Key highlights

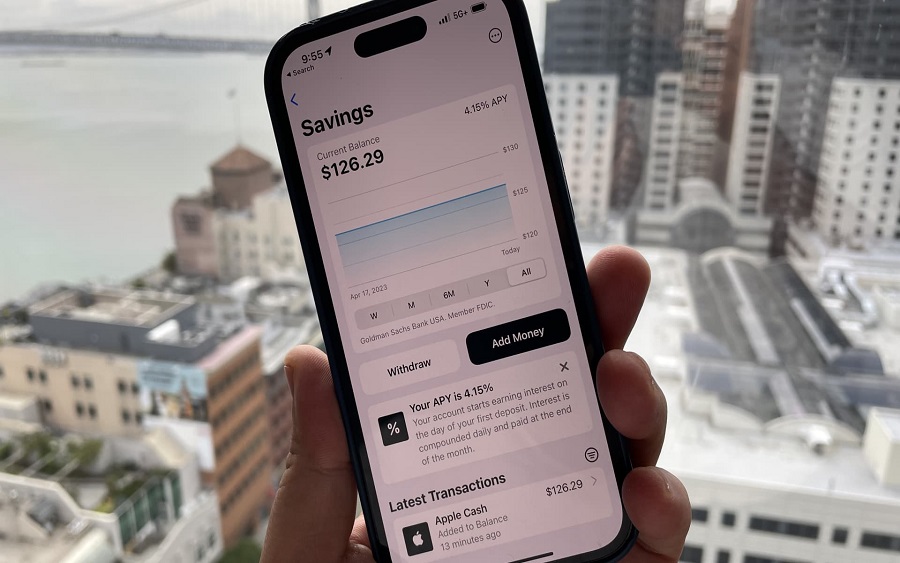

- Apple recently partnered with Goldman Sachs to launch a high-yield savings account for Apple Card users, offering an interest rate of 4.15%, over 10 times the US national average.

- The account has no fees or minimum balance requirements, and users can easily create an account through the Wallet app on IOS 16.

- To open the account, users must be US residents with an SSN, at least 18 years old, have a physical US address, and update to the latest version of iOS.

US tech giant Apple has partnered with one of the biggest banks in the world Goldman Sachs and unveiled a new high-saving yield account which promises a mouth-watering 4.15%. These are good returns, especially for a savings account. Moreso, according to the US Federal Deposit Insurance Commission(FDIC), the average interest rate on savings accounts in the US is 0.37%. Invariably, the new Apple card account is promising over 10 times the average returns in the US.

According to Apple’s vice president of Apple Pay and Apple Wallet Jennifer Bailey, “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Apple also claims that the new offering builds upon the financial health benefits that the Apple Card already provides and assures users of privacy and security.

All you need to know about the new offering

- Saving with the Apple Card account does not attract any fees, no minimum balance is required and no minimum deposits.

- It is stress-free to create an account since users can easily open one directly from Apple Card in the Wallet app.

- The savings accounts are provided by Goldman Sachs Bank USA.

- The feature is only available on the new IOS 16 so users who are on lower versions of IOS may need to upgrade first.

- Issuing of the Apple Card is subject to credit approval and is currently only available to qualifying applicants in the United States.

- The account offers a 4.15% Annual Percentage Yield (APY). Apple warns thought that this APY

- Terms can change anytime.

Requirements to open the account

Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a U.S. resident with a valid, physical U.S. address.

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS.

How Nigerians can create the Apple Card Savings account

Note that the Apple card is only available to users in the United States. So Nigerians who wish to enjoy this feature must be US residents with an SSN. (social security number).

- Upgrade your device to IOS 16.4 or later. Older IOS versions do not support Savings.

- Open the Wallet app. Visit the App Store to install the app if it is not yet installed.

- Inside the Wallets app add the Card app.

- Follow the instructions to create an Apple Card.

- After creating your card, tap on the More button, then tap Daily Cash.

- Tap Set Up next to Savings, then follow the onscreen instructions.

If you already have funds in your Daily Cash, you can easily transfer them to Savings or you could directly deposit them to Savings from a linked external bank account.

Interest starts accruing on monies deposited in your Savings account the day the transfer is initiated.

You can follow these steps to deposit money from an external bank account directly into your Savings:

- On your iPhone, open the Wallet app and tap Apple Card.

- Tap Savings account, then tap Add Money.

- Enter the amount that you want to add, then tap Add.

- Select or add the payment source you wish to add money from.

- Double-click the side button to confirm with Face ID, Touch ID, or your passcode.