Article Summary

- The Nigerian National Assembly has approved the securitization of Ways and Means loans of N22.7tn.

- The securitized debt will have a tenor of 40 years with a moratorium on principal repayment of 3 years and an interest rate of 9%.

- The securitization is expected to improve debt transparency, reduce debt service costs, and help reduce the budget deficit.

The National Assembly has approved the securitization of Nigeria’s Ways and Means loans currently estimated at about N22.7 trillion, paving the way for the legislation of the controversial debt.

The Ways and Means refer to a provision that allows the government to borrow from the Central Bank of Nigeria (CBN) if it needs short-term or emergency finance to fund delayed government expected cash receipts of fiscal deficits.

Provisions in the act cap monetary financing of fiscal deficits at 5% of the prior year’s revenues but this has been breached by the Buhari government. To legalize the breach, the Buhari government presented a bill to the national assembly to approve the conversion of the loan into a national debt.

Terms of the Securitization

According to the latest data from the Debt Management Office, the tenor of the securitization is a whopping forty (40) years with a moratorium on the principal for three years and an interest rate of 9% per annum.

- Tenor: Forty (40) years

- Moratorium (on Principal only): Three (3) years

- Interest Rate: 9% p.a.

- Repayment: Amortising over thirty-seven (37) years

- Holder of the Securities: The Securities will be issued to the Central Bank of Nigeria (CBN) by the Federal Government of Nigeria (FGN).

- The Securities will not be issued to the public by the FGN to raise funds.

The debt management office also provided details of the benefits of securitization, stating what it is meant to achieve.

- Improve debt transparency as the securitized Ways and Means Advances will now be included in the public debt statistics.

- It will reduce the Debt Service Cost as the new interest Rate is 9% p.a. compared to the Monetary Policy Rate plus 3% which translates to 20.5%6 p.a. (MPR – 18.5% +3%) currently being charged on the Ways and Means Advances.

- The large savings arising from the much lower Interest Rate will help reduce the deficit in the Budget and expectedly, the level of New Borrowings.

In addition, it stated that the provisions for Interest on the securitized Ways and Means Advances (starting from 2023) and principal repayments starting from year four (4), will be made in the Annual FGN Budgets.

Securitization will not lead to new loans

The DMO also stated that the securitization of the Ways and Means Advances does not involve new money being given to the FGN as the CBN had already provided the funds to the FGN.

National Assembly Approval

For the Securitization to be statutorily approved, it requires the approval of the Senate and the House of Representatives. Therefore, implementation will be upon receipt of the approval of the House of Representatives.

On Wednesday, May 3rd the Nigerian State approved the recommendations to convert the N22.7 trillion Ways and Means loan to be securitized. On Thursday, May 4th the House of Representatives followed suit approving the loans to be securitized.

In fact, the committee of the House of Representatives that recommended the approval of the bill went a step further and recommended that the House “approve the requested additional N1 trillion Ways and Means Advances for implementing the 2022 Supplementary Appropriation Act as passed by the National Assembly.

It also approved the securitization of the total outstanding Ways and Means amount under the following terms: Amount N23,719,703,774,306.90; tenor, 40 years; moratorium on principal repayment, 3 years; pricing/interest rate, 9 percent per annum.

Nigeria’s Public Debt is now N69 trillion

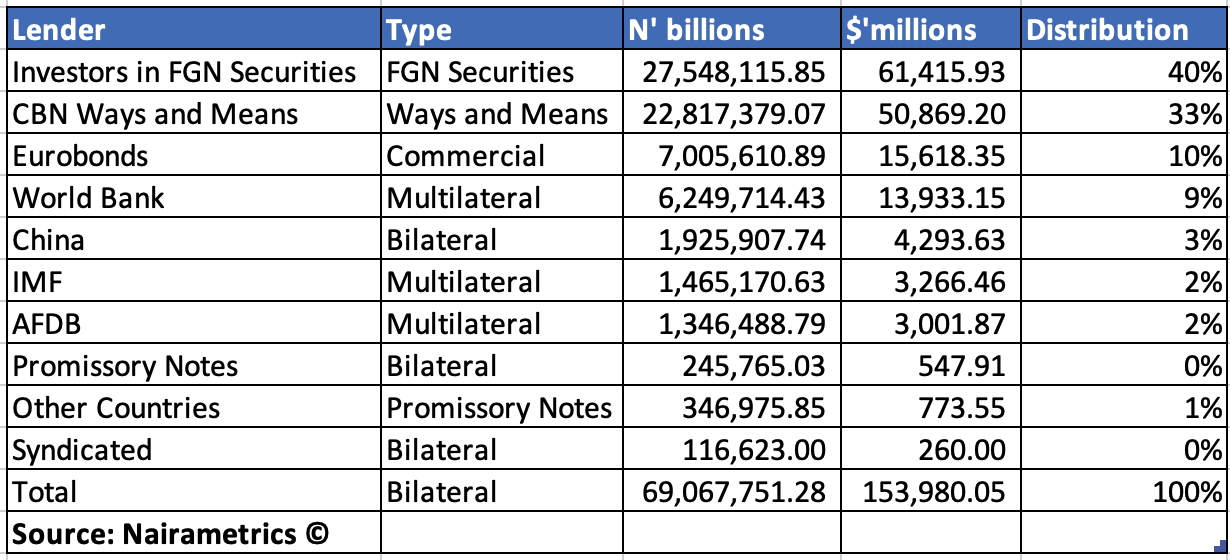

Based on the approval of the N22.7 trillion Ways and Means by the National Assembly and the more than likely passage by both chambers of the National Assembly, the total public debt will be N69 trillion as of December 2022.

How did we arrive at this number? See table below

Nairametrics explained how we arrived at this balance in a prior article here.

Critics Push Backs

The Labour Unions commented on the planned securitization describing it as shocking and suspicious. TUC Secretary General, Nuhu Toro, said: “It is ridiculous and creates room for suspicion. We don’t think this is necessary, especially on the eve of this administration’s departure. This leaves us with the question of whether governance is a continuous exercise or not.”

A top spokesperson of the NLC also stated “For the Senate to approve such extra-budgetary spending demonstrates the continuing gang-up of those in leadership, especially the Executive and Legislature, against the masses. We, therefore, view this not just with disgust but also with great alarm, given the parlous state of our economy and the poor condition of living of the citizenry.”