Article Summary

- Fitch Solutions said protests are likely in the short term, particularly in urban areas like Lagos, following the swearing-in of Bola Ahmed Tinubu.

- Much will depend on how Peter Obi and other opposition figures react over the coming days.

- In the meantime, Nigeria’s social stability score has been lowered, indicating higher risk.

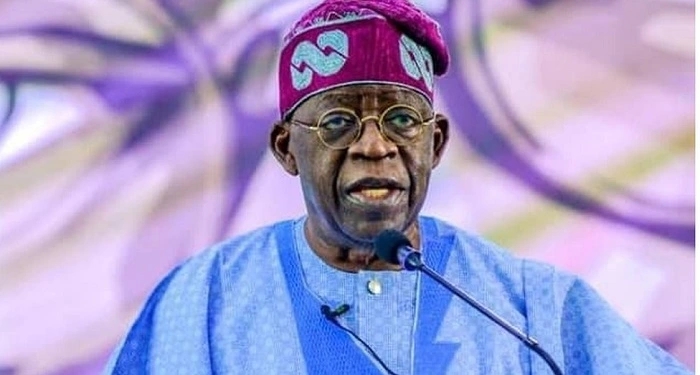

Fitch Solutions has projected likely short-term protests in Lagos and other urban areas across Nigeria if President-elect Bola Ahmed Tinubu is sworn in as president.

The global ratings and advisory agency disclosed this in its Africa Monitor Report, a copy of which was obtained by Nairametrics.

The report warned that the potential political risks in Nigeria could be due to reduced trust in the electoral system and a lack of widespread political support for Tinubu. Part of the report said:

- “We expect that protests are likely over the sort-term, particularly in urban areas such as Lagos. The LP drew significant support from members of the #EndSars protest movement, which launched a series of protests in the commercial capital in 2020.

- “Given that several pre-election polls showed the LP’s candidate winning the vote, we expect that the party’s youthful supporters are likely to be dissatisfied with the result.”

The opposition’s reaction will set the pace

The report added that much will depend on how Peter Obi and other opposition figures react over the coming days.

In the meantime, Fitch Solutions said it has lowered Nigeria’s social stability score to 17.5 out of 100 from the previous score of 25.0.

- “Taking this into account, we have lowered Nigeria’s ‘social stability’ score in our proprietary Short-Term Political Risk Index (STPRI) to 17.5 out of 100 from 25.0 previously (a lower score implies higher risk). This brings Nigeria’s overall STPRI from 42.1 to 40.2,” the report explained.

Can Tinubu stem Nigeria’s high inflation problem?

The Fitch report also noted that given Tinubu’s weak political mandate and widespread opposition to his government, they doubt that the incoming administration will launch any serious economic reforms in 2023.

- “High inflation – we forecast that inflation will average 18.0% in 2023 – and Tinubu’s weak political mandate will discourage Tinubu from implementing strong economic reforms in the short term.

- “The liberalisation of Nigeria’s exchange rate regime and the removal of the fuel subsidy would put upside pressure on inflation and would likely lower the president’s already weak support base, something we believe Tinubu will seek to avoid. Given divisions within the legislature, widespread political opposition, and concerns about the president-elect’s health, we expect a long period of political stasis.”

Energy and oil production

Fitch Solutions added that it expects that fuel shortages, disruptions surrounding the election in February 2023, and weakness in the oil sector will cause headline growth in Nigeria to slow from 3.1% in 2022 to just 2.3% in 2023.

- “We think that growth will accelerate markedly in 2024 and 2025 as increased offshore oil production provides a brief boost to the country’s key export industry.

- “Risks to this forecast are elevated given uncertainties surrounding the conduct and result of the country’s 2023 presidential election.”

What you should know

There have not been any widespread protests since the general elections were concluded. This has mainly been due to the fact that the Labour Party’s Peter Obi has repeatedly called for peace. He has assured his supporters that he would challenge the alleged electoral fraud in court.

The Courts, however, recently rejected a proposal by the Labour Party to live-broadcast the tribunal’s judgments.