Article Summary

- Ten banks paid N227.3 billion to AMCON as sector resolution cost in 2022.

- The aggregate assets of the banks increased by 23.7% to N60.69 trillion as of the end of 2022.

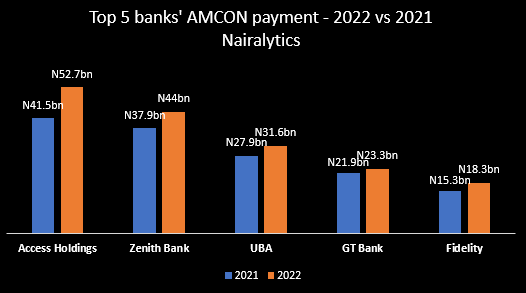

- Access, Zenith Bank, and UBA recorded the highest AMCON expenses in 2022.

- The listed banks incurred N109.6 billion as deposit insurance premiums, bringing the total regulatory cost to N333.6 billion in 2022.

Ten publicly listed commercial banks in Nigeria incurred N227.3 billion in banking sector resolution costs to the Asset Management Corporation of Nigeria (AMCON) in 2022.

Compared to the previous year (N192.14 billion), the AMCON expense by the banks increased by 18.3% year over year. This is according to data extracted from the audited reports of the banks by Nairalytics.

The increase in AMCON banking sector resolution cost is following a 23.7% increase in the total assets of the banks. Findings by Nairametrics revealed that the total assets of the ten banks increased from N49.1 trillion recorded as of December 2021 to N60.7 trillion in 2022, representing an increase of N11.62 trillion in one year.

A breakdown of the data as compiled by Nairalytics showed that Access Bank incurred the highest amount of N52.73 billion, while Wema Bank recorded the least with N6.47 billion. It is worth noting that First Bank and Unity Bank were not included in the list of banks, as the groups are yet to release their audited results for the year.

Other banks that were not included in this article are Ecobank and Jaiz Bank. Both banks did not report their regulatory expenses.

Why banks pay AMCON fees

AMCON was established in 2010 in a bid to stabilize the Nigerian banking system by efficiently resolving the non-performing loan assets of the banks in the economy.

- Currently, it is being funded by a combination of loan recoveries, contributions from the Central Bank of Nigeria (CBN), sales of pledged assets, and a sinking fund assessed to the banks.

- The federal government established AMCON with a 10-year mandate in response to the mounting bad loans and the requirement to prevent the banking sector’s impending collapse. The AMCON Act 2019 (Amended) gives the corporation broader authority to pursue obligors for unpaid debts.

- Additionally, helping eligible financial institutions efficiently dispose of eligible bank assets in compliance with the Act’s rules is one of the key objectives of the Act.

- Initially, banks were required to pay 0.3% of all assets into the sinking fund. In 2013 it was raised to 0.5% of total assets (and 0.3% of contingent liabilities).

Deposit insurance premiums gulped N109.6 billion

The listed ten banks also incurred a sum of N109.6 billion as deposit insurance premiums paid to the Nigeria Deposit Insurance Corporation (NDIC), bringing the total regulatory cost of the banks to a whopping sum of N336.9 billion for the year.

- This is slightly lower than the N355.61 billion paid to shareholders as total dividends for the year.

- This implies that bank profit and eventual value for shareholders could have been higher without the regulatory costs to AMCON and the NDIC.

- The banks posted an aggregated post-tax profit of N935.9 billion in the review year, which is 9.5% higher than the N854.9 billion recorded in the previous year.

Breakdown of banks’ AMCON payments in 2022

- Access Bank – N52.73 billion

Access Bank incurred N52.73 billion on AMCON expenses in 2022, representing a 27% increase when compared to N41.51 trillion recorded in the previous year. This is following the significant increase in the asset value of the newly restructured bank, which grew on the back of multiple mergers and acquisitions.

As of December 2022, Access Bank recorded a total asset value of N14.99 trillion, which is 27.8% higher than the N11.73 trillion recorded in the same period of the prior year. At almost N15 trillion, Access Bank is the largest financial institution in the country based on total assets.

- Zenith Bank – N44.01 billion

Zenith Bank recorded N44.01 billion as sector resolution cost for the year ended 2022, 16.1% higher than the N37.92 billion incurred in the previous year. Zenith Bank, which is also the second-largest bank by asset value and the most capitalized bank in the equities market saw its total asset grow by 30%.

The total assets of Zenith Bank increased from N9.45 trillion recorded as of the end of December 2021 to N12.29 trillion in 2022, owing to an increase in loans and advances to customers, which had increased by 19.6% year-on-year to N4.01 trillion in the same period.

- UBA – N31.59 billion

United Bank for Africa incurred N31.59 billion on AMCON fees in 2022, surpassing the N27.98 billion recorded in the previous year by 12.9%. UBA accounted for 13.9% of the total AMCON expenses by the ten banks.

Similarly, the total assets of the Pan-African bank increased by 27.1% from N8.54 trillion as of the end of 2021 to N10.86 trillion as of December 2022.

Others include:

- GT Bank – N23.29 billion (+6.4% year-on-year)

- Fidelity Bank – N18.29 billion (+19.1% year-on-year)

- Stanbic IBTC – N14.6 billion (+13% year-on-year)

- Union Bank – N14.33 billion (+24.9% year-on-year)

- FCMB – N12.84 billion (+21.9% year-on-year)

- Sterling Bank – N9.17 billion (+25.9% year-on-year)

- Wema Bank – N6.47 billion (+22.3% year-on-year)