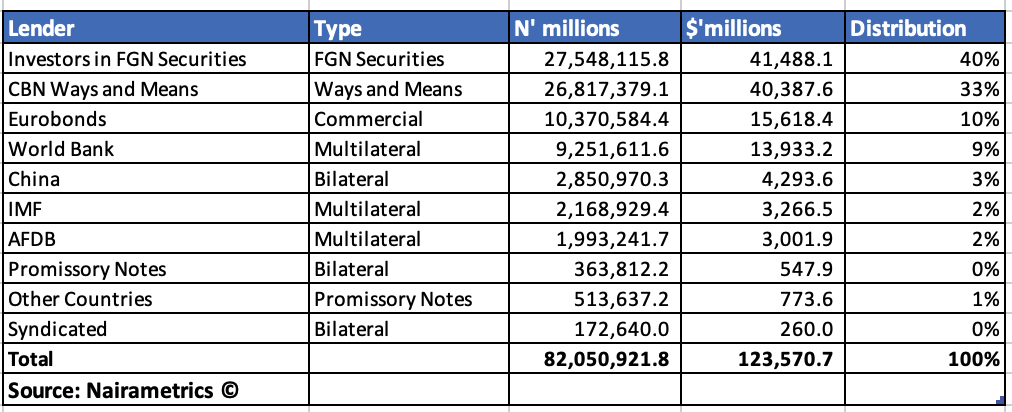

- Nigeria’s public debt increased from N73 trillion to N82 trillion after the unification of the naira.

- The central bank of Nigeria issued a press release announcing operational changes to the foreign exchange market, including the unification of multiple exchange rates.

- The conversion of the public debt from dollars to naira led to an increase in the total debt, with the naira portion rising to N54.3 trillion and the dollar portion decreasing. However, the actual debt obligations remain in foreign currency.

Nigeria’s total public debt rose by fiat to N82 trillion following the unification of the naira. It was N73 trillion before the unification.

The central bank of Nigeria issued a press release titled Operational Changes to the Foreign Exchange Market, signaling a unification of the multiple exchange rates.

This is in line with the instruction of the president, Bola Ahmed Tinubu who first announced this as a policy change in his inauguration broadcast.

However, the implementation of the scheme which saw the exchange rate first depreciate to N662/$1 attracts several consequences for the economy one of which includes the automatic increase of the public debt.

Source: Nairametrics

Impact on Public Debt

Before now, the nation’s public debt was quoted at N448.50/$1 by the Debt Management Office as the official exchange rate but this has now been depreciated to N662/$1.

- This means the total public debt increases from an estimated N79 trillion to N82 trillion.

- The increase is due to the conversion of the dollar portion of the debt which is estimated at about $41.6 billion. When adjusted for the most recent exchange rate it converts to N27.6 trillion.

- The naira portion of Nigeria’s public debt is about N54.3 trillion and it includes Ways and Means which Nairametrics estimates at about N26.8 trillion.

But while the naira portion of the loan increases the dollar value drops.

Other considerations

It is important to note that the actual obligations of the public debt do not change as Nigeria still needs to pay the debt of $41.6 billion in foreign currency and not in naira.

Thus the conversion is purely for the purposes of reporting.

While the public debt is expected to increase when converted, the government’s revenue profile is also likely to rise.

- All the government’s revenue from the sale of crude oil, and taxes (converted in USD) will all increase by fiat, meaning more money for the government.

Why Public debt is in naira and dollars

Public debt refers to the total amount of money that a government owes to domestic and foreign creditors.

- It represents the cumulative borrowing by the government to finance its budget deficits and cover expenditures beyond its tax revenues.

- Public debt plays a crucial role in funding government operations, stimulating economic growth, and addressing fiscal challenges.

- It can be used to finance infrastructure projects, social programs, and other government initiatives.

- Public debt is typically denominated in both the domestic currency (in this case, naira) and foreign currency (usually dollars), reflecting the sources from which the government borrows.

Why multiple currencies? The use of multiple currencies in denominating public debt serves specific purposes.

- First, denoting debt in the domestic currency (naira) means the government must have borrowed some of the loans in naira.

- This allows the government to have more control over the debt repayment process. It means that the government can make repayments using its own currency, which it can print or control the supply of. T

- his provides a degree of flexibility and reduces the risk of default due to foreign exchange fluctuations.

On the other hand, denominating public debt in foreign currency (such as dollars) provides access to international capital markets and a broader investor base.

- It allows the government to tap into global funding sources and potentially secure more favorable borrowing terms.

- Foreign currency-denominated debt can be attractive to investors seeking diversification and stability, as it is less influenced by domestic economic conditions.

- However, it also exposes the government to exchange rate risks.

- If the domestic currency depreciates significantly against the foreign currency, the burden of debt repayment in local currency terms can become more challenging.

The mix of naira and dollar-denominated public debt reflects the government’s need for a balanced approach that considers both domestic and international borrowing conditions.

This article seems to lack accuracy in its assessment. Sovereigns typically employ various financial instruments such as currency swaps and forwards to mitigate the foreign exchange risk associated with their external debt. These instruments help lock in the effective conversion rate of their debt and protect it from repricing due to currency devaluation, which the article seems to wrongly suggest.

To make a valid assessment of Nigeria’s foreign debt, it is necessary to obtain additional information from the Debt Management Office regarding the actual management practices employed. Without such information, it is inappropriate to assert or report that Nigeria’s foreign debt has increased in tandem with the devaluation of its currency.

This article seems to lack accuracy. Sovereigns typically employ various financial instruments such as currency swaps and forwards to mitigate the foreign exchange risk associated with their external debt. These instruments help lock in the effective conversion rate of their debt and protect it from repricing due to currency devaluation, which the article seems to wrongly suggest.

To make a valid assessment of Nigeria’s foreign debt, it is necessary to obtain additional information from the Debt Management Office regarding the actual management practices employed. Without such information, it is inappropriate to assert or report that Nigeria’s foreign debt has increased in tandem with the devaluation of its currency.