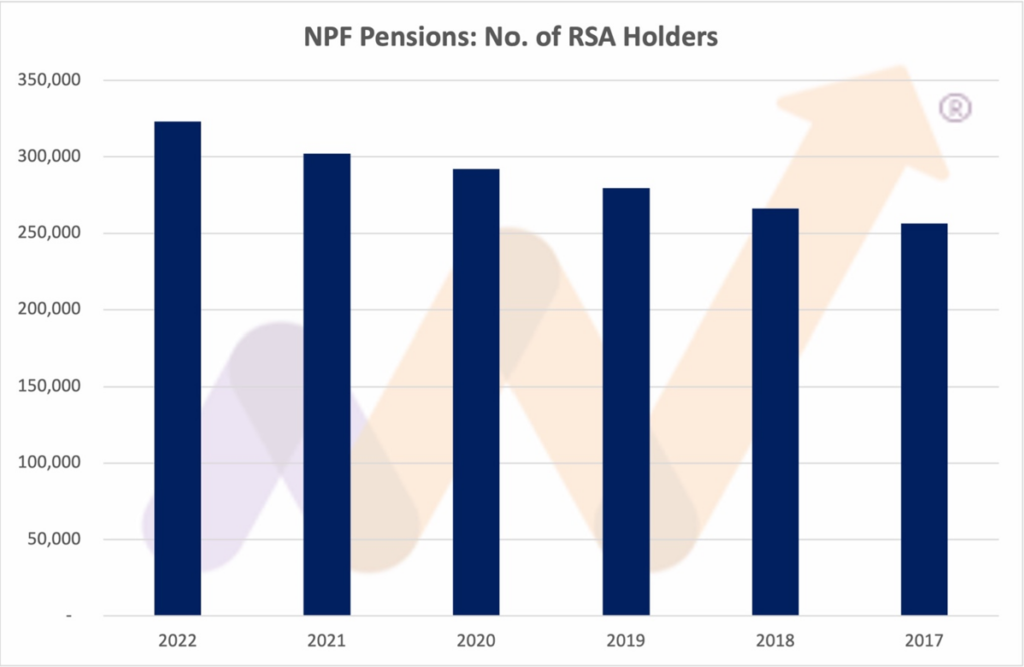

- NPF Pensions’ RSA holders increased from 20,852 holders 2021 to a total of 323,096 RSA holders by the end of 2022.

- The audited assets under management for NPF Pensions’ Retirement Savings Accounts (RSAs) grew by 18.08% in 2022, totaling N827.60 billion, compared to N700.91 billion in 2021.

