On Sunday, March 12, it was announced that Saudi Arabia’s national oil company, Saudi Aramco has posted a net profit of $161.1 billion for 2022. This is the highest profit ever declared by an oil firm anywhere in the world.

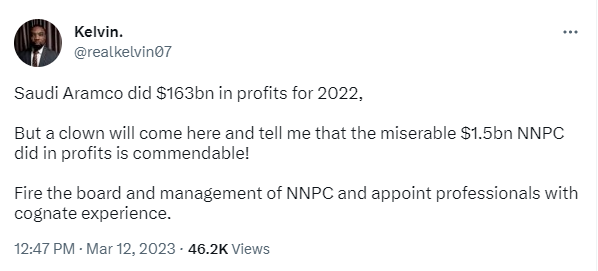

Since the announcement, some Nigerians have raised concerns about why NNPC Limited is not turning out better profits, after all, Nigeria is also an oil-rich country – the largest oil producer in West Africa.

High oil prices during war in Ukraine: Saudi Aramco made its profits from the Russian invasion of Ukraine in 2022. Also, note that Saudi Aramco’s profits have been on an upward trend since the end of the coronavirus pandemic. In 2022, the company’s profits rose 46.5% from its declared $110 billion profit in 2021, which is higher than its $49 billion in 2020.

Are NNPCL and Aramco on the same level? Saudi Aramco is the largest oil company in the world. To put this into perspective, as of 2022, Aramco’s crude production was 11.5 million barrels a day and the company plans to reach 13 million barrels per day by 2027. Meanwhile, Nigeria’s crude production (aside from condensates) was 1.3 million barrels per day as of February 2023.

Aramco has said it intends to increase its crude production by spending up to $55 billion in 2023 on capital projects. Meanwhile, NNPCL has not revealed any definite plans as to how much will be spent on capital projects in 2023. Nigerians have however been told that the company is working to increase production by attracting investments. Citizens cannot hold on to anything definite from an administration that has less than 3 months to exit power.

Is it a question of incompetence? Analysts have said issues of underinvestment, lack of transparency, and incompetence across the board are some reasons why Nigeria has not been successful in its oil business in recent times.

Oil analyst, Kayode Oluwadare earlier noted that although Aramco has more oil assets than Nigeria, the issue of transparency has made Aramco so successful while the lack of it has worked against Nigeria as the oil business is shrouded in secrecy. The question of incompetence also arises especially for the fact that salaries are being paid to the staff of refineries that are currently not in use.

Capacity to make profits: As it stands, NNPC Limited cannot realize the same profits that Saudi Aramco is making because they do not have the capacity to make profits. Oil and gas analyst, Dan. D. Kunle told Nairametrics that in the last 10 to 12 years, NNPC has been run as the biggest clerical bureaucratic body in Nigeria in charge of managing oil and gas resources in the country. Dan D. Kunle has said time and again that there is a need to unbundle the NNPC because they produce nothing. He said:

- “Since August 2022 when NNPCL was created, the structure has remained the same. Proceeds from crude sales are going to fuel subsidy payments. Now, Nigerians are eager to know the net profit made by NNPC Limited which has existed for less than a year, or the old corporation that is declaring profits or losses.

- “Nigeria is spending a lot on overhead and personnel costs in the NNPC. We hope the new president will take note of the new dimension the hydrocarbon industry is going, we have to cut costs and operate the industry properly. The new president needs to ensure that he turns NNPC around and avoids making the same mistakes that have brought Nigeria to this level. It is a shame that a country that should be doing up to 3.5 to 4 million barrels per day and refining up to 1.5 million barrels per day in its refineries is unable to do so.”

An oil analyst at an indigenous firm who pled anonymity told Nairametrics that the reason why Nigeria is not doing better numbers is due to a number of reasons, some of which are;

The Nigerian factor: The analyst does not think personal competence is something to be worried about because NNPC Limited has some of the finest minds in the industry. However, the Nigerian system encourages complacency, which affects people across the system.

Crude oil theft: According to the analyst, the issue of crude oil theft as well as pipeline destruction is yet another factor hampering crude oil production in Nigeria. He also pointed to the fact that there are no international seismic production companies in the country because we are not exploring, unlike other African countries like Tanzania and Ivory Coast, where exploration activities are the current trend.

While addressing the possibility of moving the industry forward as Nigeria changes government administrations, oil, and gas analyst, Etulan Adu told Nairametrics that it is possible to see some fruition in Port Harcourt Refinery due to the level of work done, if the fuel subsidy is successfully removed. According to him, international oil companies (IOCs) will be careful and disciplined in pushing out capital for major upstream projects till there is a certainty with the new government. Based on Adu’s observations, only projects that have been on for more than four years with strong financing from banks and private investors would pull through.

Will we simply overlook the fact that NNPC paid a whopping $10 billion in fuel subsidy in 2022 alone, directly impacting their profitability? Remove this single largest expense to NNPC’s income statement, and you have profit margins that are nearly identical to Aramco, despite the challenges of illegal bunkering and crude theft.

Unless Nigeria is willing to admit that the flawed fuel subsidy only benefits the wealthy, upper middle class, and vehicle owners in the country, rather than the poor, as it is widely believed, Nigeria will continue to be seen as a financially mismanaged state by international investors. Despite the fact that commercial transport costs have risen almost five times faster than inflation since 2020, the misguided belief that the subsidy helps the poor persists.

Know this and know peace…