Key highlights

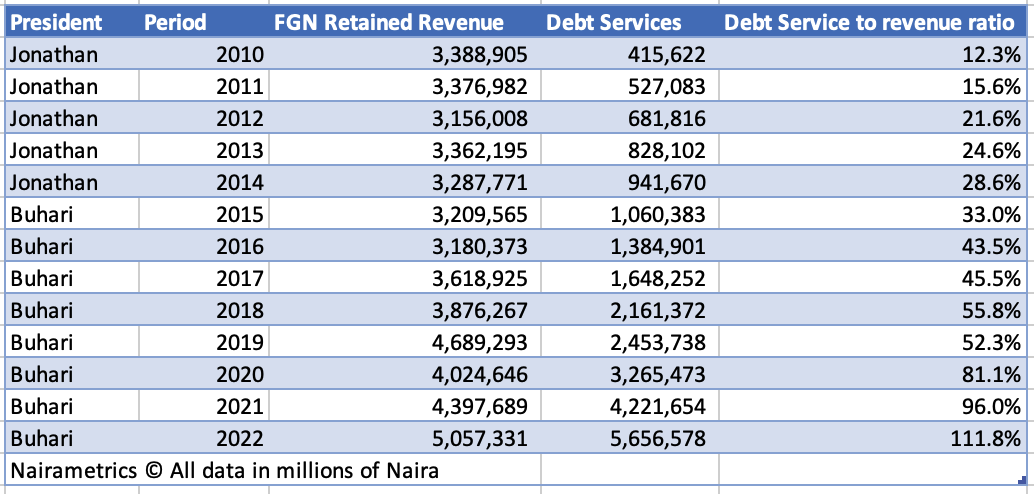

- The federal government’s debt service to revenue ratio reached a concerning 111.8% in 2022, as revealed by the Central Bank of Nigeria’s data.

- Under President Buhari’s administration, the ratio has steadily increased since 2015, with the figure reaching 33% that year and culminating in 111.8% in 2022.

- Nigeria’s rising debt burden, coupled with the escalating debt service to revenue ratio, indicates poor financial planning and management, severely limiting the government’s ability to invest in critical sectors and posing long-term implications for the country’s economic stability.

The latest data from the Central Bank of Nigeria reveal the federal government’s debt service to revenue ratio rose to 111.8% in 2022.

This is according to the CBN’s 2022 statistical survey data where most of the country’s fiscal and monetary-based data is reported. The CBN updates the data quarterly. Scroll to the end of the article to see the data used.

The debt service to revenue ratio looks at the ability of a country’s revenue to cover its debt service obligations.

According to the information contained in the data seen by Nairametrics, the government spent N5.65 trillion on debt servicing while only earning about N5 trillion in 2022. This is the highest debt service to revenue ratio recorded in Nigeria’s recent history topping the 96% recorded in 2021.

The high level of debt service to revenue ratio raises serious concerns about the financial management of the current administration led by President Buhari.

CBN data vs Budget Office data

A Nairametrics article published in January indicated the debt service to revenue ratio was 80.7% according to the information contained in the 2023 Budget presentation made by the Minister of Finance.

- The report reveals a total debt service of N5.2 trillion in the first 11 months of 2022 out of a total revenue of N6.49 trillion.

- This figure is different from the central bank data which quotes the FGN Retained Revenue of N5 trillion for the first 12 months of 2023.

- The apex bank however provides a monthly breakdown of the FG revenues and expenditures.

- Nairametrics opines the difference in the revenue data could be how the central bank defined FG’s actual retained revenue, subtracting grants and other non-directly related revenues.

Debt service is worse under Buhari

A comparison of the debt service to revenue ratio across different years underscores the deteriorating state of Nigeria’s finances under President Buhari.

- During the presidency of the late President Yar’Adua in 2010, the ratio was a relatively modest 12.3%.

- However, since President Buhari assumed office in 2015, the ratio has shown a steady increase, reaching an alarming 33.0% that year.

- The ratio has continued its upward trajectory, culminating in the troubling figure of 111.8% in 2022.

- Under the previous administration led by President Jonathan, the ratio had already been on the rise, with its highest point recorded at 28.6% in 2014.

- Nevertheless, the Buhari administration has taken the situation to new heights.

Nigeria’s high debt burden

This sustained increase in the debt service to revenue ratio suggests poor financial planning and management, presenting a significant burden on Nigeria’s economy.

Data from the Debt Management Office indicate Nigeria’s total public debt as of December 2022 is N49 trillion without including the Ways and Means which is estimated at N22.8 trillion.

At the end of May 2015 when the Buhari administration came into power, Nigeria’s public debt stock was about N12 trillion.

Nigeria’s rising debt burden has been a source of concern for several years, and the escalating debt service to revenue ratio exacerbates the problem. It severely limits the government’s ability to invest in critical sectors such as infrastructure, education, and healthcare.

This ratio poses long-term implications that could undermine the well-being of the Nigerian people and the overall economic stability of the nation.

Revenue challenges: Between 2016 and 2022 the Nigerian government failed to meet its revenue targets due to falling oil prices and rampant oil theft that has decimated the federal resources.

- For example, in 2021 the government targeted revenue of N8.1 trillion but was only able to generate N6.1 trillion leaving a revenue shortfall of N2 trillion. However, its total debt service incurred for that year was N4.2 trillion.

- This is according to the information contained in the Medium Term Expenditure Framework 2023-2025 of the Budget Office.

- In the first 11 months of 2022, it has only generated N6.4 trillion in revenues compared to the prorated target of N7.4 trillion. However, the government has also incurred about N5 trillion in non-debt expenditures.

See data below

Source: CBN