Article Summary

- The acquisition of 9.5 million shares represents 0.03% of the company’s total outstanding shares of the company.

- With the acquisition, Alawuba has increased its number of shares from 1,593,248 units of shares as of December 31, 2022, to N11,093,248 units.

- UBA closed its last trading day (Thursday, May 18, 2023) at N8.45 per share on the Nigerian Stock Exchange (NGX), recording a 1.7% drop from its previous closing price of N8.60.

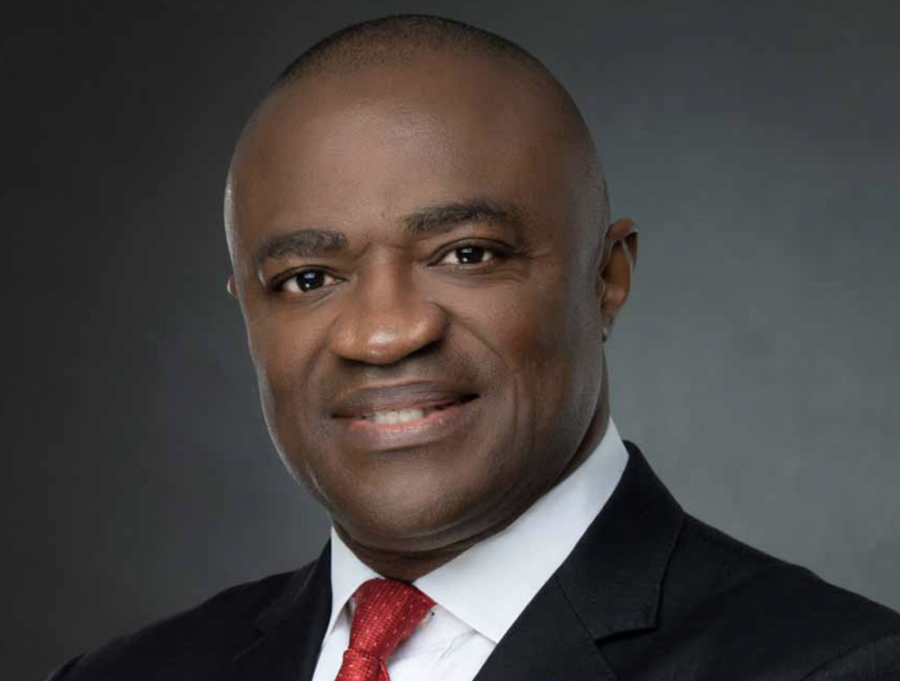

Group Managing Director of UBA Plc, Mr. Oliver Alawuba has acquired an additional 9.5 million shares worth N80.37 million in the company.

This is contained in a notice of share dealing by an insider to the Nigerian Exchange Limited obtained by Nairametrics, as the acquisition of 9.5 million shares represents 0.03% of the company’s total outstanding shares of the company.

With the acquisition, Alawuba has increased its number of shares from 1,593,248 units of shares as of December 31, 2022, to N11,093,248 units.

The notice signed by Bili A. Odum, Group Company Secretary/Legal Counsel indicated that Alawuba on May 16th, 2023, purchased 9,500,000 units of UBA shares at an average price of N8.46 per share valued at N80.37 million.

UBA closed its last trading day (Thursday, May 18, 2023) at N8.45 per share on the Nigerian Stock Exchange (NGX), recording a 1.7% drop from its previous closing price of N8.60. United Bank for Africa began the year with a share price of N7.60 and has since gained 11.2% on the price valuation.

What you should know

The 2022 financials, filed by the bank on the floor of the Nigerian Exchange Limited (NGX), showed that despite the highly challenging global economic and business environment, UBA recorded a laudable profit before tax, with a 31.2% growth, to close the year under review at N200.8 billion, rising from the N153.01 billion recorded at the end of the 2021 financial year.

Its profit after tax (PAT) grew by 43.5% to N170.2 billion in 2022, compared to N118.7 billion recorded the year before. Consequently, UBA Group Shareholders’ Funds rose to N922.1 billion, as of December 2022, achieving an impressive growth of 14.6% compared to the prior year.

The results showed that the bank’s gross earnings rose significantly to N853.2 billion, from N660.2 billion recorded at the end of the 2021 financial year, representing a strong 29.2% growth.

Total assets rose remarkably by 27.2%, crossing the N10 trillion mark, to close at N10.9 trillion in December 2022, up from N8.5 trillion in 2021.

According to the statement, this was a significant achievement and milestone in the history of the powerhouse financial institution.

In the year under consideration, UBA Group’s cost-to-income ratio dropped to 59.2%, from over 60% in the prior year, pointing to the Group’s improving efficiency.