Key Highlights

- The fresh pay increase proposal by the Federal Government would lead to a 40% rise in the current pay of government workers.

- The payment of the pay increase will likely commence by the end of April 2023, with the 3 months’ arrears to be paid later.

- The source is not sure if President Buhari has signed off on the proposal.

The Federal Government has concluded arrangements to commence the payment of the planned increase of civil servants’ pay by the end of this April with President Muhammadu Buhari expected to give his final assent for the disbursement any moment from now.

The success of the proposal means that the pay increase will be coming barely 2 months before the June date proposed for the removal of the fuel subsidy.

According to Punch, officials of the Federal government during an exclusive interview said the fresh pay increase, tagged consequential allowance, would lead to a 40% rise in the current pay of government workers.

3 months’ arrears to be paid later

The Director of Press and Public Relations, Federal Ministry of Labour and Employment, Olajide Oshundun, revealed that the Federal Government might begin payment of the 40% pay rise by the end of April this year, adding that the 3 months arrears of January, February and March would be paid at a later date.

Oshundun, however, said he could not confirm if the proposal by the government committee saddled with the task had been finally approved by the President.

- He said, “Consequential allowance Salaries will be increased by 40 percent for civil servants from level 1 to level 17.

- “What we receive now is called consolidated public service salary structure, it is the combination of basic and all allowances. So, the increase will be 40 percent of what a public servant is earning now.

- “They will start paying from the end of this month (April) and the arrears of January, February and March will be paid later. The salary increase is effective from January 2023. That is the proposal submitted by the committee set up to look into salary adjustment for civil servants, but am not sure if the President has signed it yet.”

For the record

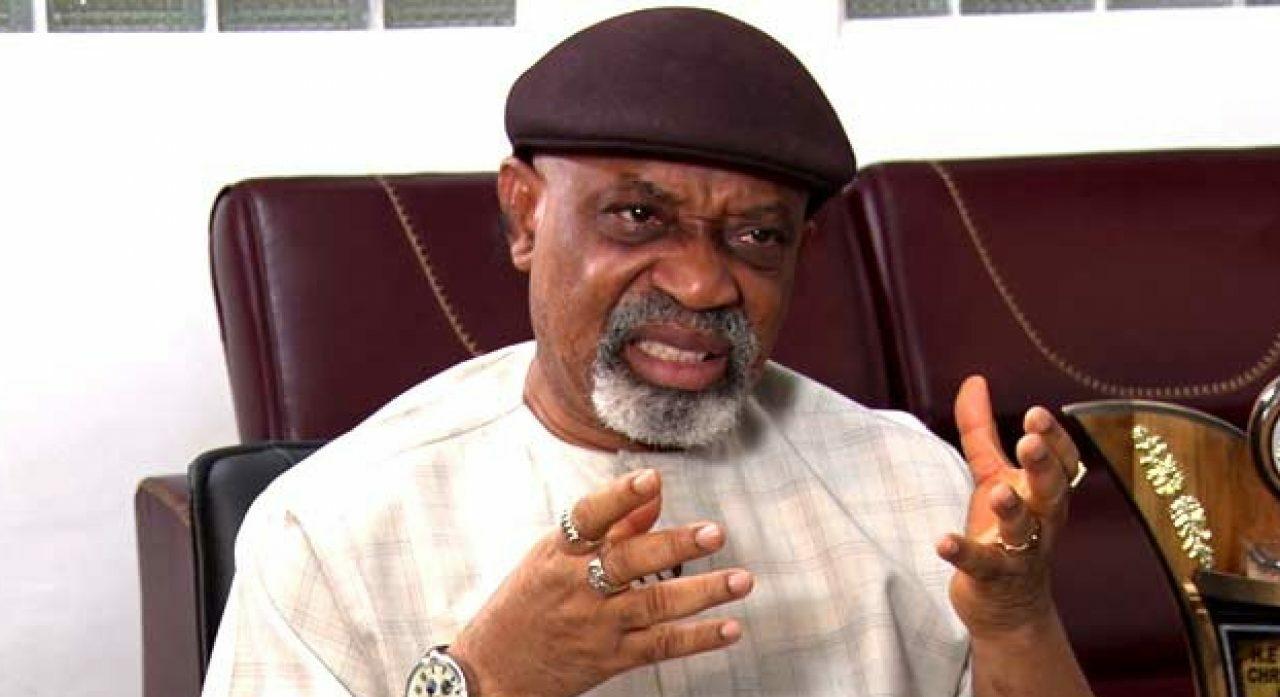

- Recall that in March 2023, the Minister for Labour and Employment, Dr. Chris Ngige, revealed that the outgoing administration of President Muhammadu Buhari approved pay raise for “hardcore civil servants”, effective January 1, 2023, adding that there is a provision for it in the 2023 budget.

- Ngige, who did not state the amount or percentage increase, said the pay raise is to enable civil servants to cushion the effect of inflation, increase the cost of living, increase transportation, and increase housing increase in electricity and other utilities.

- He also said that the government had approved different percentages of pay increases for staff of corporations and agencies depending peculiarities of each organisation.

- Also, Ngige had said that the incoming administration of the president-elect, Bola Tinubu, should review the new minimum wage immediately after its inauguration on May 29, 2023.

There’s a reason for this rush increase. The subsidy is MORE than the 40%increase.🙄🖐️💯