (NSRMEA).

The NGC is expected to enhance the ease of online access to appropriate (reliable and up-to-date) geological reports and data about mineral reserves and/or deposits in the country.

The facility was developed to boost investment decisions, research, and the overall ease of doing mining business in the country.

Also, the Nigeria Mineral Value Chain Regulations of 2021 was introduced by the Buhari administration in July 2021.

The regulation is primarily aimed at boosting the country’s revenue through the local development (processing and refining) of raw materials into refined products before export, adding value to the local economy and demanding better pricing of the output by foreign off-takers.

It is also important to note that China’s Ming Xin Mineral Separation Nigeria Limited. (MXMS) was selected by the Buhari administration to build the country’s first lithium processing plant in Kaduna State.

.gif)