Key highlights

- NPF Pensions was the best performing Pension Fund Administrator (PFA) for Q1 2023, with all four of their funds (I, II, III, and IV) outperforming all others.

- Stanbic IBTC Pension Managers, CrusaderSterling Pensions, and Fidelity Pensions also had strong performances in some funds.

- Money Counsellors offers an annual report on pensions, including analysis of PFAs and their funds, but past performance should not be used to make investment decisions.

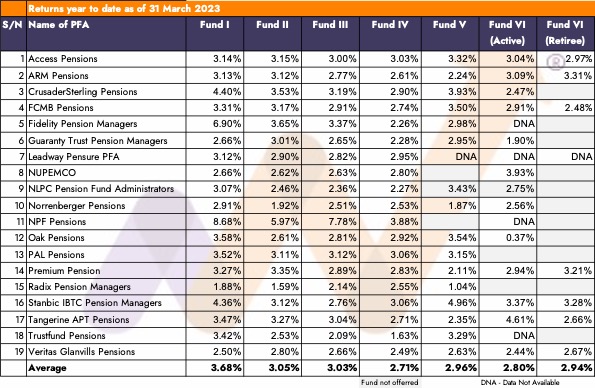

NPF Pensions is the runaway performer when it comes to investment returns on their portfolios for Q1 2023. The PFA manages pensions on behalf of the Nigerian Police Force. The PFA offers Funds I, II, III and IV and all 4 funds took the top spot outperforming all 18 others to 31-03-2023.

