Article Summary

- Dangote Cement reported a decline in revenue to N280.3bn in Q1 2023 compared to N321.9bn in Q1 2022 due to macroeconomic headwinds and bad government policies affecting the Nigerian market.

- The Nigerian market contributes around 58% of group volumes shipped, and Dangote Cement cited a cash crunch, negative election sentiments, and the central bank’s policies for the decline in volume and revenue.

- Despite this, Dangote Cement posted a profit after tax of N109.5bn, aided by lower tax charges, and is increasing its local production capacity in Nigeria to meet the rising demand for cement.

Dangote Cement, Africa’s largest cement manufacturing company has reported its 2023 first quarter results showing a dip in volumes amidst macroeconomic headwinds in the country.

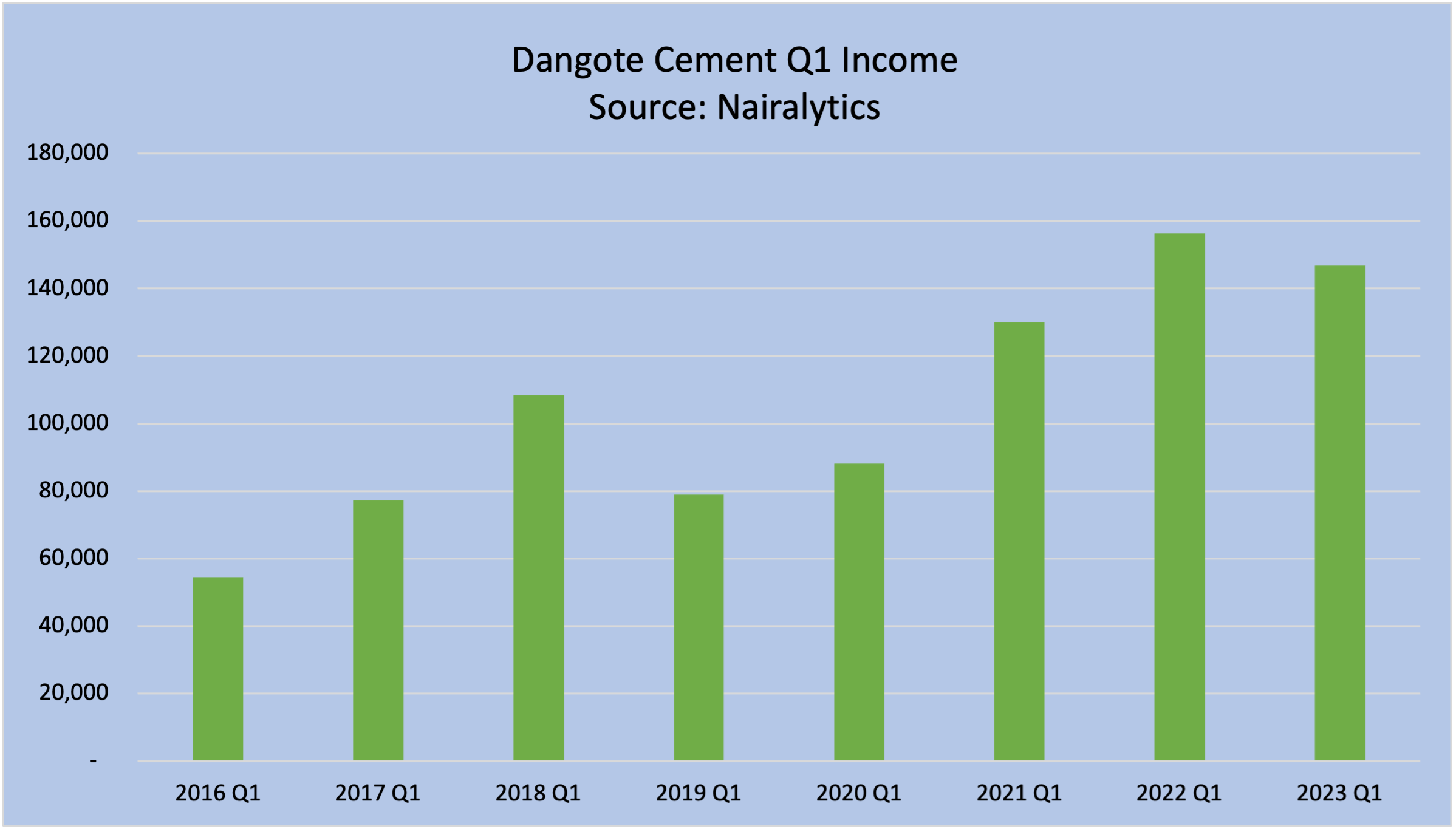

The company reported revenues fell to N280.3 billion in the first three months of 2023 compared to N321.9 billion same period but in 2022. This is the first time in 5 years that the cement giant has posted a lower revenue on a quarter-on-quarter basis epitomizing the effect bad government policies can have on businesses.

Dangote Cement has always delivered revenue growth quarter on quarter, year on year on the back of construction and infrastructure development spending (See chart).

Before now Dangote Cement has recorded 5 consecutive revenue growth in the first quarter of every year since 2019.

However, homegrown challenges such as cash crunch, and election uncertainty slowed down infrastructure spend. In late December Nigeria’s central bank exectuted policies aimed at introducing new naira notes and limiting cash withdrawal limits. The result was a catastrophic jolt to the financial system affecting busineses that rely heavily on cash to distribute products. Dangote Cement was one of such.

- “In Nigeria, the cash crunch coupled with the uncertainty around the general elections led to a slowdown in key private and public infrastructure investments. Consequently, our Nigerian operations recorded a drop in volume, resulting in a 13.5% decline in Group Volume.

- “The uncertainty and sentiments around the Nigerian elections, stalled economic activities with many private and public projects on hold, until the outcome of the elections. Collectively, this negatively impacted volume of cement sales and limited our ability to maximize production during the period.”

Dangote Cement Nigerian operations sold 3.6Mt of cement in the first quarter of 2023, down 24.6% from the 4.8Mt sold in Q1 2023. The Nigerian market makes up about 58% of group volumes shipped compared to 66.7% same period in 2022. The Nigerian operations also represented 69% of group revenues compared to 78% same period last year.