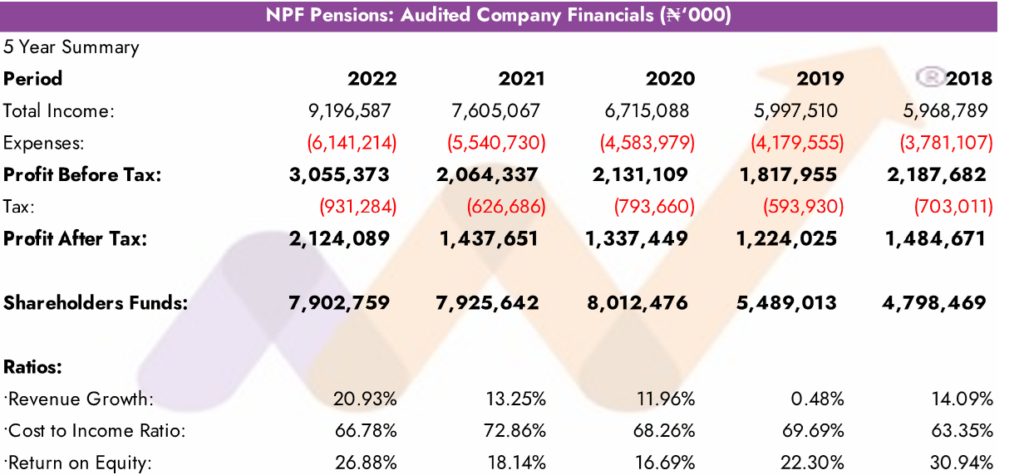

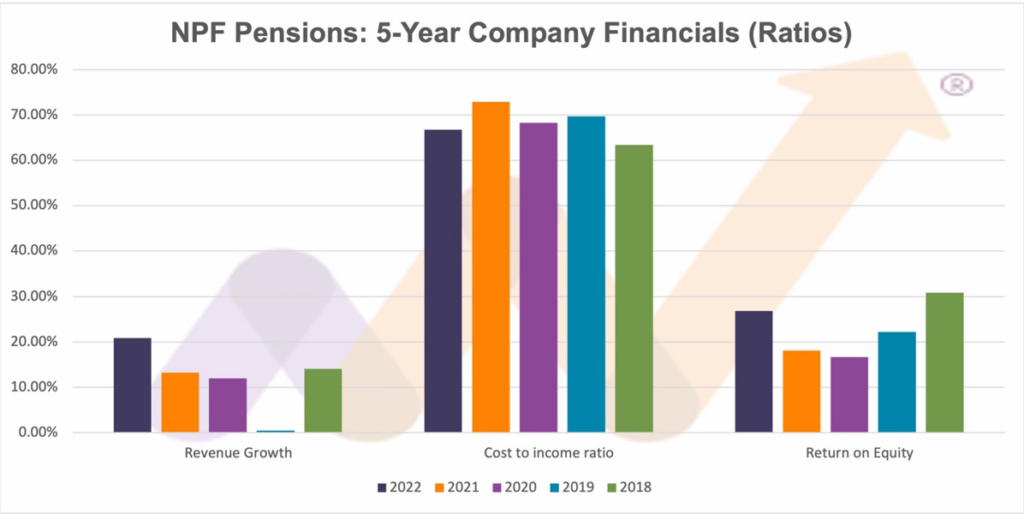

- NPF Pensions achieved positive financial performance in 2022, with total income increasing by 20.93% to nearly N9.20 billion, and a 47.75% rise in Profit After Tax (PAT) to N2.12 billion. The company’s cost-to-income ratio decreased to 66.78% from 72.86% in 2021.

Assets under management for the 4 audited Retirement Savings Accounts (RSAs) closed the year at N827.60 billion, up 18.08% from N700.91 billion in 2021.

Performance Analysis: Company

For the year ended December 31, 2022, total income grew by 20.93% to just shy of N9.20 billion, compared to N7.61 billion in 2021. The cost of managing the business rose by 10.84%, leading to a cost-to-income ratio of 66.78%, down from 72.86% in 2021. The five-year average ratio stands at 68.19%.

Profit After Tax (PAT) for 2022 increased by 47.75% to N2.12 billion, compared to N1.44 billion in 2021, whilst shareholders’ funds closed the year at N7.90 billion, down slightly from N7.93 billion in 2021.

Performance Highlights: RSA Funds (audited)

Performance Highlights: RSA Funds (audited)

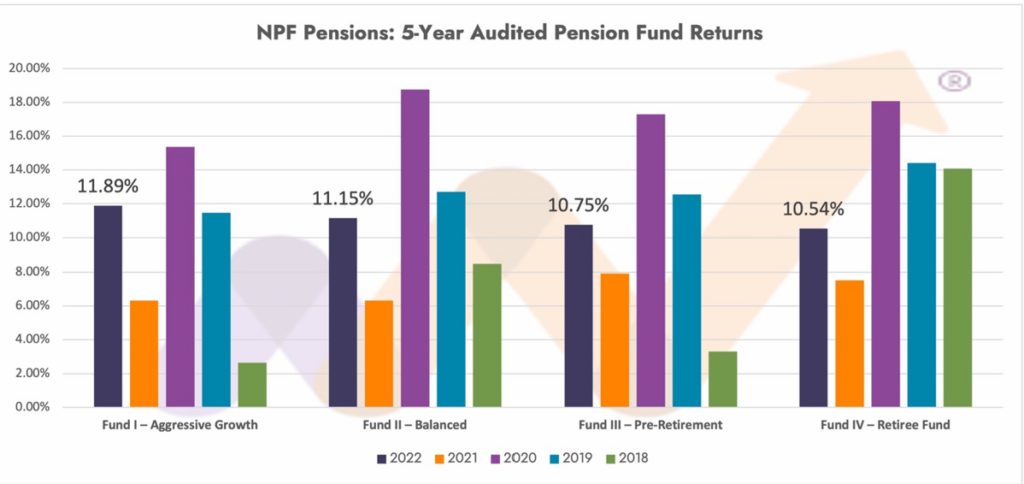

For the year ended 31 December 2022 the NPF Pensions Fund I appreciated by 11.89%, Fund II appreciated by 11.15%, Fund III by 10.75%, Fund IV by 10.54%, NPF Pensions currently only offers Funds I – IV to its closed membership of RSA holders.

Returns benchmarks are yet to be established for pension funds but for indirect comparisons it is worth noting that for the year 2022 the stock market appreciated by 19.98%, the NGX Pension index appreciated by 16.96%, inflation was 21.47% and MPR closed the year at 16.50%, having risen steadily through the year.