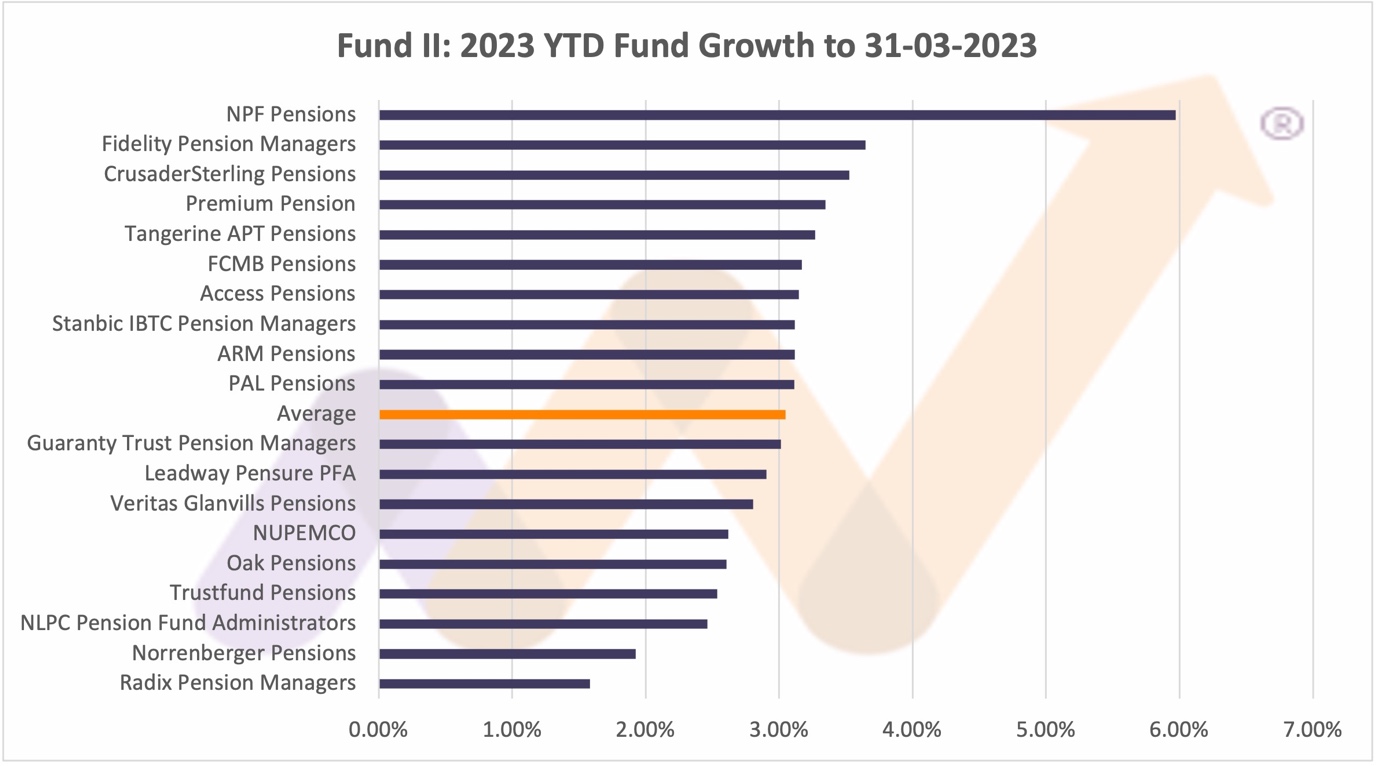

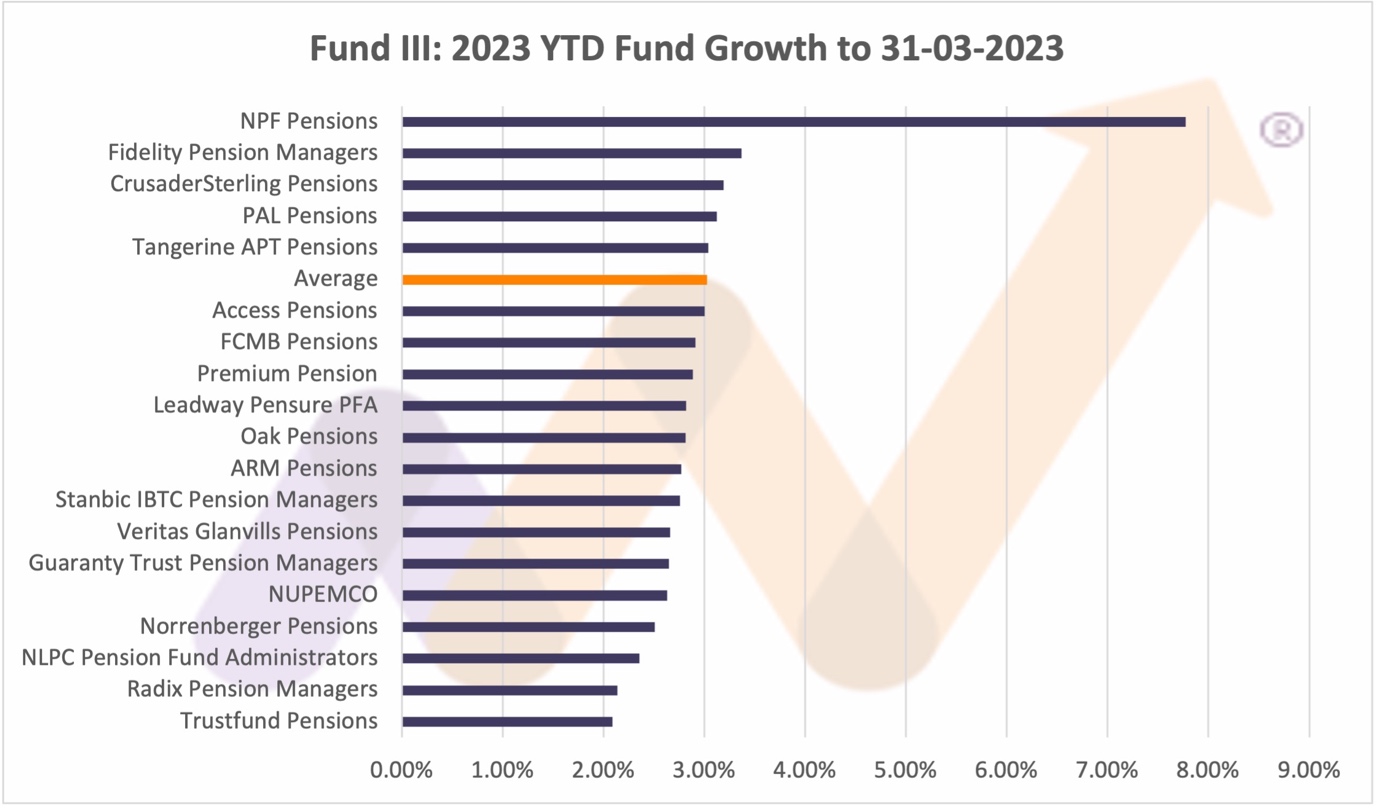

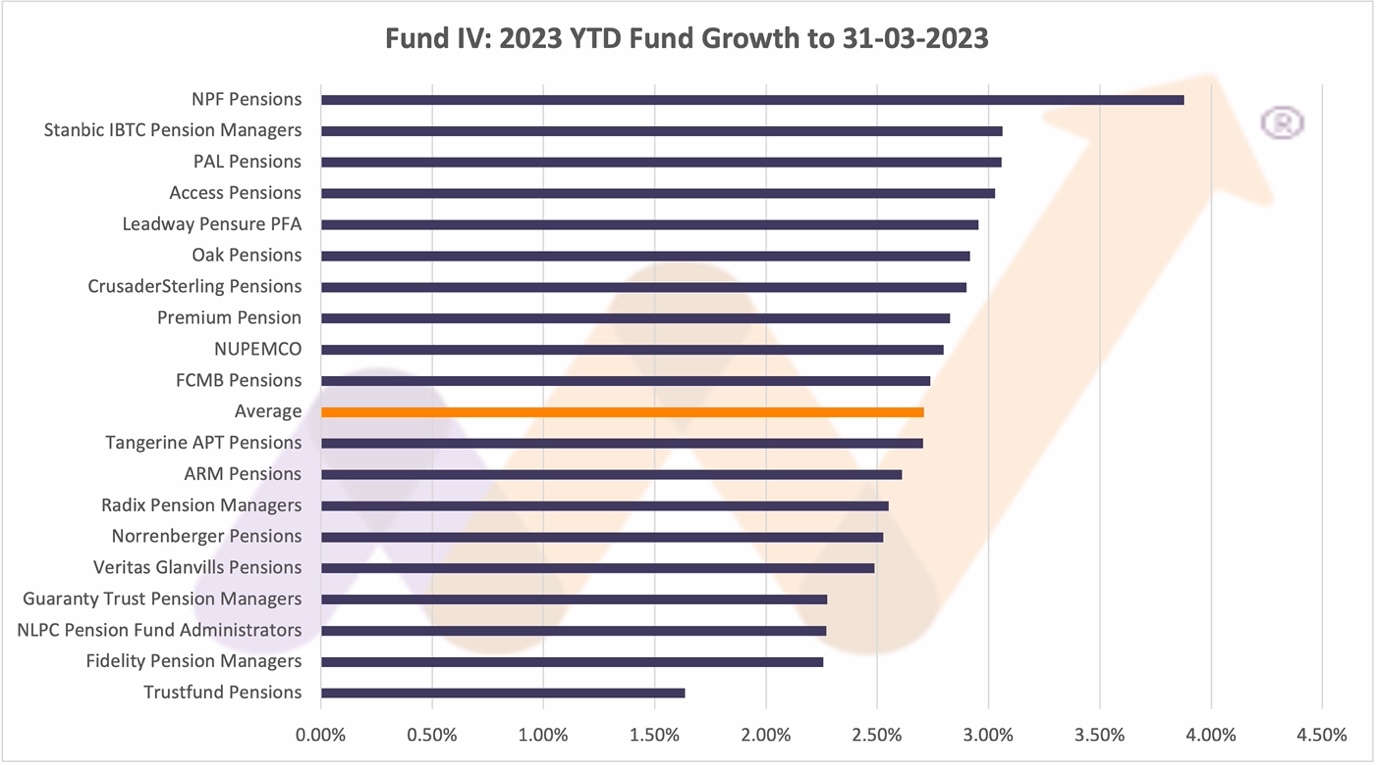

Fund I returned 8.86%, Fund II 5.97%, Fund III 7.78% and Fund IV 3.88%. Following