Article Summary

- Acorn Student Accommodation I-REIT (ASA I-REIT) recorded a 30.3% increase in profits, reaching Kshs 504.9 million in FY 2022, compared to Kshs 387.5 million in FY 2021. This growth was driven by a rise in total operating income, primarily from rental income.

- Acorn Student Accommodation D-REIT (ASA D-REIT) experienced a 50.5% decline in profits, decreasing to Kshs 384.2 million in FY 2022 from Kshs 775.9 million in FY 2021. This decline was due to increased expenses and a decrease in the fair value of investment properties.

- Rental income for both ASA I-REIT and ASA D-REIT showed significant improvement. ASA I-REIT’s rental income increased by 32.3%, while ASA D-REIT’s rental income grew by 427.1%. The completion and launch of the Qwetu Hurlingham project contributed to the increase in ASA D-REIT’s rental income.

In March 2023, Acorn Holdings released its FY:2022 results for Acorn Student Accommodation I-REIT (ASA I-REIT) and Acorn Student Accommodation D-REIT (ASA D-REIT).

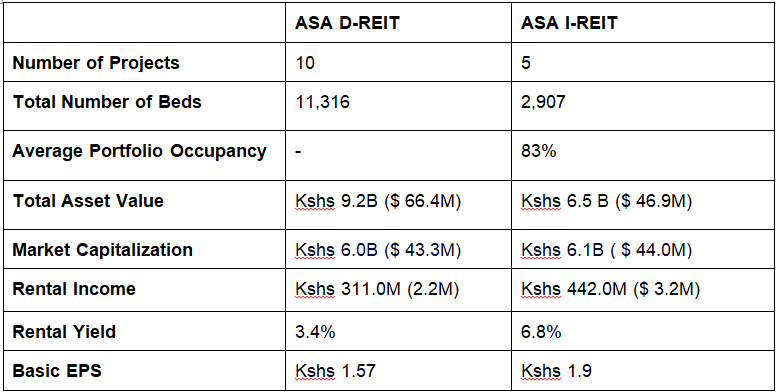

The ASA D-REIT is the investment vehicle for developing projects. Once the assets have achieved stable occupancy, they are sold to the ASA I-REIT which is the investment vehicle for holding the income-generating rental units on a long-term basis. The profits earned from the sales are channelled to new developments and dividends. We have included a few highlights from their last financial year below.

2022 Highlights:

- January 2022: Acorn Holdings through its D-REIT completed and officially launched the Qwetu Hurlingham project in Kilimani.

- February 2022: Acorn Holdings partnered with the University of Nairobi (UoN) in a bid to develop a 2,800-bed capacity hostel worth Kshs 2.5B ($14.4M), at the UoN Chiromo Campus.

- March 2022: Acorn Holdings released its FY:2021 Results, highlighting that Acorn D-REIT recorded profits of Kshs 775.9 mn in FY:2021 while the I-REIT profits came in at Kshs 387.5 mn.

- June 2022: Acorn’s Kshs 5.7B green bond floated in 2020, was voted as the most innovative bond in the Europe, Middle East, and Africa (EMEA) Finance 2021 Awards.

- November 2022: Acorn Holdings received Kshs 1.8B ($13.2M) from the sale of Qwetu Aberdare Heights I hostel located in Ruaraka, thereby settling part of its Kshs 800.2M ($5.8M) debt to investors.

According to the FY:2022 results, the I-REIT recorded a 30.3% increase in profits to Kshs 504.9M ($3.6M), from Kshs 387.5M ($2.8M) in FY:2021. This was a result of a 4.7% increase in the total operating income (majorly from rental income) to Kshs 463.0M ($3.3M), from Kshs 433,699M ($3.2M) realized in FY 2021.

The D-REIT on the other hand realized a 50.5% decline in its profits to Kshs 384.2M ($2.8M), from Kshs 775.9M ($5.6M) recorded in FY:2021. The decline was mainly driven by a 76.9% increase in the total expenses (majorly from finance costs) to Kshs 669.9M ($4.8M), coupled with a 34.3% decline in fair value of investment properties to Kshs 701.6M ($5.1M), from Kshs 1.1B ($7.9M) recorded in FY:2021.

Source: Acorn Holdings

Source: Acorn Holdings

Notably, rental income for both the ASA I-REIT and ASA D-REIT improved by 32.3% and 427.1%, to Kshs 442.0M ($3.2M) and Kshs 311.0M ($2.3M), respectively, from Kshs 334.0M ($2.4M) and Kshs 59.0M ($0.5M) recorded in FY:2021. The D-REIT’s major increase was mainly driven by the completion and official launch of the Qwetu Hurlingham project in January 2022, thereby boosting the rental income. Notably, the project is still being held under the D-REIT.

