Key highlights

- DMO says FG is committed to its debt obligations.

- Publication of default to China is fake news and is sent out to mislead the public.

- Chinese debt makes up less than 4% of Nigeria’s debt profile.

Nigeria’s Debt Management Office has called on the general public to disregard news that the Federal Government of Nigeria has defaulted on its Chinese debt.

This was disclosed in a statement by the DMO on Wednesday afternoon, reacting to media reports of the default in a statement titled “Rebuttal of False publication by some media house titled ”

The DMO urged that the FG is committed to its debt obligations and has not defaulted.

Fake News

The Debt Management Office said it strongly refutes claims by certain media outlets that Nigeria has defaulted on any of its loan repayments to China, they added:

- “Nigeria remains unwaveringly committed to fulfilling its debt obligations in a responsible and timely manner

- “The attention of the Debt Management Office (DMO) has been drawn to a publication by some media house claiming that Nigeria has defaulted in debt repayment to China which it claimed ” penalties stand at N41.21″ billion

DMO urged the general public to ignore the publication as it is False adding that a closer look at the media publication shows that the body of the publication is completely detached from the headline which gives the impression that the publishers of the report may have sent out to mislead the public, they added:

- “The Public is assured that Nigeria is fully committed to honoring its debt obligations and has not defaulted on any of its debt service obligations, the media report should therefore be disregarded.

What you should know

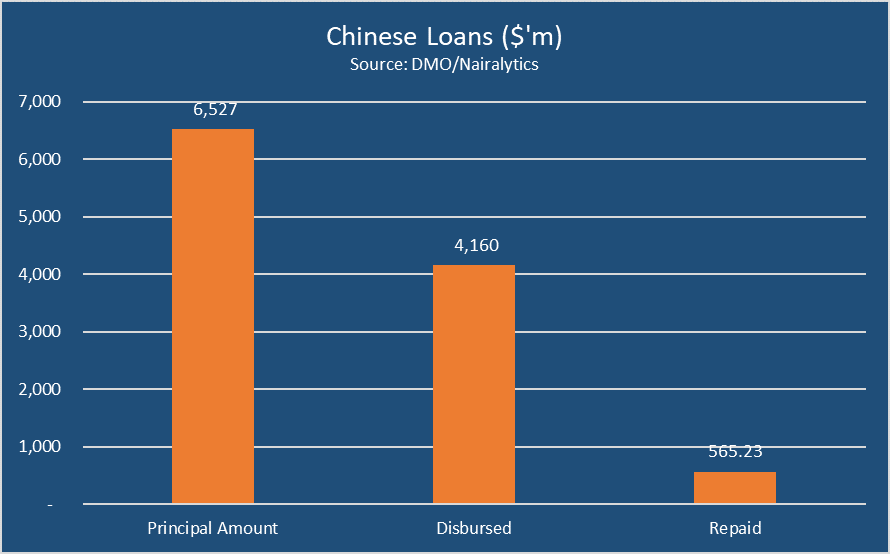

As of December 2021, DMO said Nigeria’s debt to China stood at $4.1 billion as of September 2021. This balance is out of a total debt of $6.5 billion available for Nigeria to draw down.

Most of the debts are for a period of 20 years with a grace period of to repay the principal of about 7 years. Only a $200 million debt had a tenor of 12 years with a grace period of 5 years. The loans are broken into dollar-based and Yuan based loans with $4 billion and another CNY480.

Nigeria’s debt to China has soared over the last decade as government diversifies its debt portfolio towards cheaper but controversial Chinese loans.

Interest rates for the loans average 2.5% per annum. In June 2021, the DMO reported that the total value of loans taken by Nigeria from China as of March 31, 2020, was $3.121 billion.

This represents only about 3.94% of Nigeria’s total public debt of $79.303 as of March 31, 2020. Similarly, in terms of external sources of funds, loans from China accounted for 11.28% of the external debt stock of $27.67 at the same date.

Nigeria has also repaid $565.23 million in principal repayments and another $477.98 million in interest leaving an outstanding $3.5 billion to pay from what has been drawn so far.

What Chinese loans are used for?

According to the government, Chinese loans are project-tied loans. Some of these 11 projects as of March 31, 2020, are the Nigerian Railway Modernization Project (Idu-Kaduna section), Abuja Light Rail Project, Nigerian Four Airport Terminals Expansion Project (Abuja, Kano, Lagos, and Port Harcourt), Nigerian Railway Modernization Project (Lagos-Ibadan section), and Rehabilitation and Upgrading of Abuja-Keffi- Makurdi Road Project.