close behind NPF Pensions for Funds I, II and III were Fidelity Pensions and CrusaderSterling Pensions, whilst Fund IV had Stanbic IBTC Pension Managers (3.062%) and PAL Pensions (3.058%) on their tail.

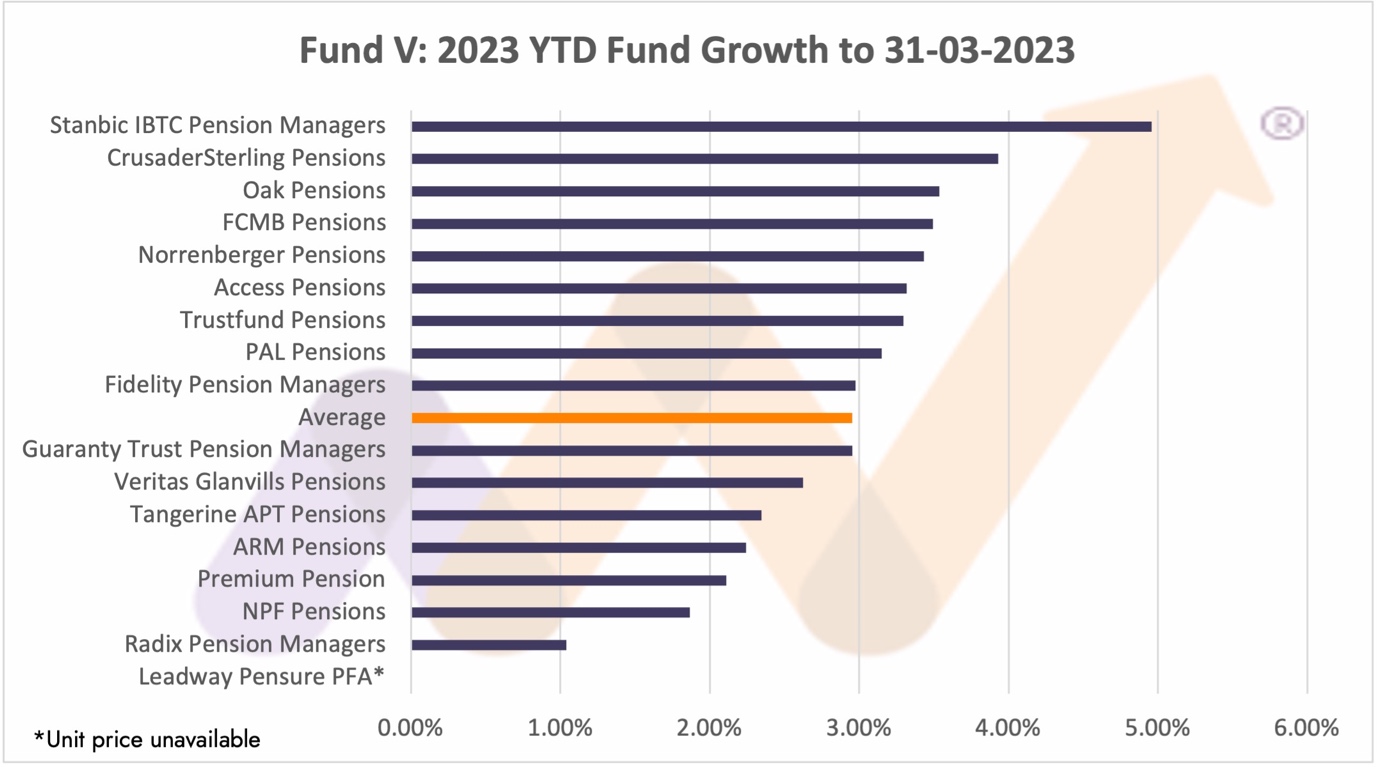

For Fund V (Micro Pension) YTD, performance was led by Stanbic IBTC Pension Managers (4.96%), followed by CrusaderSterling Pensions (3.93%) and Oak Pensions (3.54%).