Breakdown of ASA I-REIT Portfolio:

Source: Acorn Holdings

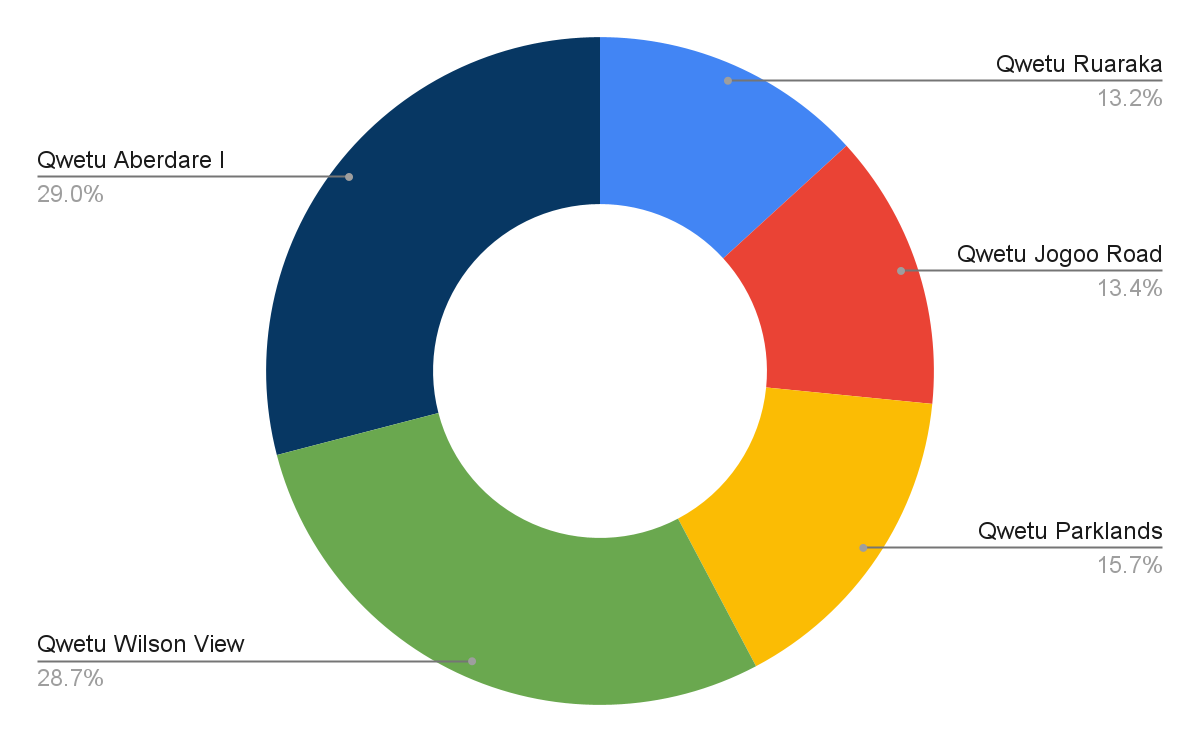

Breakdown of ASA I-REIT Portfolio By Value:

Source: Acorn Holdings

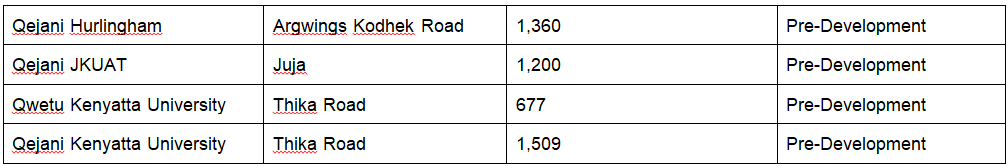

- Breakdown of ASA D-REIT Portfolio:

Source: Acorn Holdings

Breakdown of ASA D-REIT Portfolio By Value:

Source: Acorn Holdings

Moving forward, we anticipate that the ASA REIT will continue making significant improvements in its activities and performance owing to the attractiveness of the student accommodation sector, which in turn drives return on investments.

We love your feedback! Let us know what you think about ASA REIT’s performance, trends, and expectations, by sending an email to insights@estateintel.com.

Subscribe to ei Pro to access affordable real estate data such as; sales rates, yields, supply drivers, and information on key real estate market participants who are active in the market.

Author: Linah Amondi