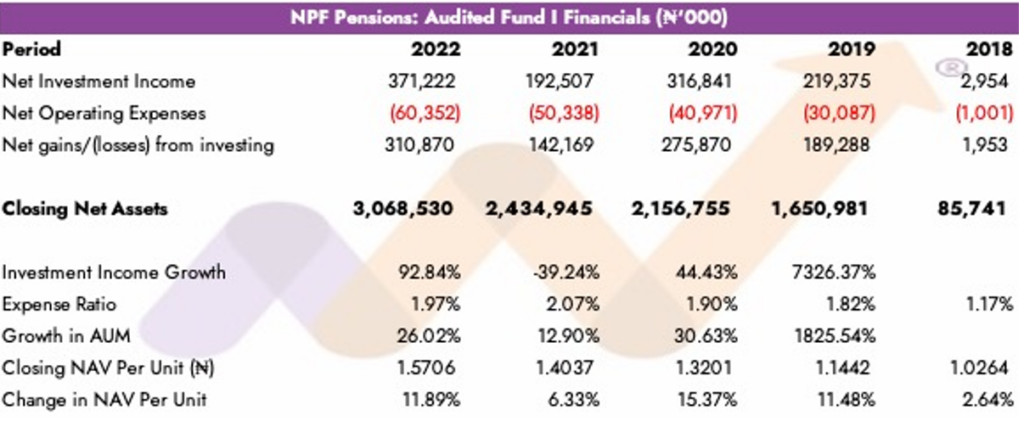

NPF Pensions Fund I highlights:

NPF Pensions Fund I highlights:

- Fund performance: up 11.89% in 2022, higher than the 6.33% in 2021 but lower than the 15.37% in 2020. The fund’s four-year average is 11.27%. The fund was launched on 14 September 2018 and had a partial year.

- Fund income: N22 million in 2022, up 92.84% from N192.51 million in 2021.

- Net gains from investing activities: N87 million in 2022, a 118.66% increase over 2021.

- Fund size: the size of the fund, measured by net assets, grew 26.02% from N43 billion to N3.07 billion.

- Expense ratio: 1.97% in 2022, down from 2.07%.

- Performance Ranking: 10 out of 19 in 2021.

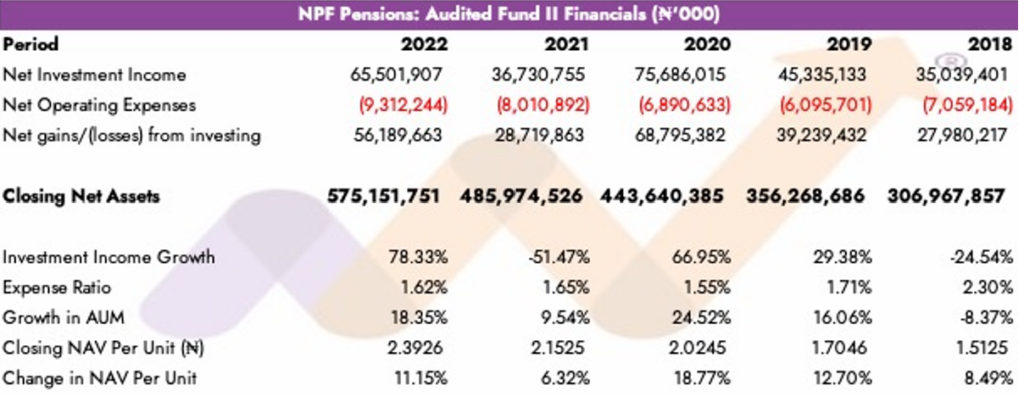

NPF Pensions Fund II highlights:

NPF Pensions Fund II highlights:

- Fund performance: up 11.15% in 2022, compared to 6.32% in 2021. The fund’s 5-year average is 11.49%.

- Fund income: N50 billion in 2022, up 78.33% from N36.73 billion in 2021.

- Net gains from investing activities: N19 billion in 2022, up from N28.72 billion in 2021.

- Fund size: Fund II grew 18.35% to N15 billion from N485.97 billion in 2021.

- Expense ratio: 1.62% in 2022, down slightly from 1.65% in 2021.

- Performance Ranking: 11 out of 19 in 2021. The ranking for 2022 will be revealed later.