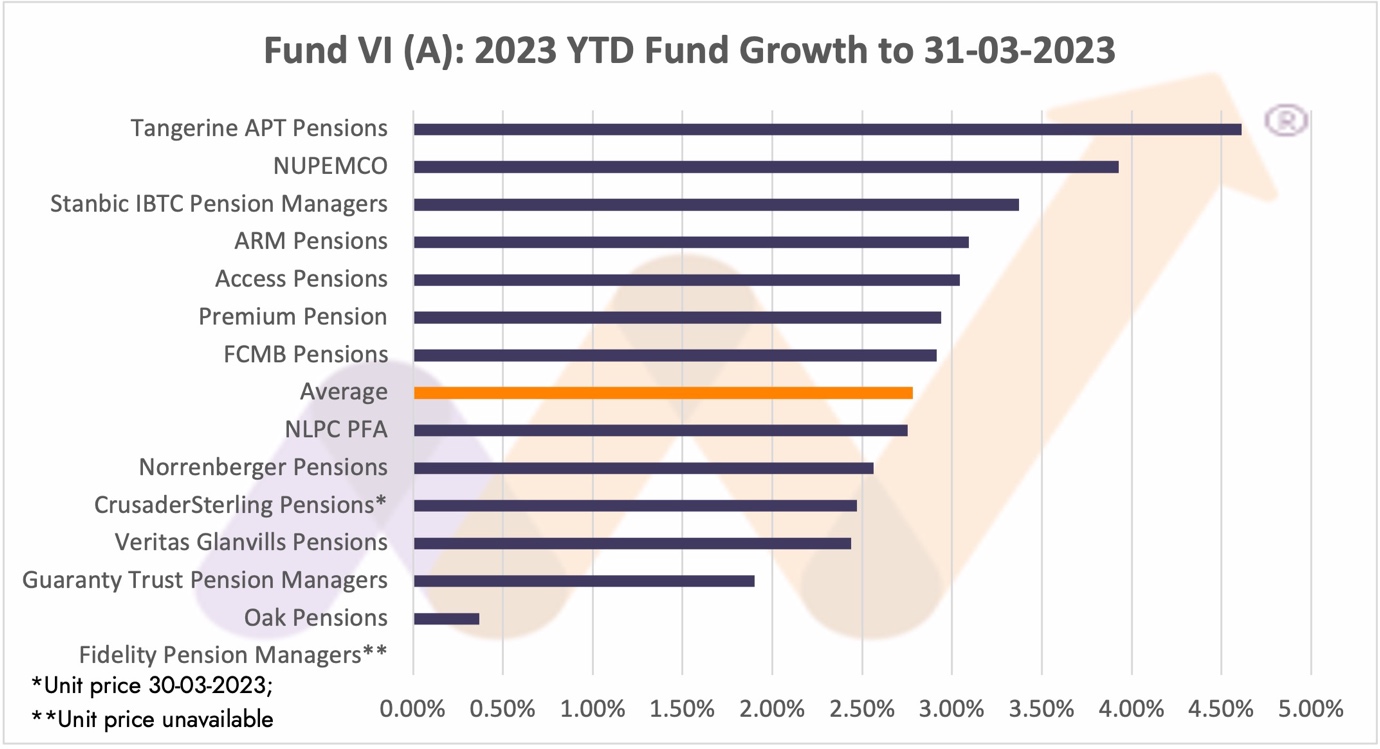

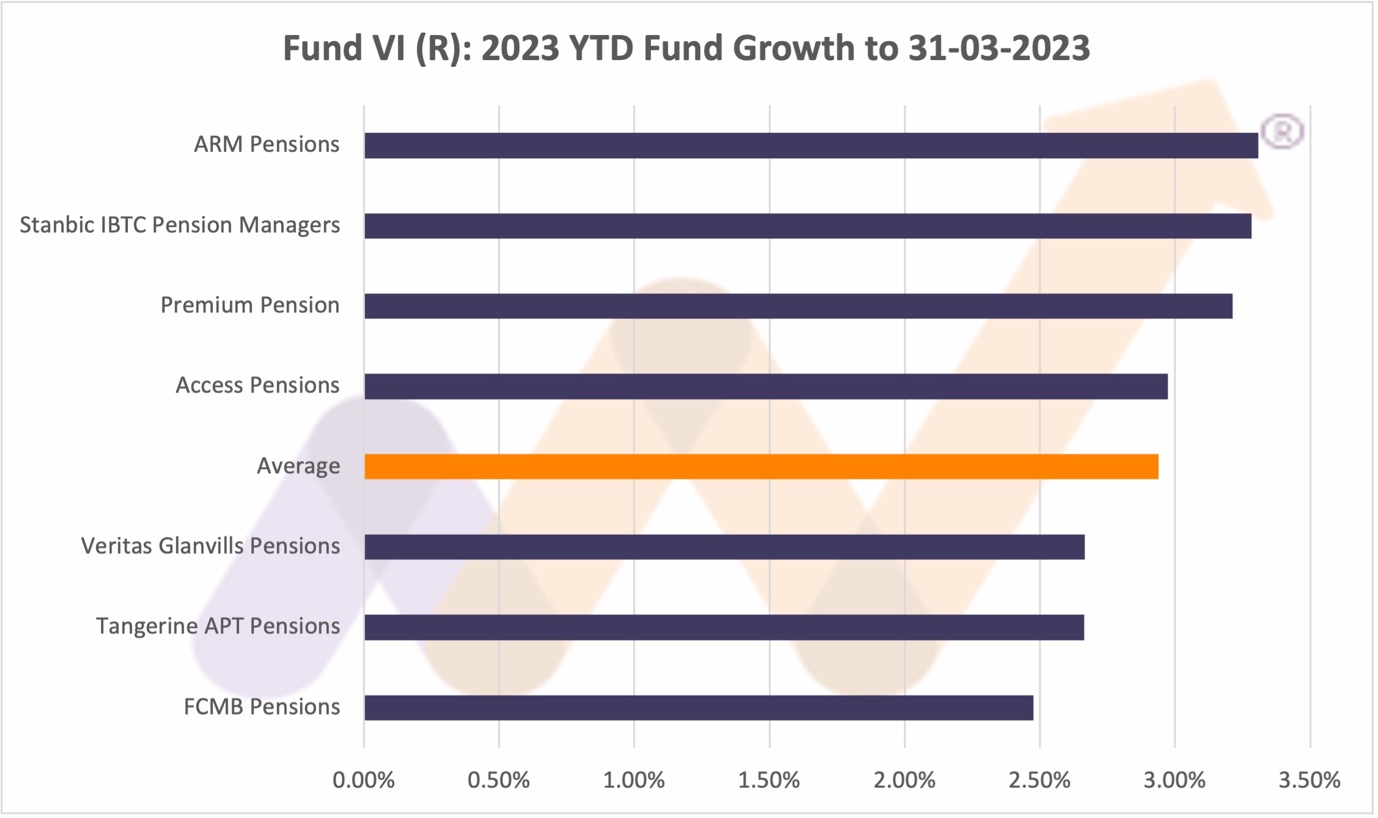

The top 3 performers for Fund VI – Non-Interest (Active) were Tangerine APT Pensions (4.61%), followed by Nupemco (3.93%) and Stanbic IBTC Pension Managers (3.37%) and for Fund VI – Non-Interest (Retiree), performance was led by ARM Pensions (3.31%), Stanbic IBTC Pension Managers (3.28%) and Access Pensions (3.21%).