The company also explained the decline in volume was due to a cash crunch and negative sentiments around the elections. The cash unavailability impacted construction workers’ daily wages and retailers’ ability to pay for cement in cash.

Higher cost pressures

The total manufacturing cost for the group also rose to N163.6 billion compared to N154.1 billion same period in 2022, while the Admin cost also rose 12.5% to N87.3 billion.

The company attributed the 6.2% rise in manufacturing cost to inflationary trends while the rise in admin cost was due to increases in haulage expenses and AGO cost. They also cited devaluation as another area of cost pressure.

Overall the company’s Ebitda fell from N211 billion to N185.7 billion dragging the Ebitda margin down to 45.7% from 51.1% same period in 2023.

Despite the challenges arising from its Nigerian operations, Dangote Cement managed to post a profit after tax of N109.5 billion up from N105.98 billion a year earlier. The company’s profit was aided by lower tax charges in 2023 compared to the same period in 2022.

What they are saying

The CEO of Dangote Cement Arvind Pathak also commented on the results citing the challenges enumerated above.

- “The cash crunch coupled with the uncertainty around the general elections led to a slowdown in key private and public infrastructure investments. Consequently, our Nigerian operations recorded a drop in volume, resulting in a 13.5% decline in Group volume.”

- “In fulfilling our commitment to create additional value for our shareholders, we have received regulatory approval for our second buyback programme. We will continue to monitor the evolving business environment and market conditions, in making decisions on tranches of the share buy-back programme.”

- “Looking ahead, our strategic growth priorities are on track. We are progressing well to deploy grinding plants in Ghana and Cote d’Ivoire, and we have further announced plans to strengthen our local production capacity in Nigeria. Arvind Pathak”

Despite the challenges, Dangote Cement stated that it has continued to see opportunities based on rising demand for cement in the country. This has hastened its efforts at increasing its local capacity in Nigeria to 41.25Mta from 35.25Mta.

- “Opportunities abound for cement demand in the Nigerian market, and to meet the increasing demand we are strengthening our local production capacity efforts with the announcement of the construction of an additional 6Mta cement plant in Itori, Ogun state. Once completed, our local capacity in Nigeria will increase to 41.25Mta.”

The company share price closed flat at N270 per share during the week ended April 28, 2023.