Key highlights:

- The plenary will not resume on 9th May 2023 as earlier adjourned.

- The next adjourned date will be Tuesday 16th May 2023.

- Change is intended to allow Members to partake actively in the ongoing induction program of the 10th National Assembly.

Nigeria’s House of Reps announced that it will postpone the date of resumption for plenaries from 9th May to 16th May.

This was disclosed in a statement by the House of Reps on Monday evening.

The House said the reason for the postponement is to enable members to partake in the ongoing induction program of the 10th National Assembly.

Induction

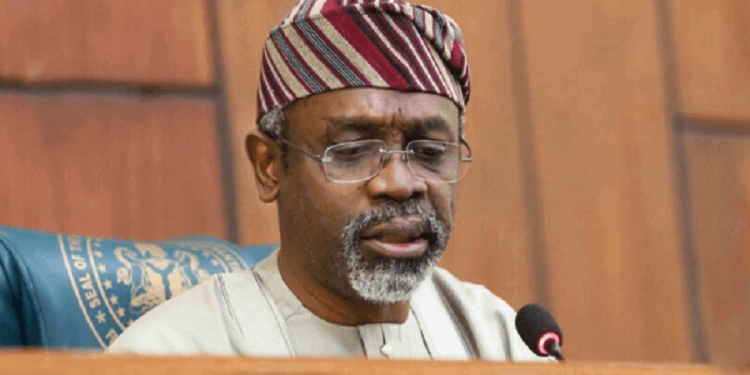

The House of Reps through Dr Yahaya Danzaria Esq. The clerk, of the House of Representatives said it regrets the inconvenience due to the induction programme, they added:

- “This is to inform all Hon Members and the general public that the House of Representatives will not resume plenary on Tuesday 9th May 2023 as earlier adjourned. The next adjourned date will be Tuesday 16th May 2023.

- “This change is intended to allow Members to partake actively in the ongoing induction program of the 10th National Assembly. All inconveniences are highly regretted.”

Ways and Means approval

Before the break, Nairametrics reported that The House of Representatives last week approved President Muhammadu Buhari’s request to restructure the N23.7 trillion loan obtained by the Federal Government from the Central Bank of Nigeria (CBN) through the Ways and Means Advances.

The approval from the lower chamber of the National Assembly came 24 hours after their counterpart in the Senate granted a similar request from the president despite some opposition.

The Joint House Committee on Finance; Banking and Currency; and Aids, Loans and Debt Management, laid its report on the request, which the lawmakers considered and approved during plenary.

The committee recommended that the House “approve the requested additional N1 trillion Ways and Means Advances for implementing the 2022 Supplementary Appropriation Act as passed by the National Assembly.

It also approved the securitization of the total outstanding Ways and Means amount under the following terms: Amount N23,719,703,774,306.90; tenor, 40 years; moratorium on principal repayment, 3 years; pricing/interest rate, 9 per cent per annum.

The joint committee in its presentation to the committee of the whole said,

- “That the House do consider the Report of the Committees on Finance, Banking and Currency and Aids, Loans and Debt Management on the Restructuring of Ways and Means Advances and approve the recommendations therein (Laid: 2/5/2023), approve the requested additional N1 trillion Ways and Means advances for the implementation of the 2022 Supplementary Appropriation Act as passed by the National Assembly.

- “Approve the securitization of the total outstanding Ways and Means amount under the following terms: amount N23,719,703,774,306.90, Tenor 40 years; Moratorium on Principal Repayment 3 years, pricing/Interest Rate 9 percent per annum.”