Pension funds’ performance charts YTD (31-03-2023):

Fund I (Aggressive fund)

Fund II (Default fund)

Fund III (Pre-retirement)

Fund IV(Retiree)

Fund V (Micro Pensions)

Fund VI – Non-Interest (Active)

Fund VI – Non-Interest (Retiree)

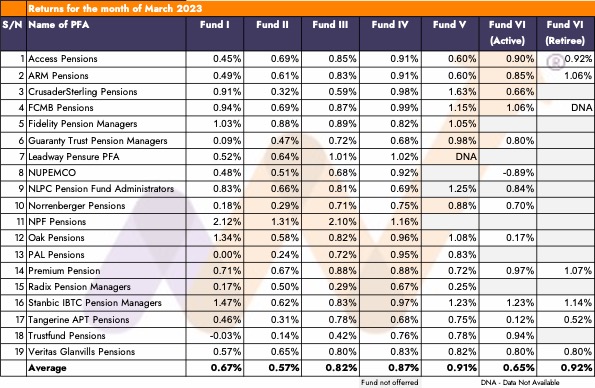

March 2023 Performance Table

YTD 2023 Performance Table

Other industry information:

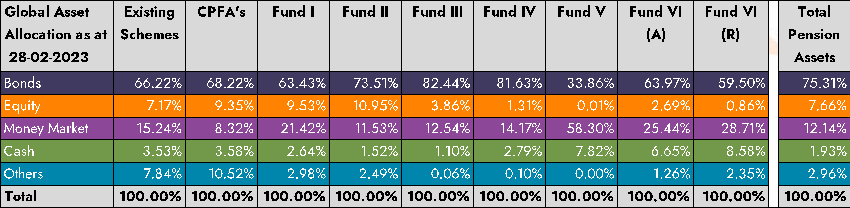

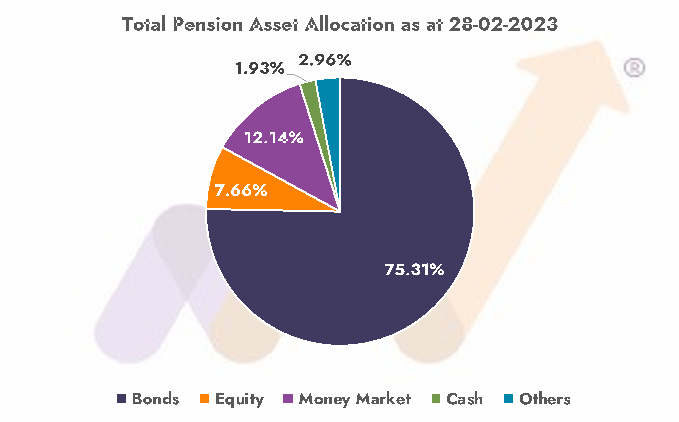

Allocation of Pension assets as at 28-02-2023

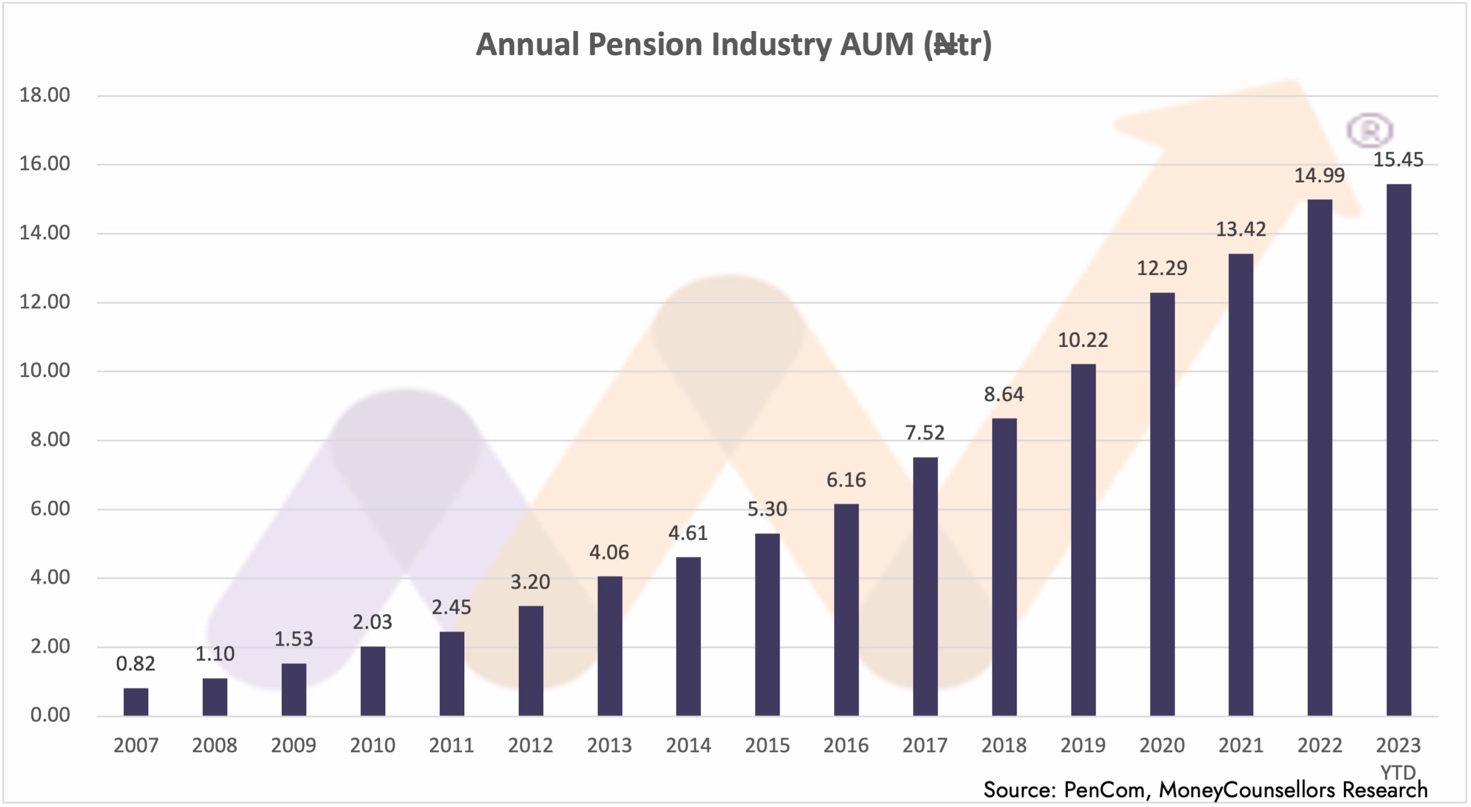

Total Assets under management

Pension Fund RSA Holders 28-02-2023

Download the Money Counsellors Annual Report on Pensions (MCARP 2022) for a full analysis of all Pension Fund Administrators (PFA) in one single document. The report presents a holistic review of the last five years of activities of all PFAs, and the funds managed, including a 5-year summary of company and fund accounts, ratios, fund performances, fund performance rankings vs. peers, asset allocation, AUM ranking, RSA ranking and much more. The Report is a must-read for all 9.9m RSA holders and those thinking of signing up for a PFA or switching a PFA.

Our data and information provided are based on public data, our regulatory intelligence effort, our archives, and other public sources such as Fund Managers, FMAN, Pension Fund Administrators (PFAs), PenOp, etc. We have taken care to ensure that the information is correct, but MoneyCounsellors neither warrants, represents, nor guarantees the information’s contents, nor does it accept responsibility for any errors, inaccuracies, omissions, or inconsistencies contained herein. Because past performance does not predict future performance, it should not be used to make an investment decision.

We make no product recommendations. No news or research item on our website or in this document should be interpreted as a personal recommendation to buy, sell, or switch any investment. Investments and the income generated by the rise and fall in value, so you may receive more or less than you invested.