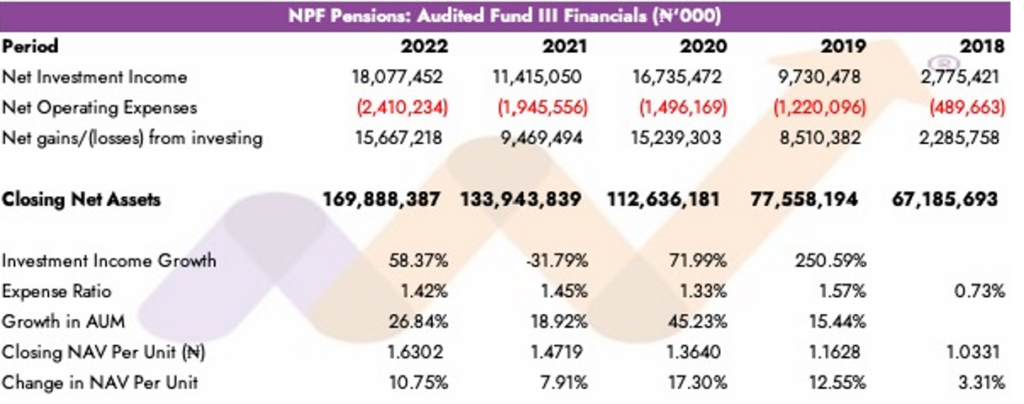

NPF Pensions Fund III highlights:

NPF Pensions Fund III highlights:

- Fund performance: up 10.75% in 2022, compared to 7.91% in 2021. The fund’s four-year average is 12.13%. The fund was launched on 16 August 2018 and had a partial year.

- Fund income: N08 billion in 2022, up 58.37% from N11.42 billion in 2021.

- Net gains from investing activities: N67 billion in 2022, up 65.45% from N9.47 billion in 2021.

- Fund size: Fund III grew 26.84% to N89 billion from N133.94 billion in 2021.

- Expense ratio: 1.42% in 2022, down slightly on 2021 which was 1.45%.

- Performance Ranking: 11 out of 19 in 2021.

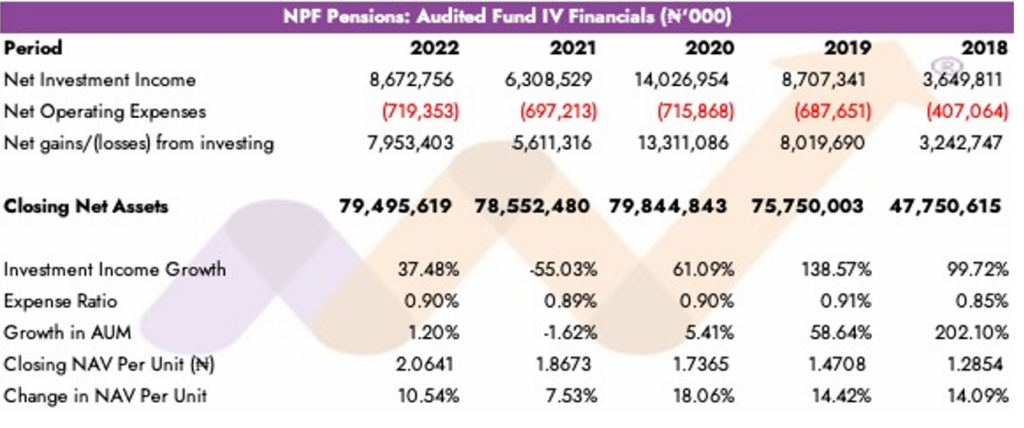

NPF Pensions Fund IV highlights:

NPF Pensions Fund IV highlights:

- Fund performance: up 10.54% in 2022, compared to 7.91% in 2021. The fund’s 5-year average is 12.93%.

- Fund income: N67 billion in 2022, up 37.48% from N6.31 billion in 2021.

- Net gains from investing activities: N95 billion in 2022, up from N5.61 billion.

- Fund size: Fund IV grew 1.20% to N50 billion from N78.55 billion in 2021.

- Expense ratio: 0.90% in 2022, up slightly from 0.89% in 2021.

- Performance Ranking: 12 out of 19 in 2021.

Please note that all fund rankings for 2022 will be included in the 2023 Money Counsellors Annual Report on Pensions. Download the 2022 report here.

Please note that all fund rankings for 2022 will be included in the 2023 Money Counsellors Annual Report on Pensions. Download the 2022 report here.

What you should know

NPF Pensions, though part of the Contributory Pension Scheme (CPS), is a stand-alone Pension Fund Administrator (PFA) that caters only to the unique needs of the members of the Nigerian Police Force, managing and administering their pension and other welfare issues.

NPF Pensions Limited was incorporated on 21st October 2013 and is a Pension Fund Administrator (PFA) licensed under the provisions of the Pension Reform Act 2014.

By Michael Oyebola

For more information and analysis, visit moneycounsellors.com

Am a police officer this news is a scam to divert the attention of the masses simply because of the present past bill efforts are made by the administrators to justify the continuation the contributory pension scheme in light of the bill, the public are now being manipulated to believe that the scheme is a progressive one, where as is the opposite, refund the officers dear money and let them have peace for God’s sake.