Article Summary

- Nigeria’s debt service-to-revenue ratio could reach 160% within five years unless extensive reforms are implemented.

- The poorest countries eligible for loans from the International Development Association (IDA) contribute more than one-tenth of their export earnings to long-term public debt and government-guaranteed external debt.

- A high debt service to government revenue ratio can make it difficult for the government to meet its debt obligations, damage its reputation, and limit its ability to respond to shocks and pursue development goals.

The World Bank has warned that Nigeria’s debt service-to-revenue ratio could reach 160% within five years unless extensive reforms are implemented to free up fiscal space.

In a separate report, the World Bank also found that the poorest countries eligible for loans from the International Development Association (IDA), now contribute more than one-tenth of their export earnings to long-term public debt and government-guaranteed external debt.

He said it was spending on repayment and this was the highest amount percentage since 2000.

What you should know about debt service to revenue

The debt service to revenue ratio is a measure of how much of a country’s revenue is used to pay interest and principal on debt. It demonstrates a country’s financial sustainability and solvency, as well as its ability to invest in public services and development.

Ben Akabueze, head of the federation’s budget office, warned on Wednesday that Nigeria is rapidly running out of its limited credit line.

- “Right now, our credit space is very limited, not because we have a high debt-to-GDP ratio, but because our revenues are too small to support the size of our debt,” he said. “This explains our high debt service ratio.”

- “When a country’s debt service ratio goes over 30%, it’s in trouble, but we’re aiming for 100%, which shows how big a problem we’re in.”

- “We have limited space available for rent. Considering how much revenue you can generate and how much you can reasonably borrow, that’s the size of your budget. The next step would be to consider the government’s priorities for what projects get what.

Rising interest rates and a slowing global economy have put many countries at risk of a debt crisis, with about 60% of the poorest countries already at high risk of a debt crisis, if not a crisis.

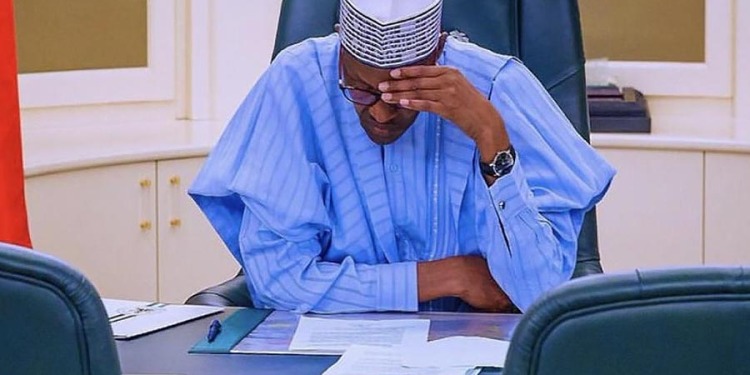

Nigeria’s economy is in a slump as inflation and rising unemployment have pushed total debt to $103.11 billion. The country’s outgoing President Muhammadu Buhari will hand over the dire economic situation to a new president on May 29, 2023.

According to the Nigerian Debt Management Office (DMO), Nigeria’s total public debt consists of the domestic and external debt of the Federal Government of Nigeria (FGN) and its 36 state governments.

Reasons Nigeria’s debt to revenue ratio is a problem

There are several reasons why Nigeria’s debt-to-revenue ratio is a major problem:

Less fiscal space and flexibility for governments – When governments spend most of their revenues on debt servicing, it leaves less money for other priorities such as healthcare, education, infrastructure, and social protection. This limits the ability of governments to respond to shocks, crises, and emergencies and to pursue long-term development goals.

Increased risk of debt crises and defaults – A high debt service to government revenue ratio may make it difficult to meet its debt obligations and may force it to resort to further borrowing, debt restructuring, and debt restructuring. This not only increases costs and reduces government confidence, but it can also damage the government’s reputation and credibility in international financial markets.

Hurt economic growth and development – A high debt service-to-revenue ratio for governments may require cutting spending on productive sectors such as agriculture, manufacturing, trade, and technology. This can make the economy less productive and competitive, reducing the income and wealth of the population.

Worsens inequality and poverty – Higher government debt-to-revenue ratios may require higher taxes and reduced subsidies and social transfers to raise revenues or reduce spending. This can affect disposable income and household purchasing power, especially for poor and vulnerable households. This can increase inequality and poverty within countries.